- Belgium

- /

- Diversified Financial

- /

- ENXTBR:KEYW

How Much Is Keyware Technologies NV (EBR:KEYW) CEO Getting Paid?

Stéphane Vandervelde has been the CEO of Keyware Technologies NV (EBR:KEYW) since 2001, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Keyware Technologies.

See our latest analysis for Keyware Technologies

Comparing Keyware Technologies NV's CEO Compensation With the industry

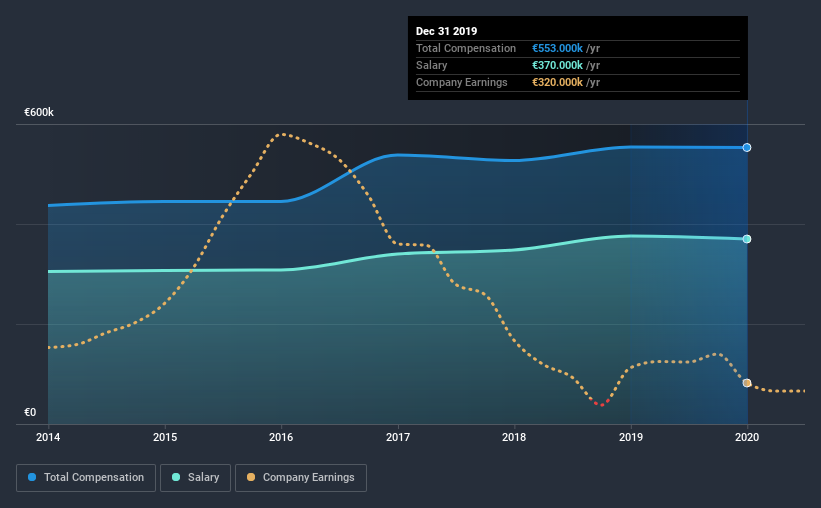

At the time of writing, our data shows that Keyware Technologies NV has a market capitalization of €15m, and reported total annual CEO compensation of €553k for the year to December 2019. That's mostly flat as compared to the prior year's compensation. Notably, the salary which is €370.0k, represents most of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below €167m, reported a median total CEO compensation of €279k. Accordingly, our analysis reveals that Keyware Technologies NV pays Stéphane Vandervelde north of the industry median.

Talking in terms of the industry, salary represented approximately 64% of total compensation out of all the companies we analyzed, while other remuneration made up 36% of the pie. There isn't a significant difference between Keyware Technologies and the broader market, in terms of salary allocation in the overall compensation package. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Keyware Technologies NV's Growth

Over the last three years, Keyware Technologies NV has shrunk its earnings per share by 60% per year. It saw its revenue drop 12% over the last year.

The decline in EPS is a bit concerning. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Keyware Technologies NV Been A Good Investment?

With a three year total loss of 52% for the shareholders, Keyware Technologies NV would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As previously discussed, Stéphane is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. This doesn't look good against shareholder returns, which have been negative for the past three years. Add to that declining EPS growth, and you have the perfect recipe for shareholder irritation. Considering such poor performance, we think shareholders might be concerned if the CEO's compensation were to grow.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 4 warning signs for Keyware Technologies you should be aware of, and 1 of them is significant.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Keyware Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Keyware Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTBR:KEYW

Keyware Technologies

Provides electronic payments processing and management solutions in Belgium.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Tesla will achieve a 392% PE ratio increase according to recent forecasts

Lynas Rare Earths: Owning the Policy-Backed Growth Regime, Not Just the Ore Body.

Bunker Hill Mine: A Case For $5 Per Share by 2030

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026