- Belgium

- /

- Industrial REITs

- /

- ENXTBR:WDP

Assessing Warehouses De Pauw (ENXTBR:WDP): Is There Untapped Value Behind Recent Stock Trends?

Reviewed by Simply Wall St

Warehouses De Pauw (ENXTBR:WDP) has recently appeared on the radar of many investors, not due to a single game-changing headline, but because of its muted yet steady stock performance. Sometimes, when a stock moves sideways or slips under the surface, questions about its true value come to the forefront. That is especially true for WDP, whose business model remains squarely in focus as real estate trends shift across Europe.

Over the past year, the company’s shares have pulled back by 9%, despite a small bump of 0.2% over the past month. Notably, year-to-date, WDP is up 13.9%. This pattern suggests that while momentum has faded from last year’s lows, there are signs that investor confidence could be stabilizing or even quietly building once more. Recent financials show annual revenue trending higher, and profits have grown even faster, adding further intrigue for those watching from the sidelines.

So after a year of lackluster returns but with recent positive momentum, are investors overlooking a bargain in Warehouses De Pauw or is the market already anticipating its next phase of growth?

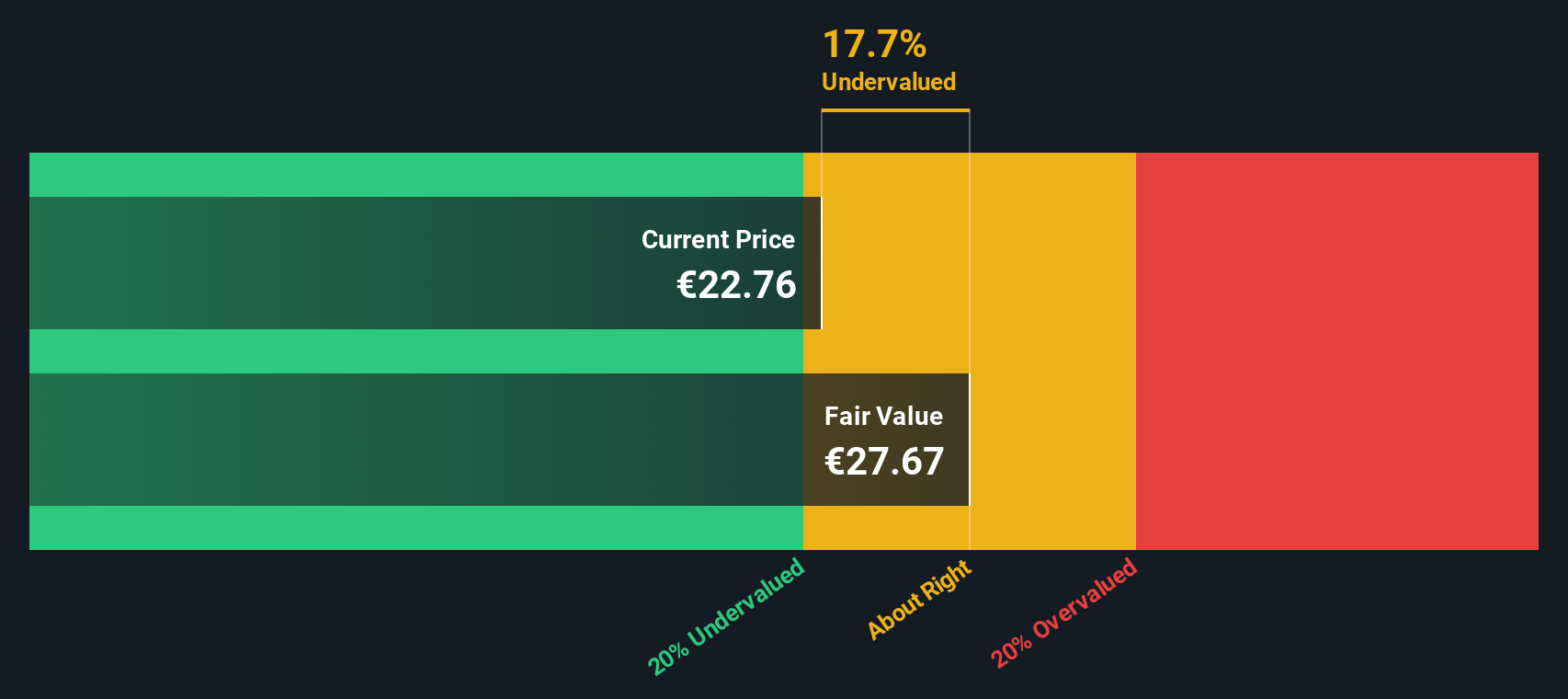

Most Popular Narrative: 19.9% Undervalued

The most widely followed narrative suggests Warehouses De Pauw is undervalued, with analysts calculating a fair value that is notably higher than the current share price.

The robust balance sheet and liquidity position allow WDP to capitalize on acquisition opportunities and to sustain returns through strategic investments, supporting future earnings per share growth.

What is powering this bullish outlook? Analysts behind this narrative project a dramatic leap in profitability within just a few years, fueled by strategic regional growth and new projects. Want to uncover which headline financial forecasts are propelling the stock’s potential upside? The most interesting assumptions are all inside the detailed narrative. Do not miss out on what could reshape your view of WDP’s worth.

Result: Fair Value of €26.99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower tenant demand and competitive pressures in key markets could challenge WDP’s growth outlook and reduce the strength of this bullish narrative.

Find out about the key risks to this Warehouses De Pauw narrative.Another View: Our DCF Model Suggests More Upside

To challenge the analyst narrative, our SWS DCF model comes to a similar conclusion. It indicates that the stock could be undervalued based on its projected cash flows. But are forecasts or cash flow models giving the truer picture?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Warehouses De Pauw Narrative

If you see the story differently or want to dig into the numbers for yourself, crafting your own narrative takes just a few minutes. Do it your way

A great starting point for your Warehouses De Pauw research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take charge of your next investment move. Simply Wall Street’s screeners reveal opportunities you cannot afford to ignore, and the best prospects might be just a click away.

- Power up your portfolio with tech’s brightest breakthroughs using our list of companies at the forefront of artificial intelligence: AI penny stocks.

- Amplify your dividend income by searching for firms offering strong yields with reliable track records: dividend stocks with yields > 3%.

- Target genuine bargains with our selection of stocks trading below their underlying cash flow value: undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warehouses De Pauw might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTBR:WDP

Warehouses De Pauw

WDP develops and invests in logistics real estate warehouses and offices.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives