- Belgium

- /

- Retail REITs

- /

- ENXTBR:RET

What Retail Estates (ENXTBR:RET)'s Rising Half-Year Net Income Means For Shareholders

Reviewed by Sasha Jovanovic

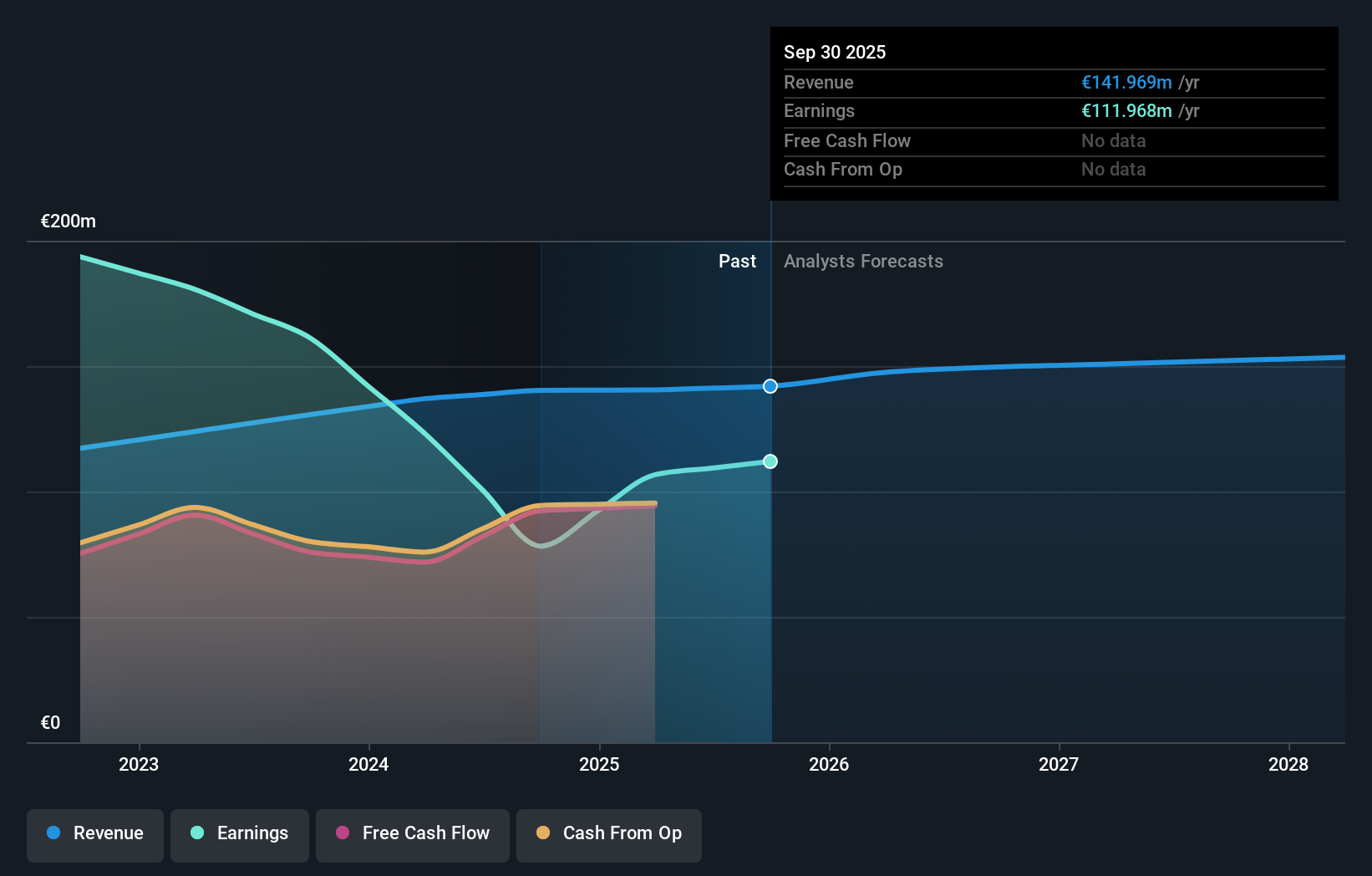

- Retail Estates N.V. recently reported earnings for the half year ended September 30, 2025, with sales of €72.84 million and net income of €47.15 million, both up from the same period last year.

- This higher net income suggests operational gains that may draw attention to the company's performance in the retail property sector.

- We'll explore how the improvement in net income highlights Retail Estates' current investment narrative and outlook within its market segment.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Retail Estates' Investment Narrative?

To justify a position in Retail Estates, the fundamental belief centers on its ability to consistently generate reliable earnings from its retail-focused property portfolio, underpinned by robust dividends and apparent value trading below consensus fair value. The recent half-year results saw continued top-line growth and a noticeable rebound in net income after last year’s dip, suggesting that some headwinds may have eased. For now, the main near-term catalysts remain operational performance and investor focus following recent changes in the shareholder base, while risks tied to debt coverage and the slower forecast revenue growth compared to the broader Belgian market still linger. The latest earnings beat is a positive marker but, unless sustained, is unlikely to materially alter the bigger risks identified pre-announcement. For shareholders, shifts in these earnings or exposure factors could become meaningful only if the resurgence in profitability is repeated over subsequent periods.

On the other hand, challenges around debt coverage are still a concern investors should keep in mind. Despite retreating, Retail Estates' shares might still be trading 41% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on Retail Estates - why the stock might be worth as much as 69% more than the current price!

Build Your Own Retail Estates Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Retail Estates research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Retail Estates research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Retail Estates' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:RET

Retail Estates

Retail Estates NV is a Belgian public real estate investment trust and is a niche player specialised in making out-of-town retail properties located on the periphery of residential areas or along main access roads to urban centres available to users.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives