- Belgium

- /

- Industrial REITs

- /

- ENXTBR:MONT

Montea (ENXTBR:MONT): Assessing Valuation After Higher Sales and Lower Profits in Latest Earnings

Reviewed by Simply Wall St

Montea Comm. VA (ENXTBR:MONT) just announced its earnings for the first nine months of 2025, showing higher sales compared to last year, but both net income and earnings per share declined.

See our latest analysis for Montea Comm. VA.

Despite Montea Comm. VA’s mixed nine-month results, investor sentiment has shown resilience, with the share price rising 12.2% year-to-date and the one-year total shareholder return reaching a solid 14.3%. While long-term three-year returns remain positive, the five-year total return is still in negative territory. This suggests that momentum has improved lately, but the company is still working to recover from earlier declines.

If you’re curious about what else is gaining traction in the market, this is a perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

With higher sales but shrinking profits, the latest results raise an important question for investors: is Montea now trading below its true worth, or is the market already anticipating stronger future growth?

Price-to-Earnings of 9.9x: Is it justified?

Montea Comm. VA is trading at a price-to-earnings (P/E) ratio of 9.9x, which is notably low compared to both its industry and market peers. With the last close price at €70.7, investors should pay attention to how this valuation compares within the broader landscape.

The price-to-earnings ratio shows how much investors are willing to pay today for each euro of the company's earnings. For real estate investment trusts like Montea, a lower P/E can indicate the market is factoring in lower earnings or growth expectations, or that the stock offers a value opportunity relative to its profit potential.

In this case, Montea's P/E of 9.9x is significantly below the Global Industrial REITs industry average of 16.8x. It also trails the peer average of 10.6x and the Belgian market average of 14.6x. The estimated fair P/E for Montea is 13.1x, which suggests there may be potential for upward re-rating if the market reassesses the company’s prospects.

Explore the SWS fair ratio for Montea Comm. VA

Result: Price-to-Earnings of 9.9x (UNDERVALUED)

However, investors should remain mindful that any slowdown in revenue growth or unexpected earnings pressures could quickly dampen the current optimism.

Find out about the key risks to this Montea Comm. VA narrative.

Another View: What Does Our DCF Model Say?

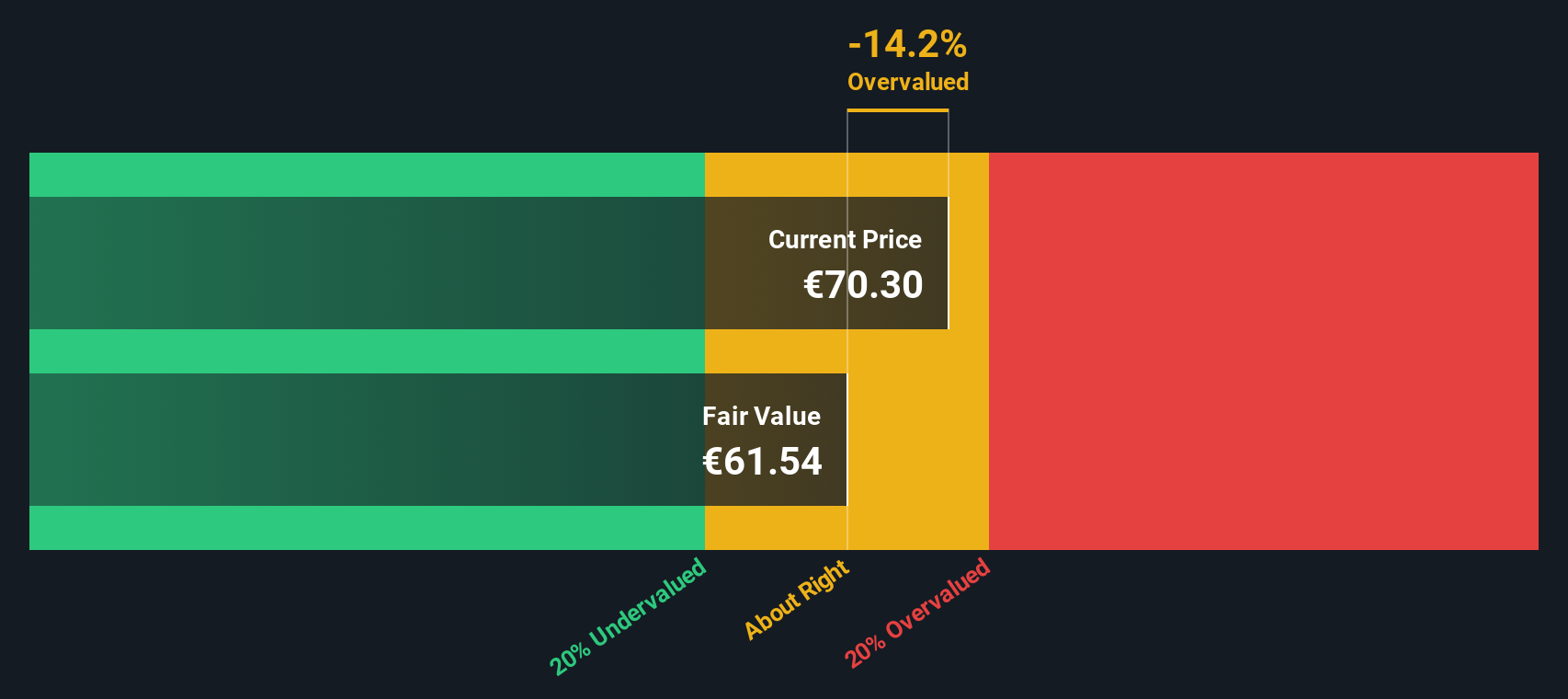

Taking a different approach, our SWS DCF model suggests a more cautious picture. According to this method, Montea is trading above its estimated fair value of €61.55, which could indicate possible overvaluation. Could the market be ignoring risks, or will future growth justify the current price?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Montea Comm. VA for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Montea Comm. VA Narrative

If you want to interpret the numbers differently or dive into your own analysis, you can easily craft your own perspective in just minutes. Do it your way

A great starting point for your Montea Comm. VA research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to find stocks with the potential to outperform, now is the time to act. Don’t miss out on exciting investment opportunities that others are already taking advantage of.

- Seize reliable income by checking out these 14 dividend stocks with yields > 3%, which consistently deliver attractive yields above 3% and show strong fundamentals.

- Spot untapped value with these 865 undervalued stocks based on cash flows, which may be trading below fair value based on real cash flows and solid growth metrics.

- Catch the technological wave and add potential disruptors to your watchlist through these 25 AI penny stocks, focused on artificial intelligence innovation and sector dominance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:MONT

Montea Comm. VA

Montea NV is a listed real estate company under Belgian law (GVV/SIR) that specializes in logistics property in Belgium, the Netherlands, France, and Germany.

Established dividend payer and fair value.

Market Insights

Community Narratives