- Belgium

- /

- Health Care REITs

- /

- ENXTBR:AED

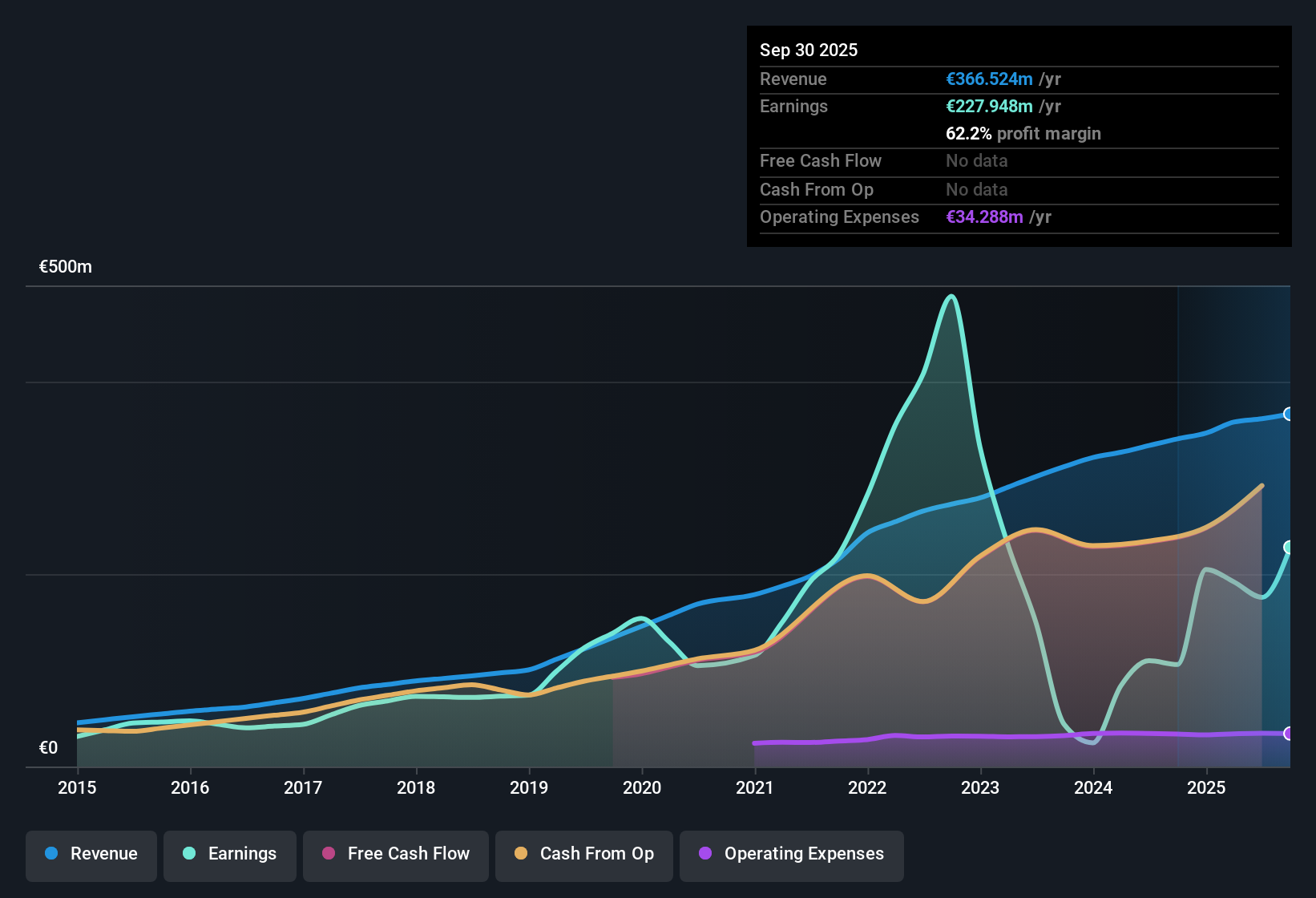

Aedifica (ENXTBR:AED) Profit Margin Doubles, Reinforcing Bullish Narratives on Earnings Quality

Reviewed by Simply Wall St

Aedifica (ENXTBR:AED) posted a net profit margin of 62.1%, doubling last year’s margin of 31.1%. EPS growth soared by 115.1% as the company rebounded from a 5-year annual decline of 10.7%. Revenue is forecast to grow 3% annually, below the Belgian market's 8.4%, but earnings are projected to climb 18.8% per year, outpacing the market's 15.6% rate. Positive investor sentiment is likely to focus on the strong momentum in profitability and attractive valuation metrics, even as financial stability remains a key risk in the current outlook.

See our full analysis for Aedifica/SA.The next section compares these headline results to the most widely followed community narratives, showing whether the numbers support or challenge prevailing investor expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Leaps to 62.1%

- Aedifica’s net profit margin surged to 62.1%, a dramatic increase from last year’s 31.1%. This highlights a structural improvement in profitability that stands out even against prior negative earnings trends.

- Stronger profit metrics provide significant support for the view that Aedifica’s business model benefits from stable income streams and disciplined cost control, as reflected in the prevailing market view.

- Despite a previous 5-year annual decline in earnings of 10.7%, the recent margin expansion aligns with claims that defensive healthcare assets and reliable tenants underpin performance.

- The company’s ability to more than double profit margins in just one year supports the argument that the current operational strategy is delivering on efficiency promises.

Revenue Growth Lags Broader Market

- Revenue is forecast to grow at 3% annually, which is below the Belgian market’s expected 8.4% rate. This indicates that Aedifica’s topline performance trails domestic peers despite bottom-line gains.

- The prevailing market view notes that while modest revenue growth could temper enthusiasm about long-term expansion, it may be an acceptable tradeoff for investors prioritizing defensive characteristics and stable dividends.

- The muted outlook for revenue growth increases the importance of continued cost discipline and portfolio resilience to maintain earnings quality.

- Bulls may argue that Aedifica’s focus on predictable healthcare assets justifies slower revenue growth, but skeptics will observe closely for any signs that profit momentum could stall without stronger topline gains.

Valuation: Discount to Industry, but Premium to Peers

- Shares trade at a 13.3x price-to-earnings multiple, which is below the industry average of 24x but still a premium to the peer group’s 11.3x. This presents a mixed message for value-focused investors.

- The prevailing market perspective suggests that the current valuation may be attractive for those seeking a bargain relative to the broader industry, but the premium over closer peers means that delivering on future earnings growth will be important to justify the price.

- Trading below the industry average indicates that the market may be exercising some skepticism pending more evidence of sustainable earnings improvements or risk reduction.

- Investors considering sector trends may find Aedifica’s discounted multiple appealing, although the difference versus its peer group could temper conviction for strict value seekers.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Aedifica/SA's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Aedifica’s slow revenue growth and below-market topline outlook could hold back long-term returns, even as recent profitability improves.

If you want steadier expansion, seek out stable growth stocks screener (2126 results) to see companies consistently delivering strong growth regardless of market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:AED

Aedifica/SA

Aedifica is a Regulated Real Estate Company under Belgian law specialised in European healthcare real estate, particularly in elderly care.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives