argenx (ENXTBR:ARGX) Profitability Confirms Strong Growth Narrative, But Valuation Debates Persist

Reviewed by Simply Wall St

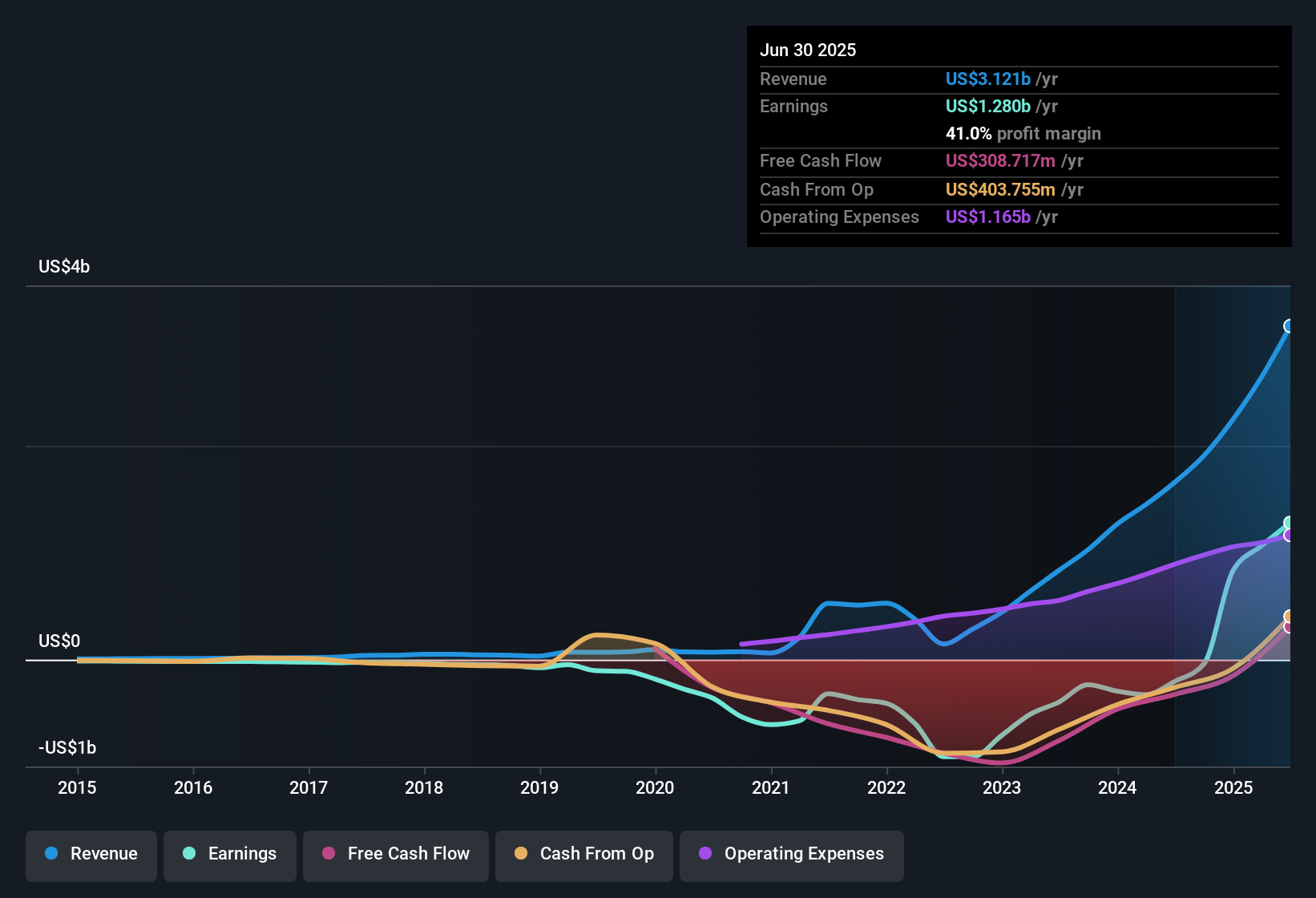

argenx (ENXTBR:ARGX) has achieved a notable turnaround to profitability over the past year, posting high-quality earnings and sustaining a five-year annual earnings growth rate of 52.7%. Looking ahead, consensus forecasts point to annual earnings growth of 28%, outpacing the Belgian market’s 15.6% projection, while revenue is also expected to rise by 18.5% per year compared to an 8.4% market average. Investors are weighing these strong growth figures and recent profitability against sector-wide valuation and short-term share price volatility.

See our full analysis for argenx.Up next, we will see how these headline numbers stack up against the dominant narratives in the market, highlighting where the stories converge and where there is tension.

See what the community is saying about argenx

Margins Face Pressure as Rebates Climb

- Gross-to-net adjustments have risen from 12% to about 20% over six months as the prefilled syringe version increases market share. This trend is putting strain on net margins even as operational leverage improves with Vyvgart’s global expansion.

- According to the analysts' consensus view, elevated discounts and rebates challenge the narrative of perpetual earnings leverage.

- Management cautions that net revenue per patient is steady for now. However, ongoing rebate “creep” could cause future net margin erosion.

- Profit margins are expected to contract from 41.0% today to 38.0% in three years. This reflects pricing and mix headwinds amidst strong topline growth.

Heavy Reliance on Vyvgart Raises Stakes

- ARGX’s results remain heavily tied to Vyvgart as the principal revenue driver. Ongoing expansion into indications like CIDP, seronegative MG, and ocular MG supports volume growth but also intensifies concentration risk.

- Consensus narrative notes that while pipeline progress and new indications could reduce reliance on a single drug,

- Any regulatory safety concern, such as a potential FAERS signal requiring a label change, or a competitive launch could abruptly impact revenues and profitability.

- Product diversification is underway, but material earnings and margin resilience still depend on successful late-stage pipeline outcomes.

Valuation Undervalued on DCF, But Sector Premium Persists

- At a current share price of €702.4, argenx trades at a Price-To-Earnings ratio of 38.8x, below the peer average of 43.4x but well above the European biotech industry’s 17.6x, and far under its DCF fair value of €2,142.7.

- According to analysts' consensus view, valuation creates a tension for investors:

- The share price is 67% below estimated DCF fair value, which heavily supports the bullish case for long-term upside.

- The premium P/E relative to the broader sector signals expectations for sustained high growth. Any stumbles on pipeline or net margin could prompt a sharp market reaction.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for argenx on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an angle others might miss? Shape your own view in just a few minutes and bring new perspective to the market story. Do it your way

A great starting point for your argenx research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite robust revenue growth, argenx's dependence on a single product and vulnerability to net margin erosion highlight its exposure to volatility and valuation risk.

If you want to focus on steadier investments with consistent earnings and lower dependence on individual products, check out stable growth stocks screener (2112 results) for companies delivering reliable results through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:ARGX

argenx

A commercial-stage biopharma company, develops various therapies for the treatment of autoimmune diseases in the United States, Japan, China, the Netherlands, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives