- Saudi Arabia

- /

- Healthcare Services

- /

- SASE:4013

3 Stocks Estimated To Be Up To 45% Below Intrinsic Value

Reviewed by Simply Wall St

Amid mixed trading and cautious optimism in global markets, investors are keeping a close eye on value stocks, which have recently outperformed growth shares. With inflation data showing signs of stability and consumer spending on the rise, the current market environment presents opportunities for identifying undervalued stocks that could be trading significantly below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Owens Corning (NYSE:OC) | US$159.61 | US$318.30 | 49.9% |

| Elders (ASX:ELD) | A$9.08 | A$18.11 | 49.9% |

| Lindab International (OM:LIAB) | SEK261.60 | SEK523.01 | 50% |

| KeePer Technical Laboratory (TSE:6036) | ¥3940.00 | ¥7876.18 | 50% |

| Serstech (OM:SERT) | SEK1.32 | SEK2.64 | 50% |

| Enphase Energy (NasdaqGM:ENPH) | US$112.91 | US$225.41 | 49.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.396 | €0.79 | 49.8% |

| ABCO Electronics (KOSDAQ:A036010) | ₩5780.00 | ₩11545.78 | 49.9% |

| Forterra (LSE:FORT) | £1.74 | £3.48 | 49.9% |

| Zillow Group (NasdaqGS:ZG) | US$52.24 | US$104.24 | 49.9% |

Underneath we present a selection of stocks filtered out by our screen.

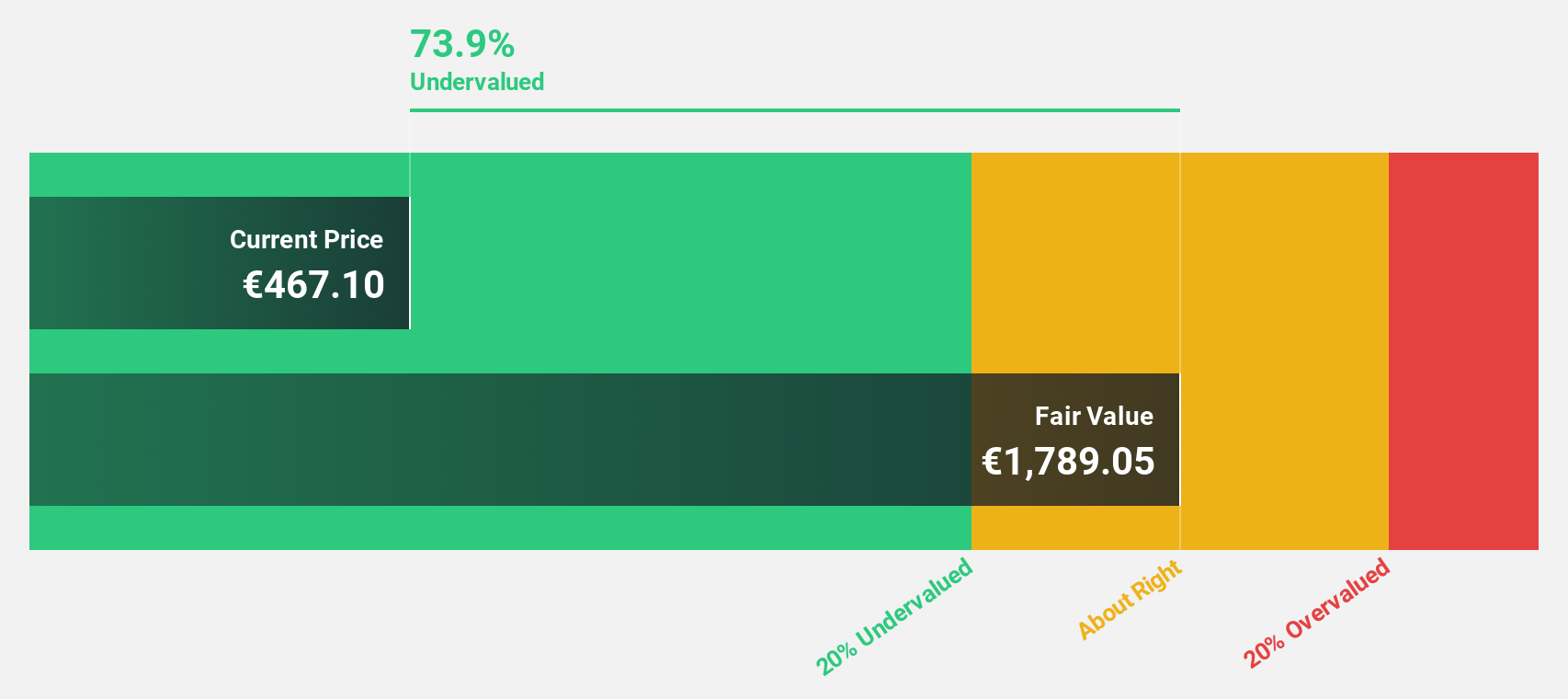

argenx (ENXTBR:ARGX)

Overview: argenx SE, a biotechnology company with a market cap of €27.93 billion, develops therapies for treating autoimmune diseases across the United States, Japan, Europe, Middle East, Africa, and China.

Operations: The company generates $1.66 billion from its biotechnology segment.

Estimated Discount To Fair Value: 45%

argenx SE appears undervalued based on its strong cash flow performance and discounted trading price relative to fair value estimates. Recent earnings reports show significant revenue growth, with second-quarter revenue at US$489.43 million, up from US$281.04 million a year ago, and net income of US$29.07 million compared to a net loss previously. The company is also expected to achieve profitability within three years, supported by high forecasted revenue growth and return on equity projections.

- In light of our recent growth report, it seems possible that argenx's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in argenx's balance sheet health report.

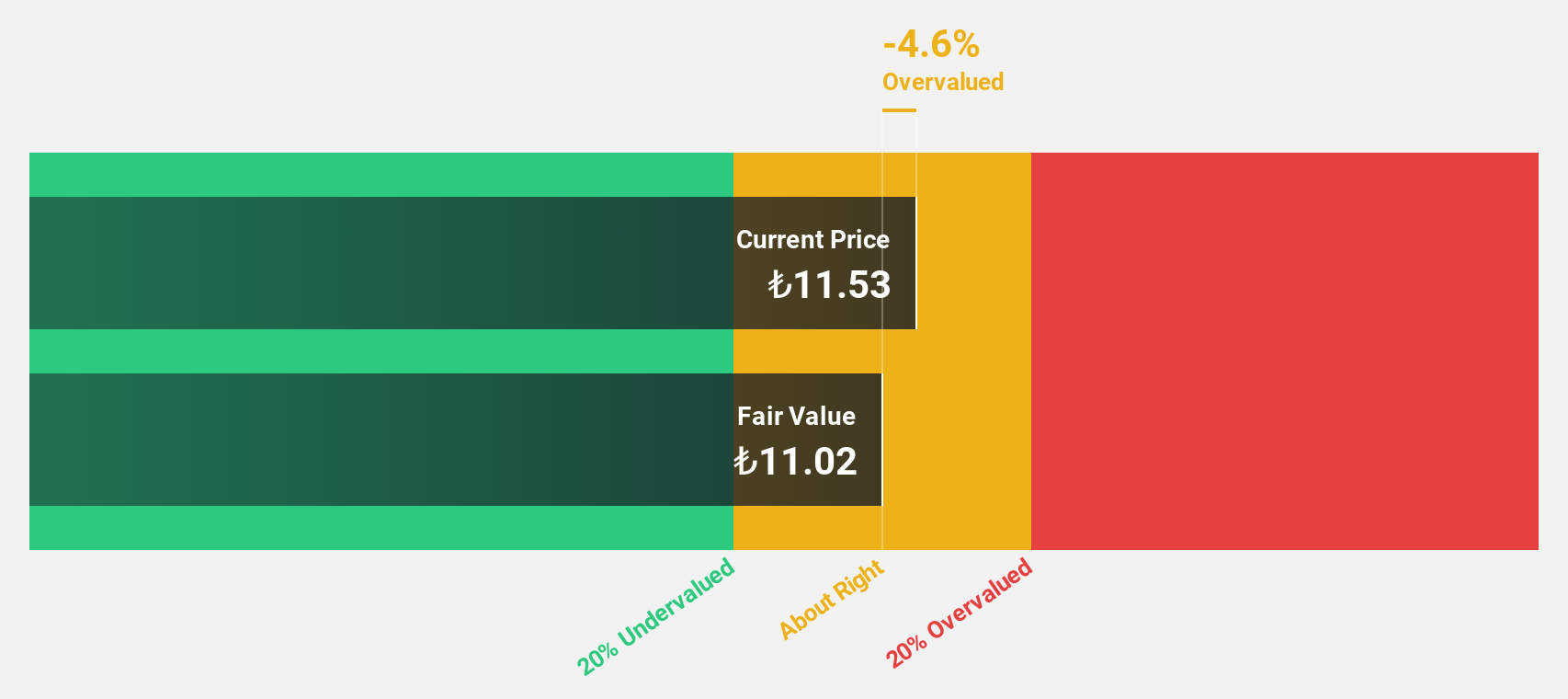

Türkiye Is Bankasi (IBSE:ISCTR)

Overview: Türkiye Is Bankasi A.S. offers a range of banking products and services in Turkey with a market cap of TRY399.10 billion.

Operations: Türkiye Is Bankasi A.S. generates revenue through Corporate/Commercial Banking (TRY142.67 billion), Treasury Transaction/Investment Activities (TRY104.34 billion), and Insurance and Reinsurance Activities (TRY48.37 billion).

Estimated Discount To Fair Value: 26.1%

Türkiye Is Bankasi appears undervalued based on cash flow analysis, trading at TRY13.67 compared to a fair value estimate of TRY18.5. Recent earnings show net interest income for the second quarter was stable year-over-year at approximately TRY 20 billion, while net income decreased to TRY 15.30 billion from TRY 18.71 billion a year ago. Despite high non-performing loans (2.2%), earnings are forecasted to grow significantly at 34.49% annually over the next three years, with strong return on equity projections (31.9%).

- Insights from our recent growth report point to a promising forecast for Türkiye Is Bankasi's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Türkiye Is Bankasi.

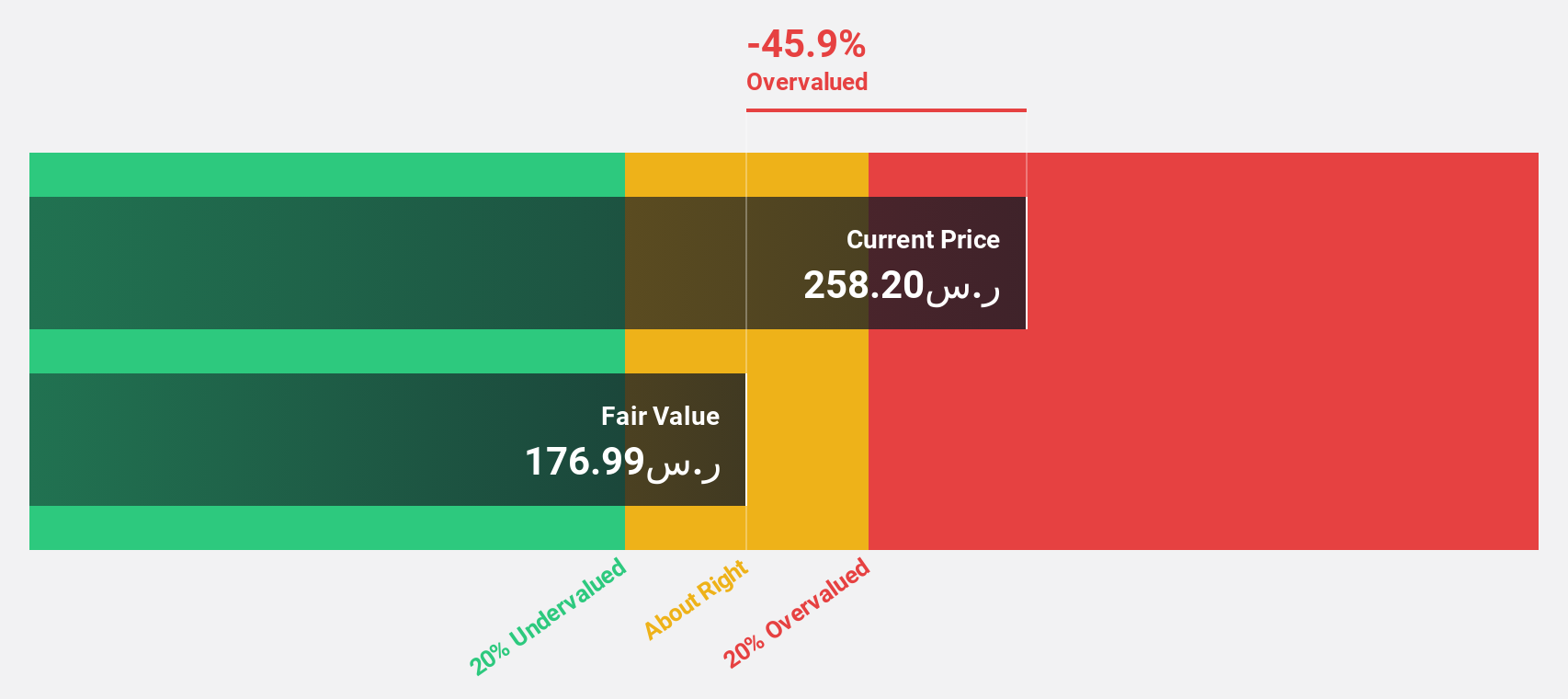

Dr. Sulaiman Al Habib Medical Services Group (SASE:4013)

Overview: Dr. Sulaiman Al Habib Medical Services Group Company establishes, manages, and operates hospitals, medical complexes, day surgery centers, and pharmaceutical facilities in Saudi Arabia and internationally with a market cap of SAR106.40 billion.

Operations: The company's revenue segments include SAR7.69 billion from hospitals and healthcare facilities, SAR2.10 billion from pharmacies, and SAR230 million from HMG Solutions.

Estimated Discount To Fair Value: 44.9%

Dr. Sulaiman Al Habib Medical Services Group reported Q2 2024 sales of SAR 2.57 billion and a net income of SAR 555.03 million, with basic EPS at SAR 1.59. Trading at SAR 305.8, it is significantly undervalued compared to its estimated fair value of SAR 554.69, reflecting a discount of approximately 45%. Despite high debt levels, the company shows robust revenue growth forecasts (14.2% annually) and strong return on equity projections (39.1%).

- Our earnings growth report unveils the potential for significant increases in Dr. Sulaiman Al Habib Medical Services Group's future results.

- Navigate through the intricacies of Dr. Sulaiman Al Habib Medical Services Group with our comprehensive financial health report here.

Where To Now?

- Dive into all 961 of the Undervalued Stocks Based On Cash Flows we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4013

Dr. Sulaiman Al Habib Medical Services Group

Dr. Sulaiman Al Habib Medical Services Group Company establishes, manages, and operates hospitals, general and specialized medical complexes, day surgery centers, and pharmaceutical facilities in Saudi Arabia and internationally.

Reasonable growth potential with acceptable track record.