- Belgium

- /

- Entertainment

- /

- ENXTBR:KIN

3 Stocks Possibly Trading Below Their Intrinsic Value By Up To 43.3%

Reviewed by Simply Wall St

In a week marked by mixed performances across major indices, with growth stocks leading the charge while value stocks lagged behind, investors are paying close attention to market dynamics and economic indicators such as job growth and potential interest rate cuts. Amid this environment of fluctuating sector performances and geopolitical developments, identifying stocks that might be undervalued can present opportunities for investors seeking to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Round One (TSE:4680) | ¥1266.00 | ¥2527.81 | 49.9% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.06 | US$99.93 | 49.9% |

| Proya CosmeticsLtd (SHSE:603605) | CN¥92.22 | CN¥184.30 | 50% |

| BMC Medical (SZSE:301367) | CN¥68.53 | CN¥136.81 | 49.9% |

| Acerinox (BME:ACX) | €9.98 | €19.93 | 49.9% |

| Grupo Traxión. de (BMV:TRAXION A) | MX$19.71 | MX$39.28 | 49.8% |

| North Electro-OpticLtd (SHSE:600184) | CN¥11.08 | CN¥22.00 | 49.6% |

| Sands China (SEHK:1928) | HK$20.20 | HK$40.33 | 49.9% |

| Equifax (NYSE:EFX) | US$266.82 | US$530.98 | 49.7% |

| iFLYTEKLTD (SZSE:002230) | CN¥51.82 | CN¥102.95 | 49.7% |

Let's uncover some gems from our specialized screener.

Kinepolis Group (ENXTBR:KIN)

Overview: Kinepolis Group NV operates cinema complexes across multiple countries including Belgium, the Netherlands, France, Spain, Luxembourg, Switzerland, Poland, Canada, and the United States with a market cap of €1.02 billion.

Operations: The company's revenue is primarily derived from Box Office (€294.05 million), In-Theatre Sales (€177.61 million), Real Estate (€13.88 million), Film Distribution (€4.07 million), and its Technical Department (€0.07 million).

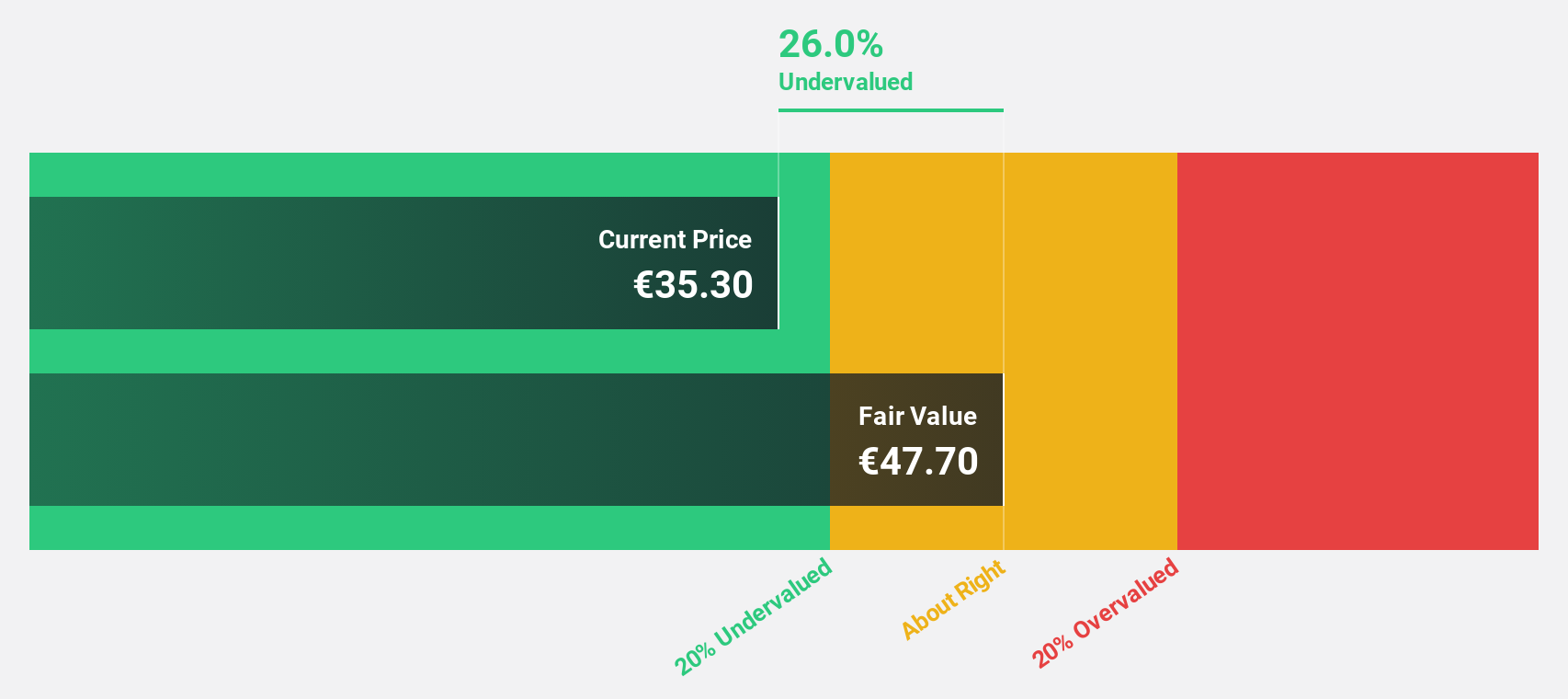

Estimated Discount To Fair Value: 41.8%

Kinepolis Group is trading at €38.2, significantly below its estimated fair value of €65.6, suggesting potential undervaluation based on discounted cash flow analysis. Despite a high debt level, the company's earnings are expected to grow significantly at 27.77% per year over the next three years, outpacing the Belgian market's growth rate of 20.7%. However, revenue growth is slower than both company and market expectations at 6% annually.

- According our earnings growth report, there's an indication that Kinepolis Group might be ready to expand.

- Click to explore a detailed breakdown of our findings in Kinepolis Group's balance sheet health report.

GemPharmatech (SHSE:688046)

Overview: GemPharmatech Co., Ltd. is a contract research organization that offers genetically engineered mouse models and preclinical research services globally, with a market cap of approximately CN¥6.03 billion.

Operations: GemPharmatech Co., Ltd. generates revenue primarily through the provision of genetically engineered mouse models and preclinical research services to the global scientific community.

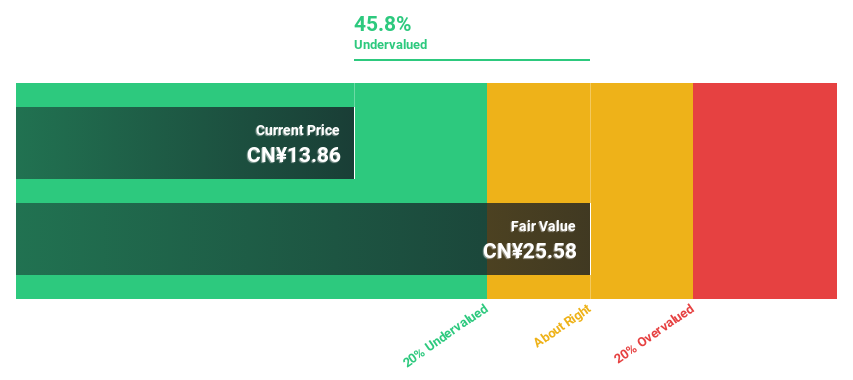

Estimated Discount To Fair Value: 43.3%

GemPharmatech is trading at CN¥14.76, substantially below its estimated fair value of CN¥26.02, highlighting potential undervaluation based on cash flow analysis. Despite a recent decline in net income to CN¥98.21 million for the nine months ending September 2024, revenue grew to CN¥509.72 million from the previous year. The company expects significant annual earnings growth of 27.91%, surpassing market averages, supported by innovative developments like the NeoMab-IgG Ease model and a share buyback program worth up to CNY 40 million.

- Insights from our recent growth report point to a promising forecast for GemPharmatech's business outlook.

- Navigate through the intricacies of GemPharmatech with our comprehensive financial health report here.

Xuzhou Handler Special Vehicle (SZSE:300201)

Overview: Xuzhou Handler Special Vehicle Co., Ltd is involved in the research, development, production, and sales of aerial work vehicles, electric emergency support vehicles, military products, and fire trucks with a market capitalization of CN¥6.05 billion.

Operations: Xuzhou Handler Special Vehicle Co., Ltd generates revenue primarily from its aerial work vehicles, electric emergency support vehicles, military products, and fire trucks.

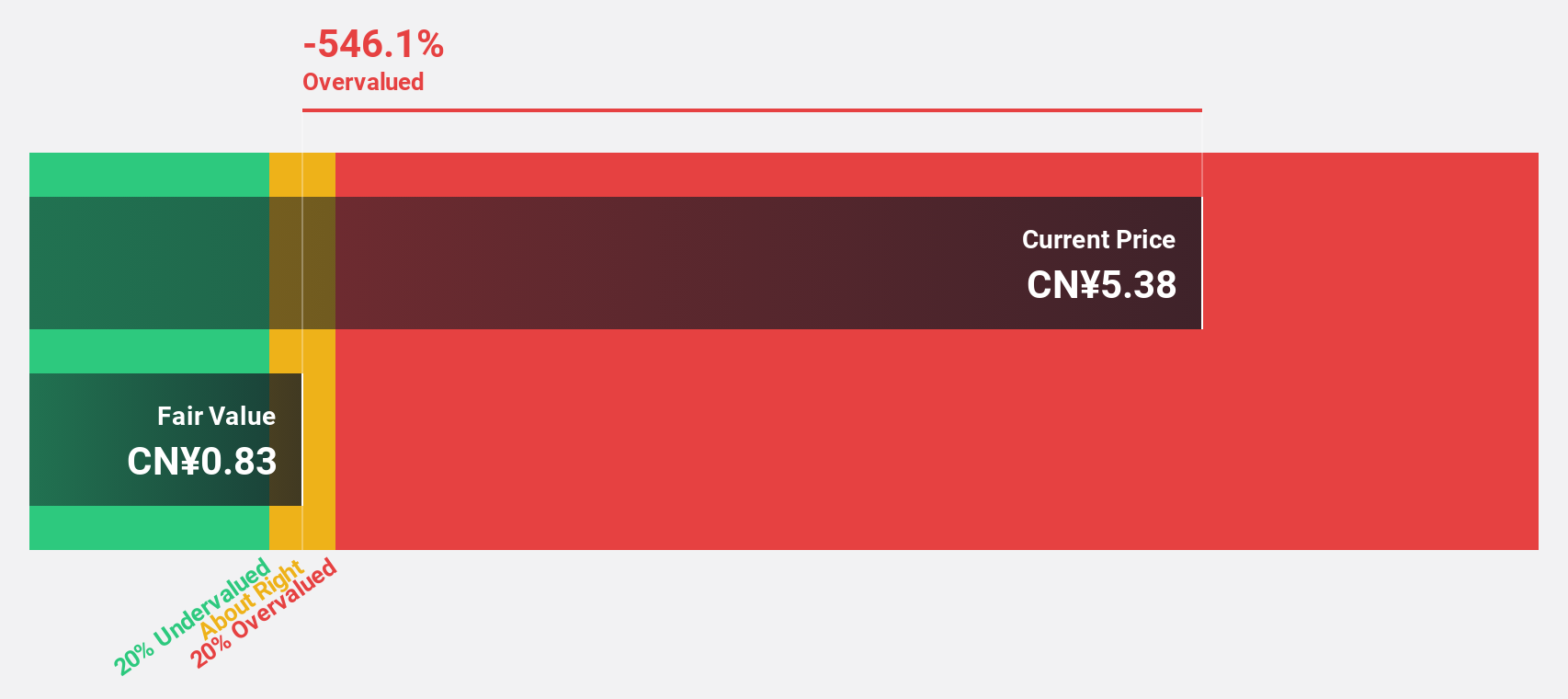

Estimated Discount To Fair Value: 18.5%

Xuzhou Handler Special Vehicle is trading at CN¥6.12, slightly below its estimated fair value of CN¥7.51, suggesting potential undervaluation based on cash flows. Despite a decline in sales to CNY 1 billion for the nine months ending September 2024, net income remained stable at CNY 133.08 million. The company forecasts revenue growth of 26% annually and significant earnings growth over the next three years, though its dividend track record remains unstable.

- The analysis detailed in our Xuzhou Handler Special Vehicle growth report hints at robust future financial performance.

- Take a closer look at Xuzhou Handler Special Vehicle's balance sheet health here in our report.

Taking Advantage

- Access the full spectrum of 884 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinepolis Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:KIN

Kinepolis Group

Operates cinema complexes in Belgium, the Netherlands, France, Spain, Luxembourg, Switzerland, Poland, Canada, and the United States.

Good value with reasonable growth potential.