Undiscovered Gems And 2 Other Promising European Stocks To Watch

Reviewed by Simply Wall St

Amidst a backdrop of mixed performances in European markets, with the STOXX Europe 600 Index slightly down and inflation staying close to target levels, investors are keenly observing small-cap stocks for potential opportunities. In this environment, identifying promising stocks often involves looking for companies that demonstrate resilience in economic uncertainty and have solid fundamentals that can weather broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Flügger group | 30.11% | 1.55% | -30.01% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Dekpol | 63.20% | 11.99% | 14.08% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

NewPrinces (BIT:NWL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: NewPrinces S.p.A. is engaged in the agri-food sector across Italy, Germany, the United Kingdom, and internationally, with a market cap of €1.09 billion.

Operations: Revenue streams for NewPrinces are diversified across multiple regions, with a focus on the agri-food sector. The company has a market cap of approximately €1.09 billion.

NewPrinces, a small European player, recently reported impressive half-year sales of €1.31 billion, up from €370.13 million last year, with net income rising to €20.93 million from €8.39 million. Basic and diluted earnings per share both increased to €0.48 from the previous year's €0.19, showcasing significant growth in profitability and operational efficiency despite its size. However, future prospects seem challenging as analysts anticipate a decline in profit margins and earnings over the next few years due to high debt levels and potential pricing volatility in private-label contracts, suggesting cautious optimism for investors evaluating this stock's fair value at current levels.

Viohalco (ENXTBR:VIO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Viohalco S.A. is a company that, through its subsidiaries, manufactures and sells aluminium, copper, cables, and steel and steel pipe products with a market cap of €1.71 billion.

Operations: Viohalco generates revenue primarily from the sale of aluminium, copper, cables, and steel and steel pipe products. The company's cost structure includes expenses related to raw materials, manufacturing processes, and distribution. Notably, its net profit margin has shown variability over recent periods.

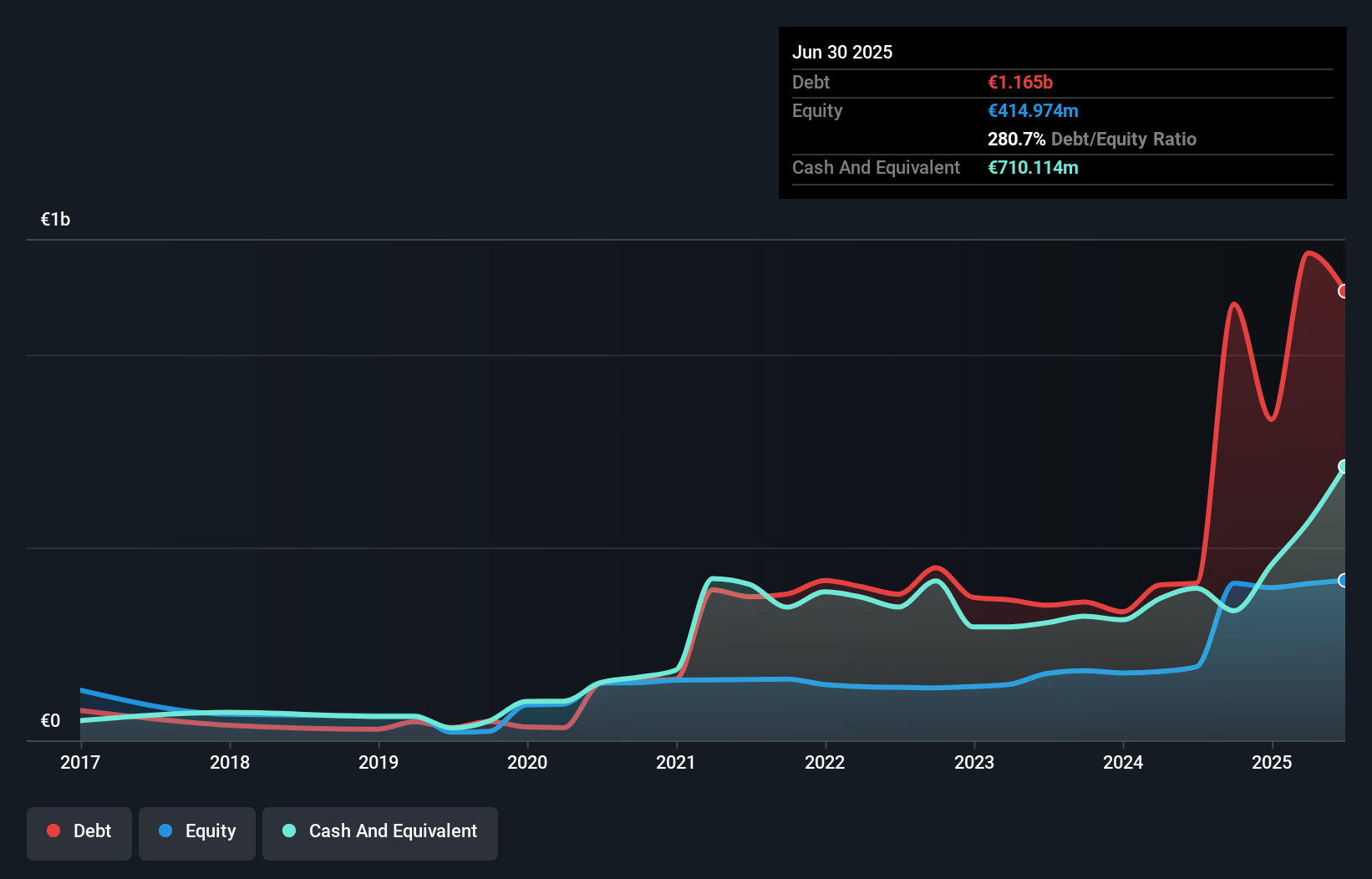

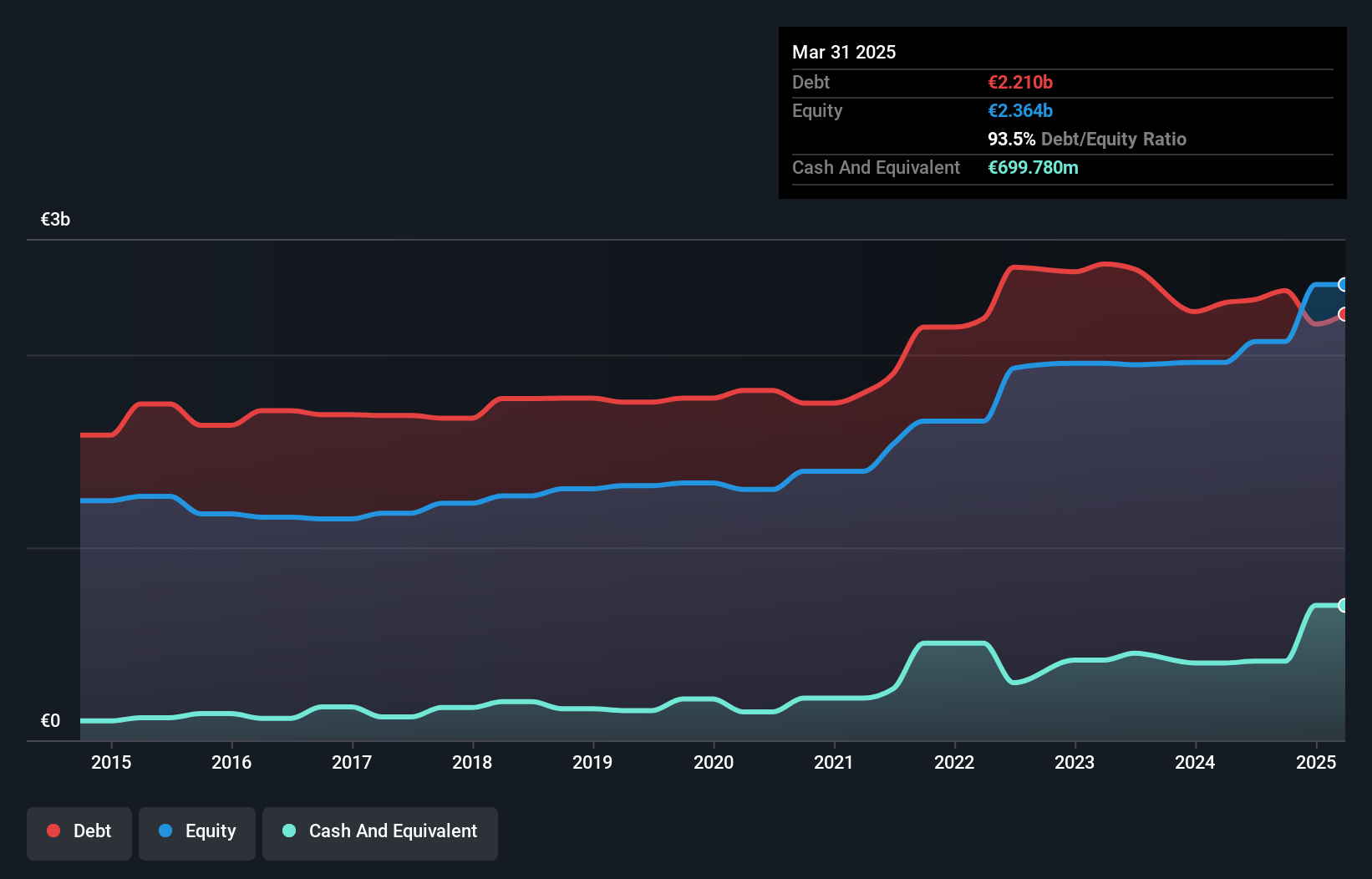

Viohalco, a notable player in the metals and mining sector, has shown impressive earnings growth of 336.9% over the past year, significantly outpacing industry averages. Trading at 51.4% below its estimated fair value, it presents a compelling valuation case. Despite this growth trajectory, Viohalco's interest payments are not adequately covered by EBIT with only 2.8x coverage; ideally, this should be at least 3x for comfort. The debt profile shows improvement with a reduction in the debt to equity ratio from 139.5% to 93.5% over five years; however, net debt remains high at 63.9%.

- Get an in-depth perspective on Viohalco's performance by reading our health report here.

Examine Viohalco's past performance report to understand how it has performed in the past.

Neurones (ENXTPA:NRO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Neurones S.A. is an IT services company offering infrastructure, application, and consulting services both in France and internationally, with a market cap of €996.06 million.

Operations: Neurones generates revenue primarily from infrastructure services (€499.74 million), application services (€257.51 million), and consulting (€53.10 million).

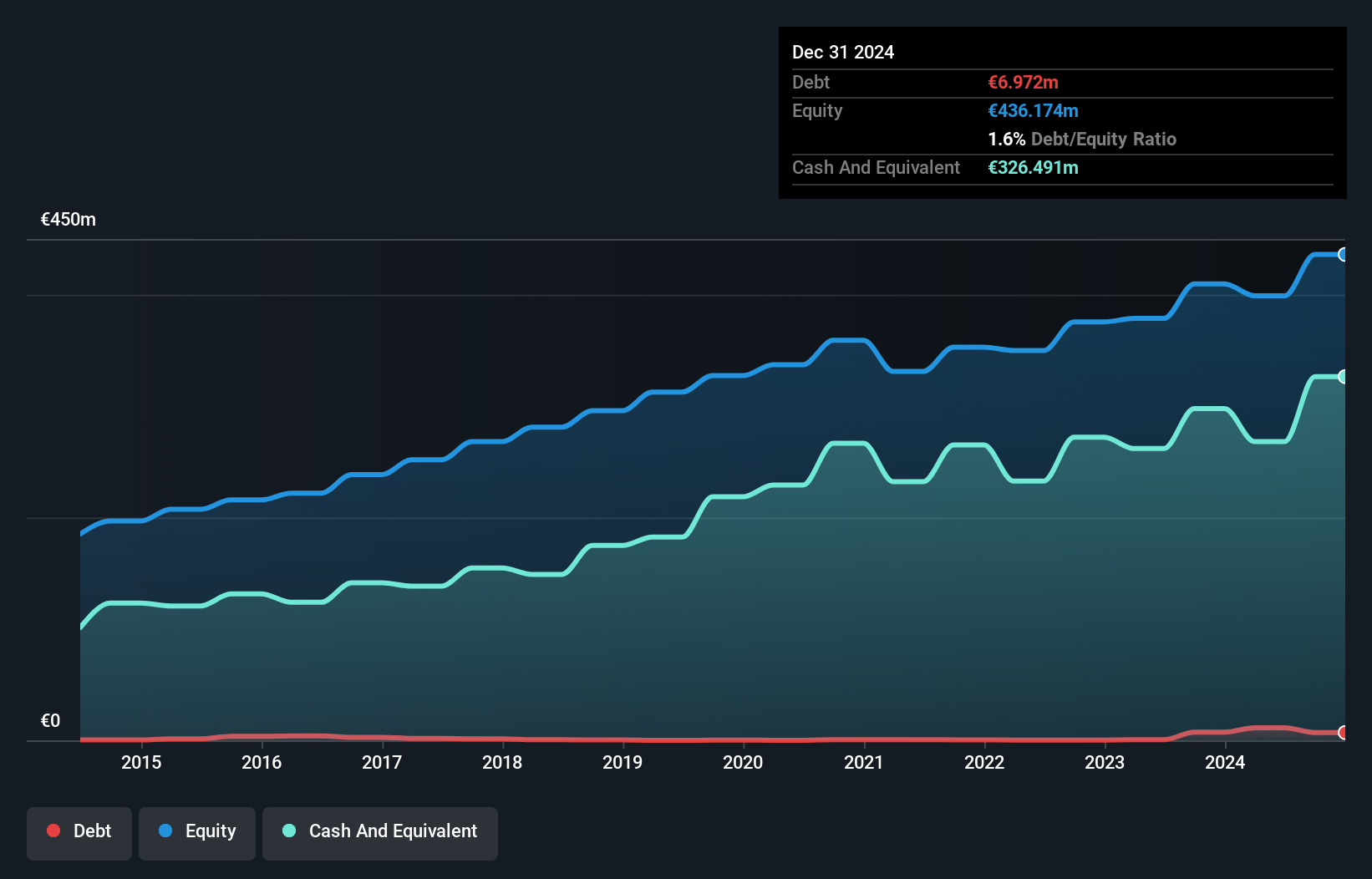

Neurones, a dynamic player in the European IT sector, demonstrates robust financial health with earnings growth of 6.4% over the past year, outpacing the industry average of 2.1%. Despite a rise in its debt to equity ratio from 0.05% to 1.6% over five years, it holds more cash than total debt and trades at approximately 30.8% below estimated fair value. Recent announcements show half-year sales reaching €424.3 million, up from €402.4 million last year, although net income dipped slightly to €22.7 million from €24.5 million previously, suggesting potential for strategic adjustments moving forward.

- Navigate through the intricacies of Neurones with our comprehensive health report here.

Explore historical data to track Neurones' performance over time in our Past section.

Make It Happen

- Get an in-depth perspective on all 330 European Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neurones might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:NRO

Neurones

Provides infrastructure, application, and consulting services in France.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives