Why Umicore (ENXTBR:UMI) Is Down 13.6% After GBL Halves Its Stake in Accelerated Bookbuild

Reviewed by Sasha Jovanovic

- Belgian holding company GBL recently sold half its stake in Umicore through an accelerated bookbuild, reducing its ownership from 16% to 8% and committing to a 90-day lock-up on its remaining shares.

- This transaction reflects GBL’s broader plan to streamline its portfolio towards private assets and follows a period of recovery for Umicore’s share price.

- We'll assess how GBL's sizable stake reduction impacts Umicore’s investment outlook and potential capital structure considerations going forward.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Umicore Investment Narrative Recap

Umicore’s investment case revolves around its potential to capture growth in electric vehicle and recycling markets, while managing exposure to volatile metals prices and operational risks in its Battery Materials division. The recent sale by GBL, while impactful for near-term share price volatility, does not materially affect the key short-term catalyst: the stabilization and recovery of its Battery Materials business, nor does it significantly change the biggest risk, which remains the persistent demand slowdown in electric vehicles.

Among the most relevant recent announcements is the reported €1.6 billion impairment in the Battery Materials segment, signaling ongoing financial headwinds in a core division. As shareholders consider the implications of GBL’s reduced stake, the focus remains on how Umicore will address profitability challenges, especially given recent volatile trading and headwinds for battery and recycling revenues.

Yet, it’s important to recognize that in contrast to portfolio shifts like GBL’s, the true risk for investors lies in persistent weakness in electric vehicle demand and the possibility...

Read the full narrative on Umicore (it's free!)

Umicore's outlook anticipates €3.8 billion in revenue and €344.5 million in earnings by 2028. This reflects a yearly revenue decline of 38.3% and an earnings increase of €215.7 million from the current earnings of €128.8 million.

Uncover how Umicore's forecasts yield a €14.79 fair value, in line with its current price.

Exploring Other Perspectives

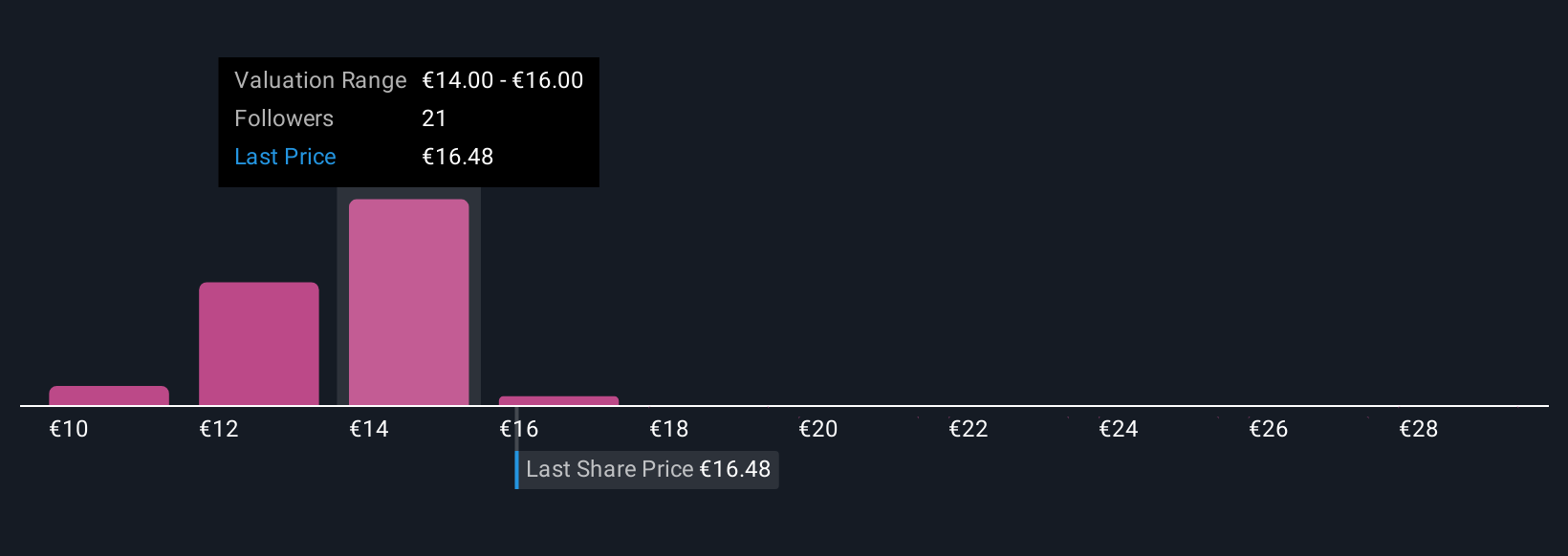

The Simply Wall St Community’s 11 fair value estimates for Umicore range broadly from €10 to €55.93 per share. While opinions vary, the most pressing issue is ongoing demand challenges in the company’s Battery Materials segment, which could shape Umicore’s longer-term trajectory and capital needs.

Explore 11 other fair value estimates on Umicore - why the stock might be worth over 3x more than the current price!

Build Your Own Umicore Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Umicore research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Umicore research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Umicore's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:UMI

Umicore

Operates as a materials technology and recycling company in Belgium, Europe, the Asia-Pacific, North America, South America, and Africa.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives