Syensqo (ENXTBR:SYENS): Exploring Valuation as Shares Draw Fresh Investor Attention

Reviewed by Simply Wall St

See our latest analysis for Syensqo.

Syensqo’s share price has shown some resilience lately, notching a 5.9% gain over the past month and a modest 1-year total shareholder return of 0.6%. While momentum has been somewhat uneven, today’s movement suggests that investors are re-evaluating its near-term prospects in light of broader sector themes.

If today’s activity has you curious about what else is gathering momentum, now is the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

With Syensqo trading below analyst price targets and showing signs of renewed interest, the central question remains: does this represent an attractive entry point, or is the market already factoring in its growth potential?

Most Popular Narrative: 14.6% Undervalued

Compared to its last close price of €71.64, the most popular narrative assigns a higher fair value for Syensqo, highlighting an opportunity that stands out amid sector volatility. This narrative offers a distinct lens on what could drive future market moves.

Volume recovery in semiconductors and growing demand for sustainable materials are driving revenue growth and expanding high-margin opportunities across multiple end markets. Organizational efficiencies, strategic expansion in Asia-Pacific, and advanced digital innovation are strengthening profitability, competitiveness, and long-term earnings potential.

Curious which financial projections justify this valuation edge? The narrative’s secret sauce includes ambitious earnings upgrades, margin expansion, and aggressive strategic plays. The numbers behind these projections might just surprise even seasoned market watchers. Don’t miss what supports this bullish outlook.

Result: Fair Value of €83.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing volume declines in key segments and broader macroeconomic unpredictability could derail Syensqo’s expected margin recovery and challenge the bullish case.

Find out about the key risks to this Syensqo narrative.

Another View: Multiplier Method Raises Questions

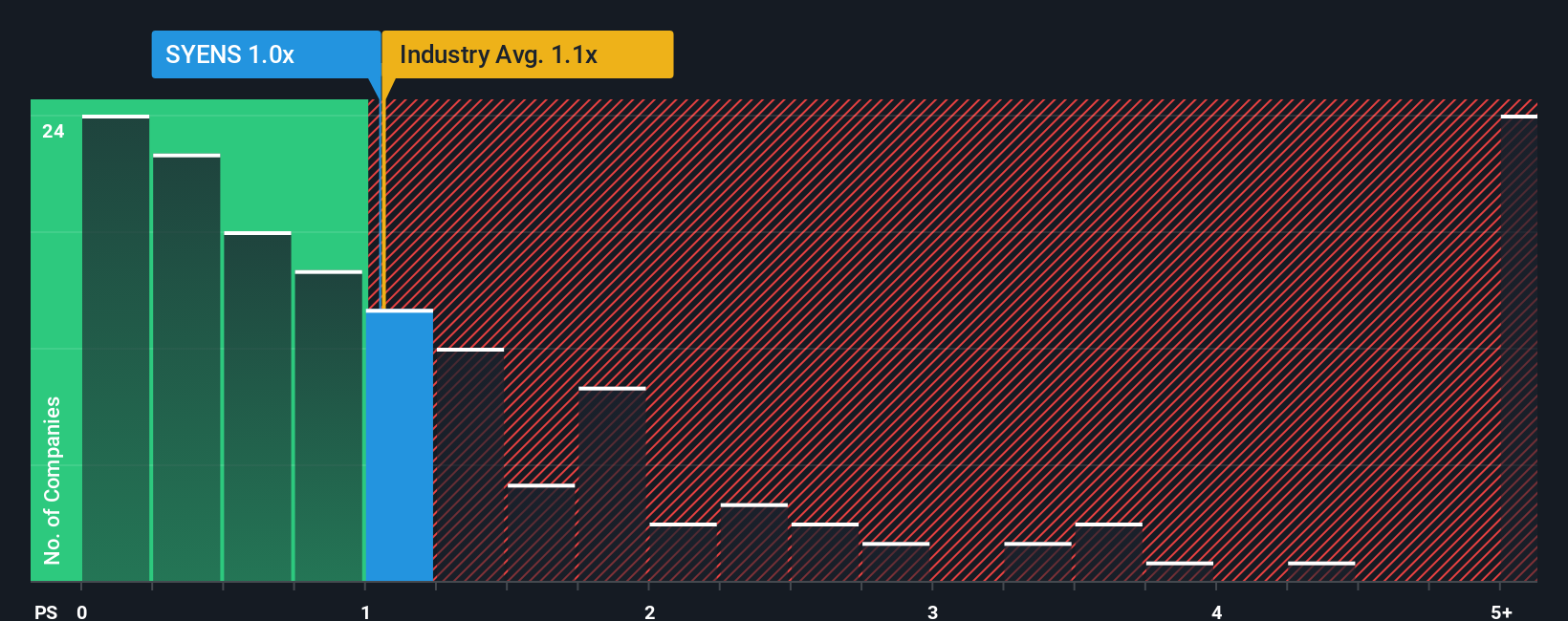

While analyst forecasts imply Syensqo is undervalued, the usual price-to-sales ratio tells a different story. At 1.1x, Syensqo trades higher than both industry (1x) and peer averages (0.4x), suggesting the market is already pricing in optimism. Yet, the fair ratio stands at 1.2x. Is there still upside, or does this premium signal risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Syensqo Narrative

If you have a different take or value your own research, it’s quick and easy to build a Syensqo narrative in just a few minutes. This allows you to analyze the numbers your way. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Syensqo.

Looking for more investment ideas?

Don’t settle for the ordinary when you can supercharge your portfolio with unique opportunities using the Simply Wall Street Screener. There’s a whole world of promising stocks just waiting for your attention.

- Capture growth potential by tracking the momentum among innovators in artificial intelligence when you check out these 26 AI penny stocks, accelerating smart technologies across industries.

- Boost your portfolio’s income profile by selecting these 23 dividend stocks with yields > 3%, delivering yields above 3 percent and stronger cash returns even in uncertain times.

- Stay ahead of market trends by uncovering these 28 quantum computing stocks, which are setting new benchmarks in computational breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:SYENS

Syensqo

Engages in the research, development, and production of advanced materials for industrial and consumer applications worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion