Solvay (ENXTBR:SOLB) Valuation: Is the Market Overlooking Opportunities After Recent Moves?

Reviewed by Simply Wall St

Solvay (ENXTBR:SOLB) shares have seen modest movement over the past week, leaving investors to dig into underlying business performance and valuation trends. With no major headlines, the focus shifts to how long-term returns compare.

See our latest analysis for Solvay.

Solvay’s recent 5.8% 7-day share price return has helped trim some of its losses, but longer-term momentum is muted. The company’s year-to-date share price return sits at -7.95%, while its three-year total shareholder return of 73.65% still stands out as evidence of significant longer-term value creation. Shares now trade at €28.5, reflecting both investor caution and an ongoing focus on the fundamentals.

If Solvay’s performance has you looking for more dynamic opportunities, consider broadening your search and explore fast growing stocks with high insider ownership.

With shares lagging and recent financials offering mixed signals, the question for investors is whether the current price offers hidden value or if the market has already accounted for Solvay’s growth prospects.

Most Popular Narrative: 2.5% Overvalued

Solvay’s most popular valuation narrative estimates the company’s fair value at €27.80, compared to its recent closing price of €28.5. This places Solvay modestly above what analysts consider justified by the fundamentals. The current trading levels appear slightly stretched and set up a debate on whether forecasted improvements will be enough to close the gap.

Prolonged pricing pressures, trade tensions, operational inefficiencies, and environmental liabilities threaten Solvay's revenue stability, margin strength, and future growth opportunities.

What hidden assumptions drive this high-magnitude call? The narrative hinges on an ambitious rebound in profit margins and a bold forecast for core earnings. Can Solvay deliver these aggressive improvements, or will the risks outlined tip the balance? Unpack the quantitative bull and bear case behind the consensus with a closer look inside the full narrative.

Result: Fair Value of €27.80 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing pricing pressures and uncertainty in key end-markets could easily disrupt Solvay’s margin recovery. This could shift the valuation narrative in the months ahead.

Find out about the key risks to this Solvay narrative.

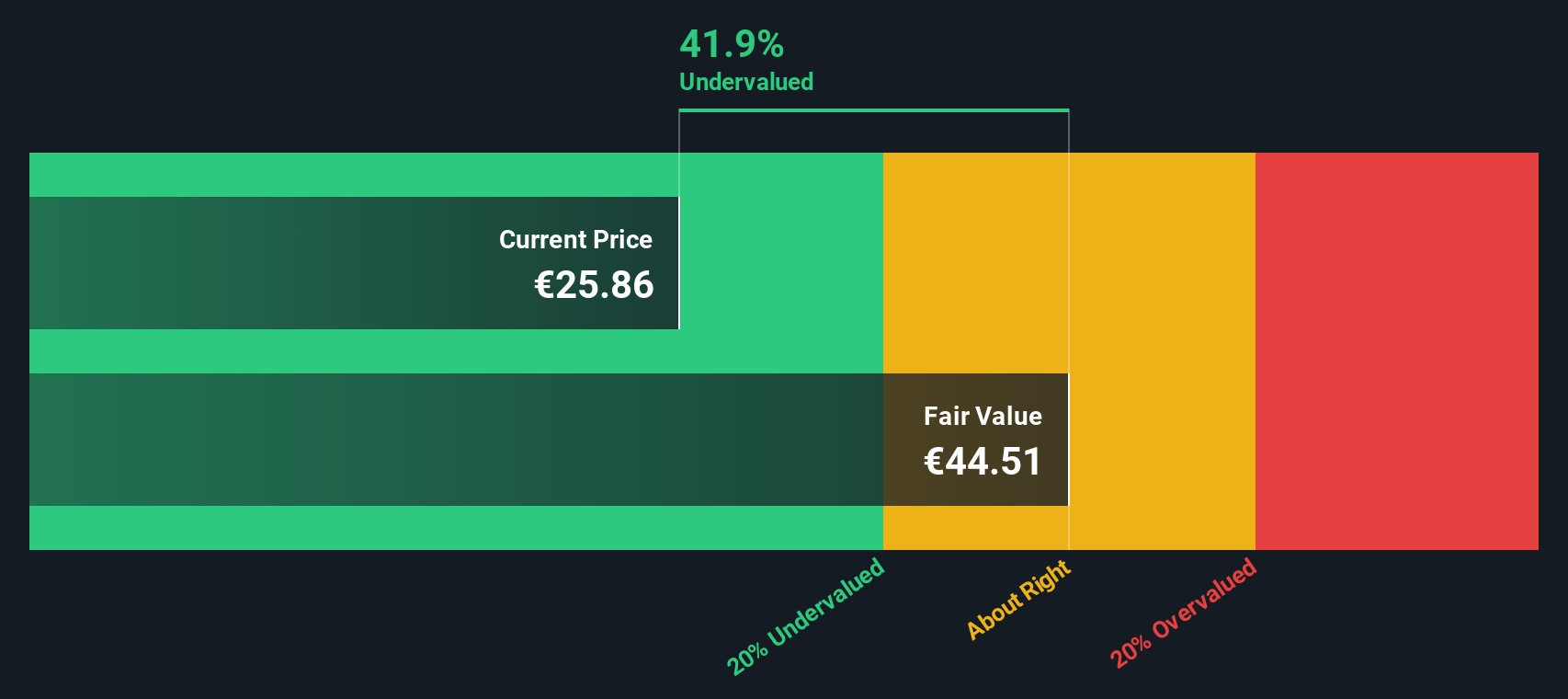

Another View: SWS DCF Model Suggests Undervaluation

While the consensus price target puts Solvay slightly above fair value, our DCF model presents a different perspective. Based on projected cash flows, Solvay is trading 32.1% below its estimated fair value (€41.95 compared to the current price). Does this indicate a potential upside that the market is overlooking, or do risks play a greater role than cash flow forecasts account for?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Solvay for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 933 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Solvay Narrative

If you see the story differently or want to dig into the numbers yourself, it’s easy to build your own personalized view in just minutes with Do it your way.

A great starting point for your Solvay research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Opportunities? Find Your Next Big Winner

Don't settle for a single stock when there are countless smart ways to build your future. Uncover standout investments that match your goals using these handpicked tools:

- Maximize your income and track down consistent high-yielders with these 14 dividend stocks with yields > 3%, which pay over 3% in dividends.

- Ride the wave of innovation by tapping into these 26 AI penny stocks in artificial intelligence, machine learning, and automation.

- Seize value-driven growth by targeting these 933 undervalued stocks based on cash flows with strong cash flows for a solid foundation in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:SOLB

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success