Solvay (ENXTBR:SOLB): Valuation Insights After New Rare Earth Supply Deal With Noveon Magnetics

Reviewed by Simply Wall St

Solvay (ENXTBR:SOLB) just inked a supply agreement with Noveon Magnetics, setting the stage for delivery of rare earth oxides starting in 2026. This collaboration aims to create a sustainable supply chain for critical magnet materials in the context of ongoing supply challenges.

See our latest analysis for Solvay.

After a tough start to the year, Solvay’s share price has slipped 11.1% year-to-date, reflecting shifting investor sentiment despite big moves like the Noveon deal and steady dividends. Still, a robust 59.7% total shareholder return over three years shows that long-term holders remain well rewarded and suggests there is potential if momentum returns.

If you’re keen to spot other companies showing signs of accelerating growth and resilience, now is the perfect time to discover fast growing stocks with high insider ownership

With shares trading close to analyst targets but reflecting a substantial intrinsic discount, investors now face a pivotal question: is Solvay’s next leg of growth already in the price, or does value remain on the table?

Most Popular Narrative: 100% Undervalued

Solvay's most widely followed narrative values the company much higher than its current share price of €27.52, placing strong emphasis on dramatic changes underway and setting up the possibility of meaningful re-rating if forecasts are met.

Advancement of digitalization initiatives (IoT, drones, process automation) is delivering consistent structural cost savings across Solvay's plants. These savings are expected to exceed interim targets and drive higher operating margins and earnings over the medium term.

Curious how cost-cutting tech and bold margin forecasts could flip the script for Solvay? The most popular narrative teases a future with accelerating earnings and valuation multiples not seen in years. Want to see which numbers underpin this call? The full narrative reveals the surprising growth levers driving that optimistic fair price.

Result: Fair Value of €27.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure in key markets and uncertainty around global trade could quickly challenge the optimistic margin recovery that is expected for Solvay.

Find out about the key risks to this Solvay narrative.

Another View: Multiples Tell a Different Story

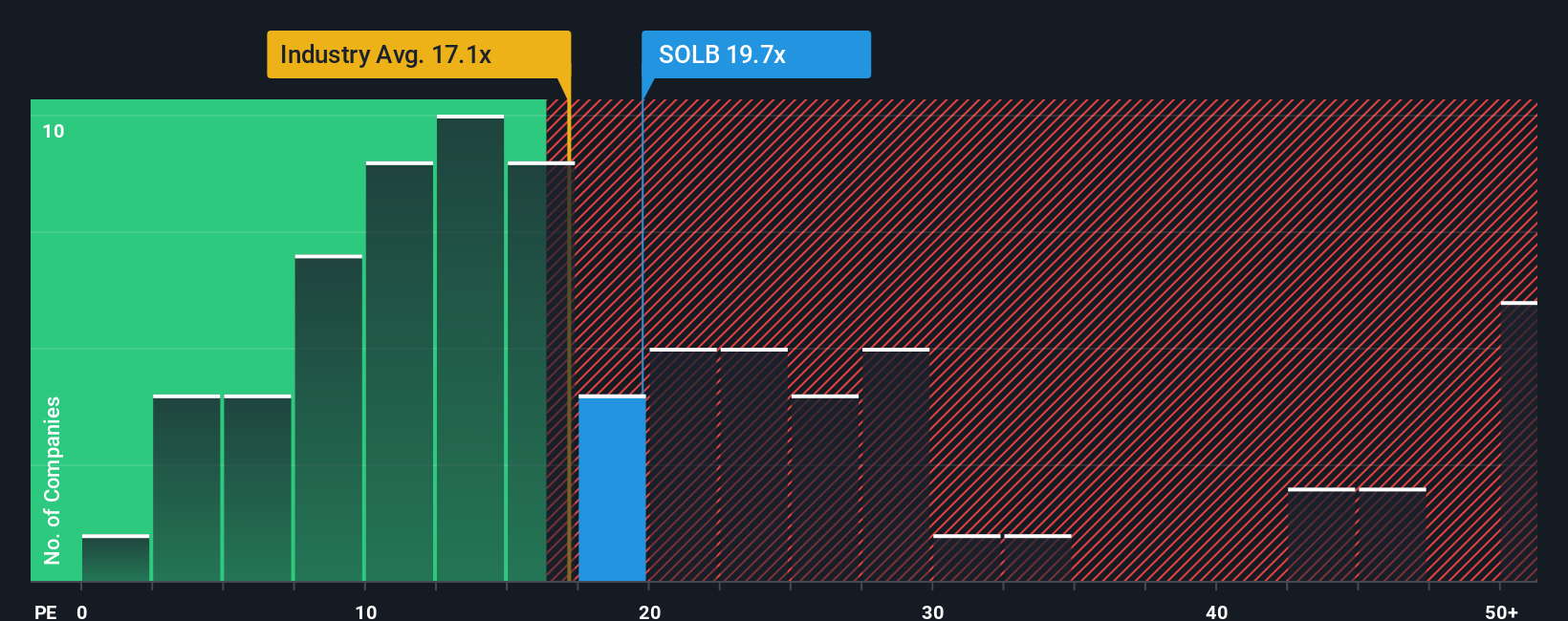

Looking at Solvay's valuation through the lens of price-to-earnings, the company trades at 18.7x, which is slightly above the European Chemicals industry average of 17.9x but below its fair ratio of 18.8x and peer average of 19.7x. This suggests the market may be pricing in some risks, but not dramatically so. Will the numbers keep investors cautious, or could improving performance close this gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Solvay Narrative

If you want a second view or have insights to add, dig into the numbers and craft your own outlook in just a few minutes. Do it your way

A great starting point for your Solvay research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for one opportunity. Uncover unique stocks, fresh trends, and sectors on the brink of breakout before the crowd catches on. Let Simply Wall Street’s powerful screener show you the way.

- Unlock substantial income potential by pursuing these 16 dividend stocks with yields > 3% that consistently offer yields above 3%, letting your portfolio grow while you collect steady returns.

- Seize the momentum in artificial intelligence by considering these 25 AI penny stocks, which highlights companies shaping tomorrow’s tech landscape before their true potential hits the headlines.

- Spot overlooked market gems when you tap into these 887 undervalued stocks based on cash flows, featuring stocks that remain undervalued based on cash flows and may offer superior upside if the market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:SOLB

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives