Undiscovered European Gems with Promising Potential August 2025

Reviewed by Simply Wall St

As European markets navigate a period of economic steadiness amidst global trade uncertainties, the pan-European STOXX Europe 600 Index recently experienced a decline of 2.57%, reflecting broader market sentiment influenced by international trade dynamics and modest economic growth within the eurozone. In this context, identifying stocks with strong fundamentals and resilience in challenging environments can be key to uncovering potential opportunities in the region's small-cap landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| Freetrailer Group | 0.04% | 22.75% | 33.30% | ★★★★★★ |

| Inmocemento | 28.68% | 3.60% | 33.84% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Safilo Group (BIT:SFL)

Simply Wall St Value Rating: ★★★★★★

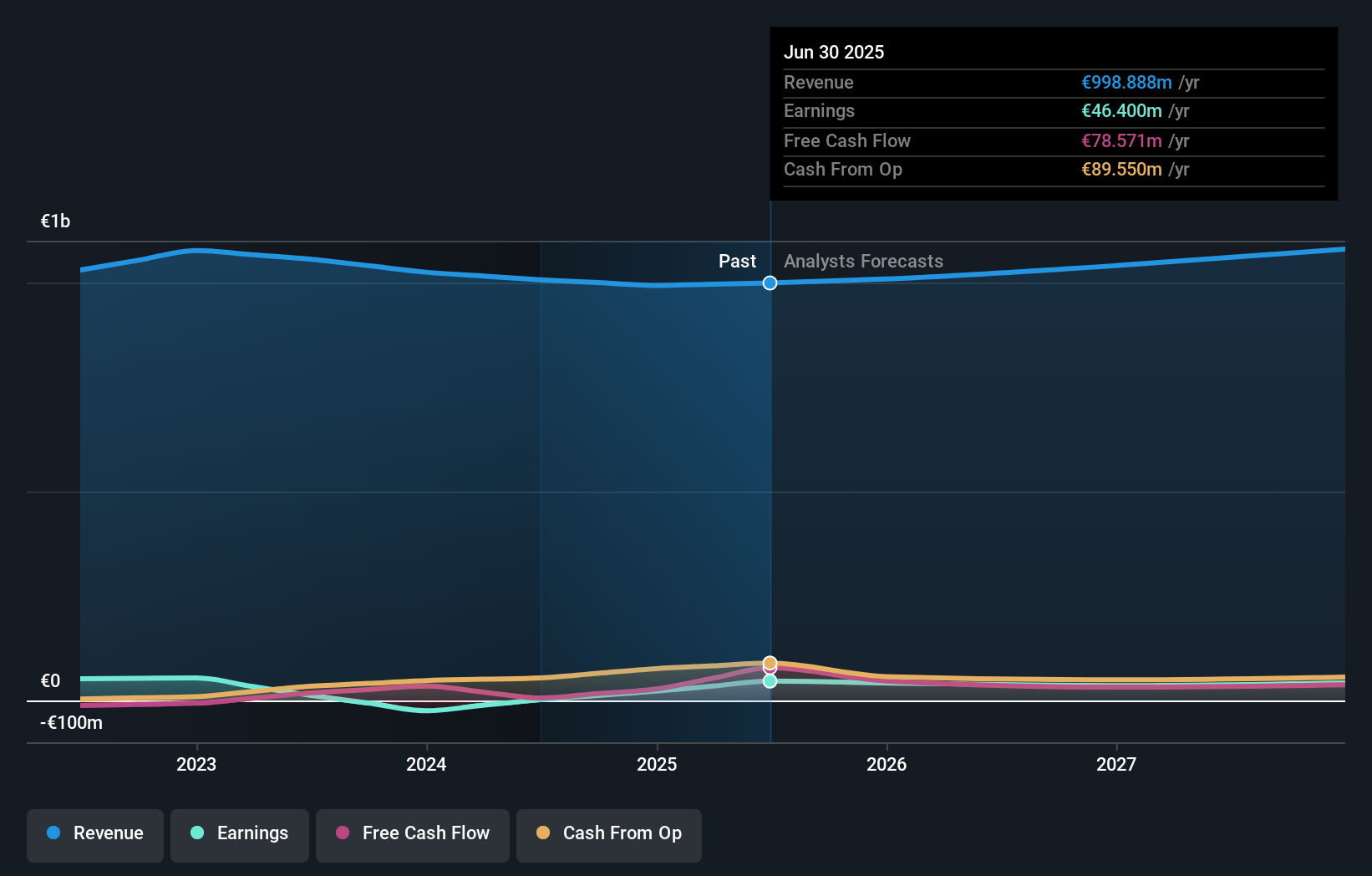

Overview: Safilo Group S.p.A. is involved in the design, manufacture, and distribution of optical frames, sunglasses, sports eyewear, goggles, and helmets across North America, Europe, the Asia Pacific, and internationally with a market cap of €505.37 million.

Operations: Safilo Group generates revenue primarily through its wholesale segment, amounting to €998.89 million. The company's financial performance is influenced by its cost structure and operational efficiencies.

Safilo Group, a notable player in the eyewear industry, has seen substantial earnings growth of 2321.7% over the past year, outpacing the luxury sector's -13.1%. The company's strategic focus on sustainability and expansion through initiatives like You&Safilo is paying off with a client base exceeding 28,000. Its debt-to-equity ratio impressively reduced from 120.5% to 17.7% over five years, showcasing financial prudence. Recent financial results show net income at €41.71 million for H1 2025 compared to €17.61 million last year, while basic EPS rose to €0.101 from €0.043, reflecting strong operational performance despite market challenges.

Campine (ENXTBR:CAMB)

Simply Wall St Value Rating: ★★★★★☆

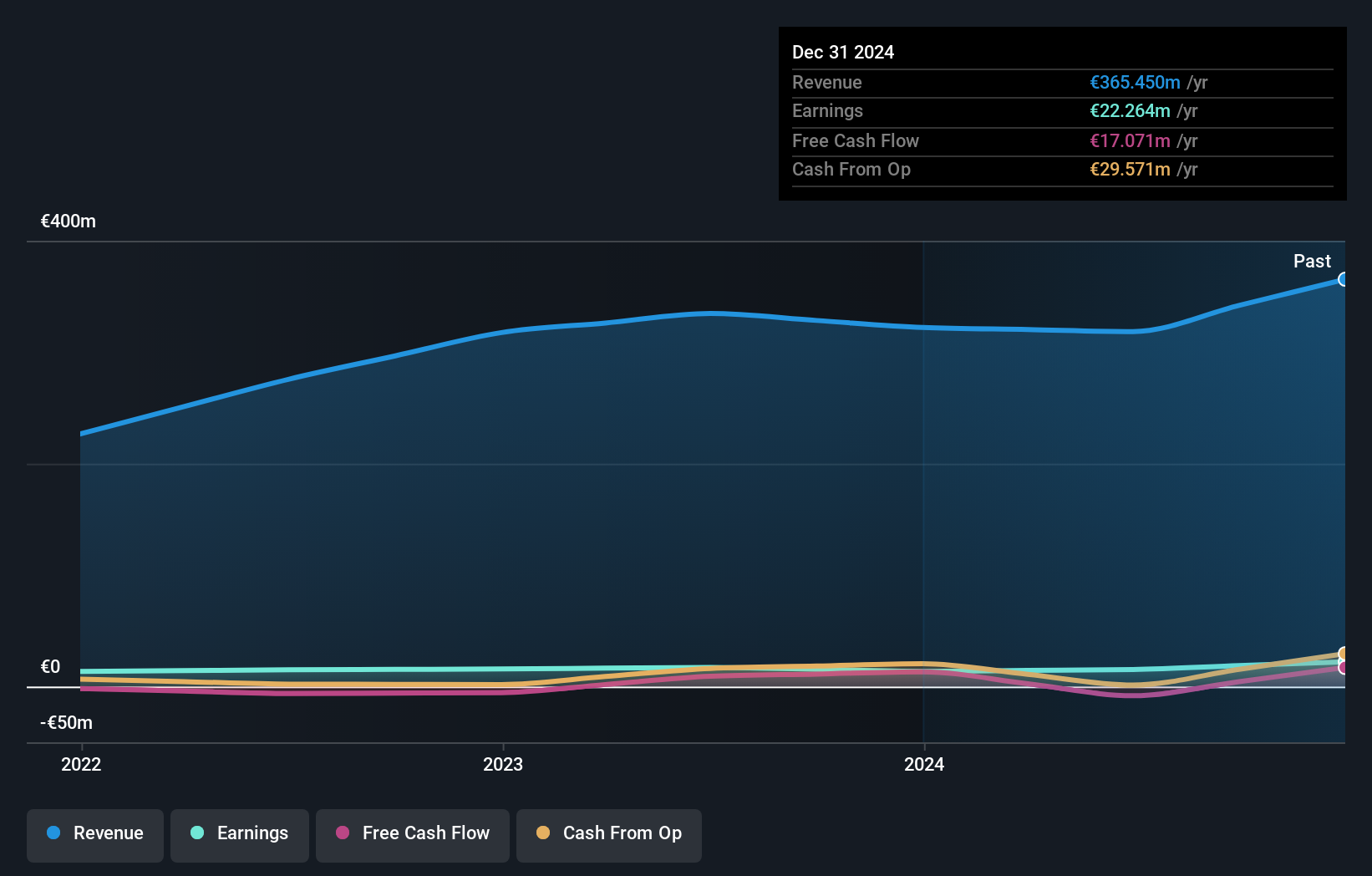

Overview: Campine NV operates in the circular metals and specialty chemicals sectors both in Belgium and internationally, with a market capitalization of €355.50 million.

Operations: Campine NV generates revenue primarily from its Circular Metals segment, contributing €211.18 million, and its Specialty Chemicals segment, adding €186.93 million.

Trading significantly below its estimated fair value, Campine has drawn attention with a robust earnings growth of 63% over the past year, outpacing the industry average. With a satisfactory net debt to equity ratio of 17.2%, financial stability appears solid. The company’s interest payments are well covered by EBIT at 16.1 times, indicating strong operational performance. Despite these positives, share price volatility remains high over recent months, which might concern some investors. A noteworthy annual dividend increase to €3.15 per share suggests confidence in future cash flows and shareholder returns amidst market fluctuations.

TF Bank (OM:TFBANK)

Simply Wall St Value Rating: ★★★★★☆

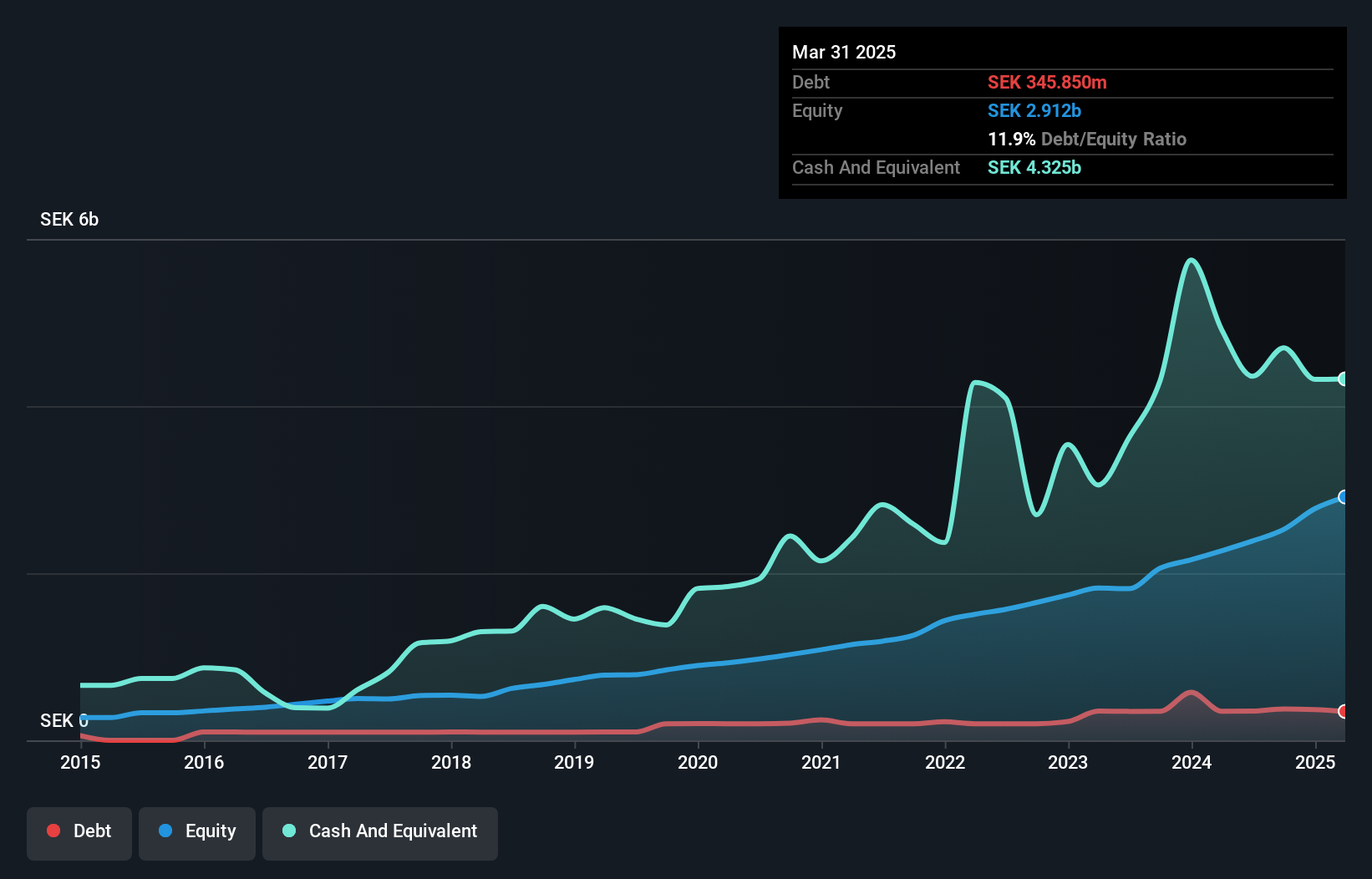

Overview: TF Bank AB (publ) is a digital bank that offers consumer banking services and e-commerce solutions via its proprietary IT platform in Sweden, with a market cap of SEK8.73 billion.

Operations: TF Bank generates revenue primarily from three segments: Credit Cards (SEK745.39 million), Consumer Lending (SEK602.84 million), and Ecommerce Solutions excluding Credit Cards (SEK396.96 million).

TF Bank, a notable player in Europe, boasts total assets of SEK26.2 billion and equity of SEK2.9 billion, with deposits reaching SEK22.2 billion against loans totaling SEK21.7 billion. The bank's earnings surged by 56.7% over the past year, outpacing the industry average of -3.4%. It holds a sufficient allowance for bad loans at 113%, though non-performing loans are high at 4.5%. A recent share split aims to optimize share count, while an extraordinary dividend of SEK5 per pre-split share highlights shareholder value focus amidst its robust financial health and growth trajectory in the banking sector.

- Get an in-depth perspective on TF Bank's performance by reading our health report here.

Examine TF Bank's past performance report to understand how it has performed in the past.

Next Steps

- Unlock our comprehensive list of 319 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:SFL

Safilo Group

Engages in the design, manufacture, and distribution of optical frames, sunglasses, sports eyewear, goggles, and helmets in North America, Europe, the Asia Pacific, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives