- Belgium

- /

- Metals and Mining

- /

- ENXTBR:BEKB

NV Bekaert's (EBR:BEKB) Upcoming Dividend Will Be Larger Than Last Year's

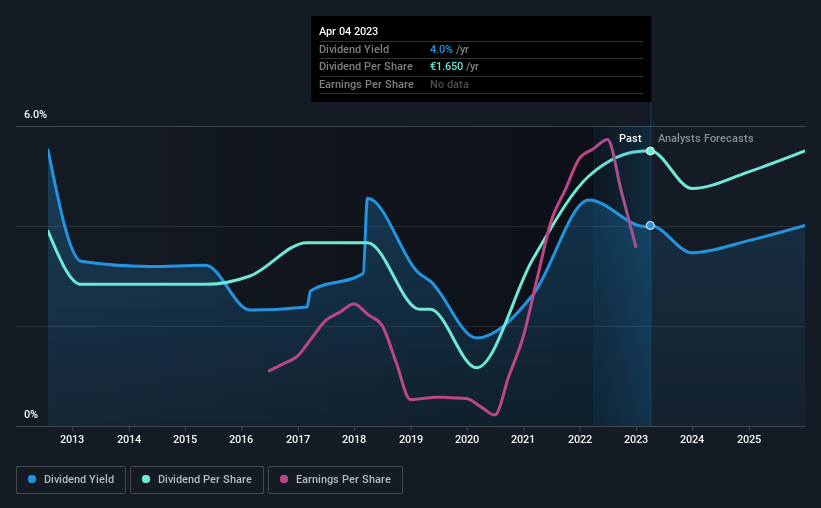

The board of NV Bekaert SA (EBR:BEKB) has announced that it will be paying its dividend of €1.16 on the 15th of May, an increased payment from last year's comparable dividend. Despite this raise, the dividend yield of 4.0% is only a modest boost to shareholder returns.

Check out our latest analysis for NV Bekaert

NV Bekaert's Payment Has Solid Earnings Coverage

Even a low dividend yield can be attractive if it is sustained for years on end. Before making this announcement, NV Bekaert was easily earning enough to cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

Looking forward, earnings per share is forecast to rise by 9.9% over the next year. If the dividend continues on this path, the payout ratio could be 22% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The dividend has gone from an annual total of €1.17 in 2013 to the most recent total annual payment of €1.65. This implies that the company grew its distributions at a yearly rate of about 3.5% over that duration. It's encouraging to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth anyway, which makes this less attractive as an income investment.

The Dividend Has Growth Potential

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. It's encouraging to see that NV Bekaert has been growing its earnings per share at 8.7% a year over the past five years. NV Bekaert definitely has the potential to grow its dividend in the future with earnings on an uptrend and a low payout ratio.

NV Bekaert Looks Like A Great Dividend Stock

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. Earnings are easily covering distributions, and the company is generating plenty of cash. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 3 warning signs for NV Bekaert that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NV Bekaert might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:BEKB

NV Bekaert

Provides steel wire transformation and coating technologies worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion