- France

- /

- Capital Markets

- /

- ENXTPA:AMUN

European Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As European markets navigate a mixed landscape, with the pan-European STOXX Europe 600 Index ending slightly lower amid various monetary policy decisions, investors are increasingly seeking stability and growth through dividend stocks. In this environment, selecting well-established companies with strong dividend histories can offer a reliable income stream and potentially enhance portfolio resilience.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.39% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.77% | ★★★★★☆ |

| Telekom Austria (WBAG:TKA) | 4.40% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.51% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.49% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.85% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.41% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.72% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.55% | ★★★★★☆ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.76% | ★★★★★☆ |

Click here to see the full list of 222 stocks from our Top European Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

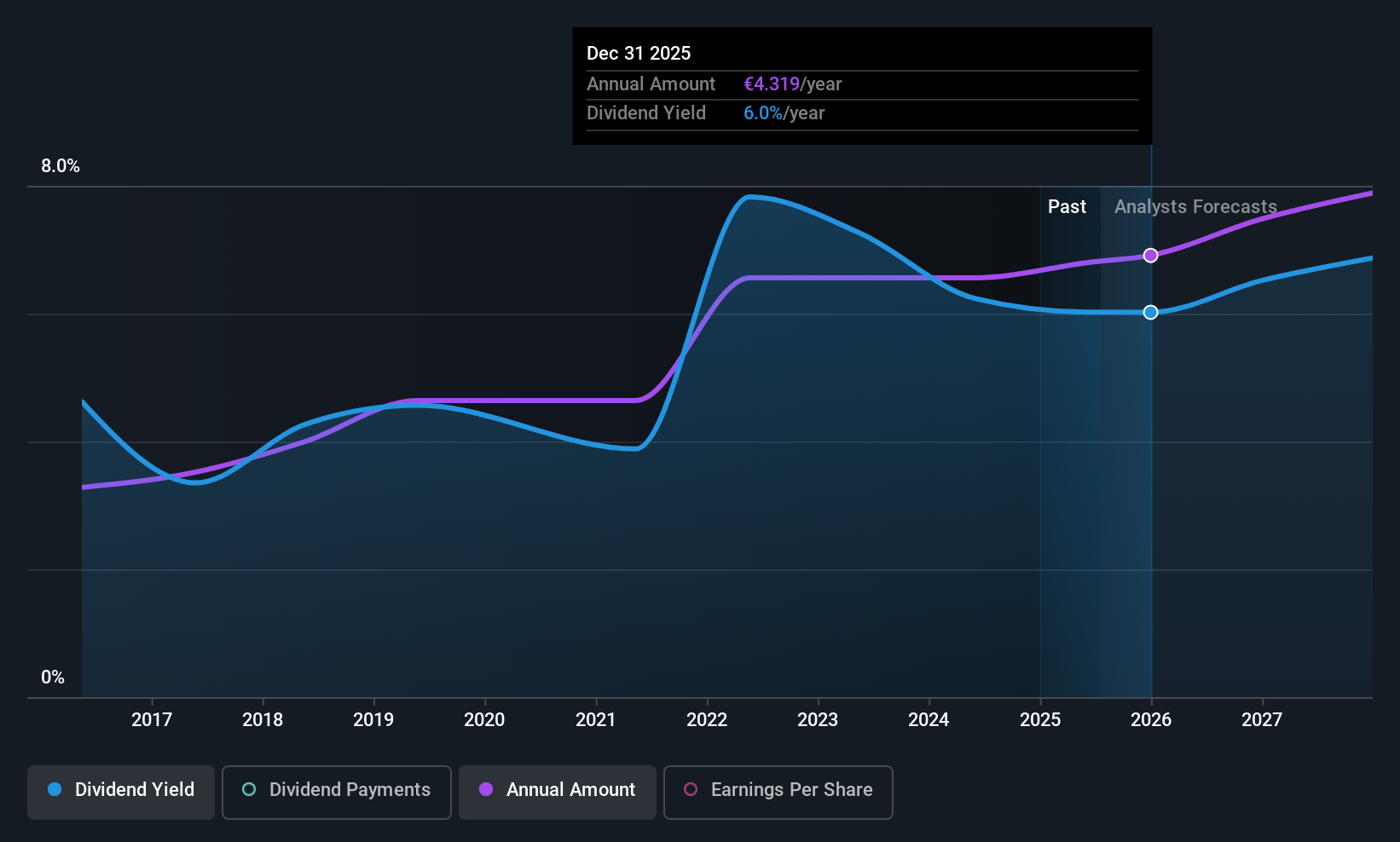

NV Bekaert (ENXTBR:BEKB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NV Bekaert SA is a global company specializing in steel wire transformation and coating technologies, with a market cap of €1.97 billion.

Operations: NV Bekaert SA generates revenue from four main segments: Rubber Reinforcement (€1.68 billion), Steel Wire Solutions (€1.08 billion), Specialty Businesses (€584.04 million), and Bridon-Bekaert Ropes Group (€561.23 million).

Dividend Yield: 4.8%

NV Bekaert's dividend profile presents a mixed picture. While dividends are well covered by earnings and cash flows, with payout ratios of 56.7% and 39.2% respectively, the company's dividend history is volatile. Recent earnings showed a decline in sales to €1.95 billion and net income to €81.72 million for H1 2025 compared to the previous year, potentially impacting future payouts despite reasonable coverage levels. The stock trades below its estimated fair value but offers a lower yield than top-tier Belgian dividend payers at 4.84%.

- Take a closer look at NV Bekaert's potential here in our dividend report.

- Our valuation report here indicates NV Bekaert may be undervalued.

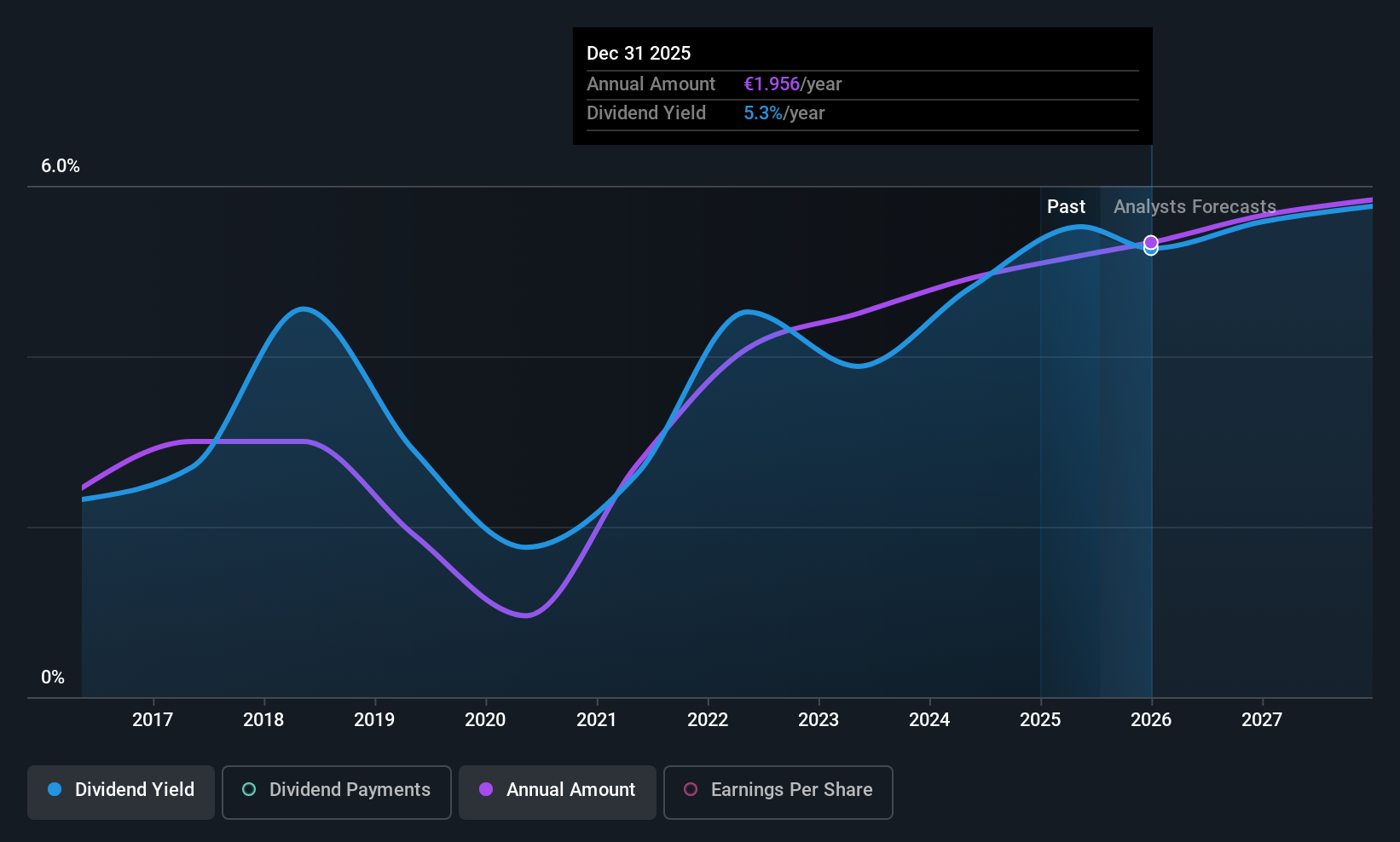

Amundi (ENXTPA:AMUN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Amundi is a publicly owned investment manager with a market cap of approximately €13.43 billion, focusing on providing asset management services.

Operations: Amundi generates its revenue primarily from its Asset Management segment, which accounts for approximately €6.83 billion.

Dividend Yield: 6.4%

Amundi's dividend profile is characterized by a high yield of 6.45%, placing it among the top 25% of French dividend payers. Despite this, its dividend history has been volatile over the past decade, with inconsistent growth and stability. The company's recent earnings report showed a slight decline in net income for Q2 2025 to €334 million from €350 million in the previous year, yet dividends remain well covered by both earnings (52.3% payout ratio) and cash flows (47.6%).

- Get an in-depth perspective on Amundi's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Amundi's current price could be quite moderate.

NOTE (OM:NOTE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NOTE AB (publ) and its subsidiaries offer electronics manufacturing services across Sweden, Finland, the United Kingdom, Bulgaria, Estonia, China, and internationally with a market cap of SEK5.60 billion.

Operations: NOTE AB (publ) generates its revenue through electronics manufacturing services, with SEK947.31 million from the Rest of World segment and SEK2.92 billion from Western Europe.

Dividend Yield: 3.6%

NOTE's dividend profile reveals a payout ratio of 77.8%, indicating coverage by earnings, while a cash payout ratio of 39.2% suggests strong cash flow support. However, its dividend yield of 3.56% lags behind the top Swedish payers and has been unstable over the past decade. Recent strategic changes in leadership aim to bolster growth, but sales guidance for 2025 was narrowed to SEK 3.9 billion - SEK 4.1 billion amidst seasonal challenges affecting Q3 performance.

- Unlock comprehensive insights into our analysis of NOTE stock in this dividend report.

- Our expertly prepared valuation report NOTE implies its share price may be lower than expected.

Turning Ideas Into Actions

- Access the full spectrum of 222 Top European Dividend Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AMUN

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives