- Belgium

- /

- Healthtech

- /

- ENXTBR:AGFB

Agfa-Gevaert (ENXTBR:AGFB) Quarterly Losses: What Do They Reveal About Management’s Turnaround Strategy?

Reviewed by Sasha Jovanovic

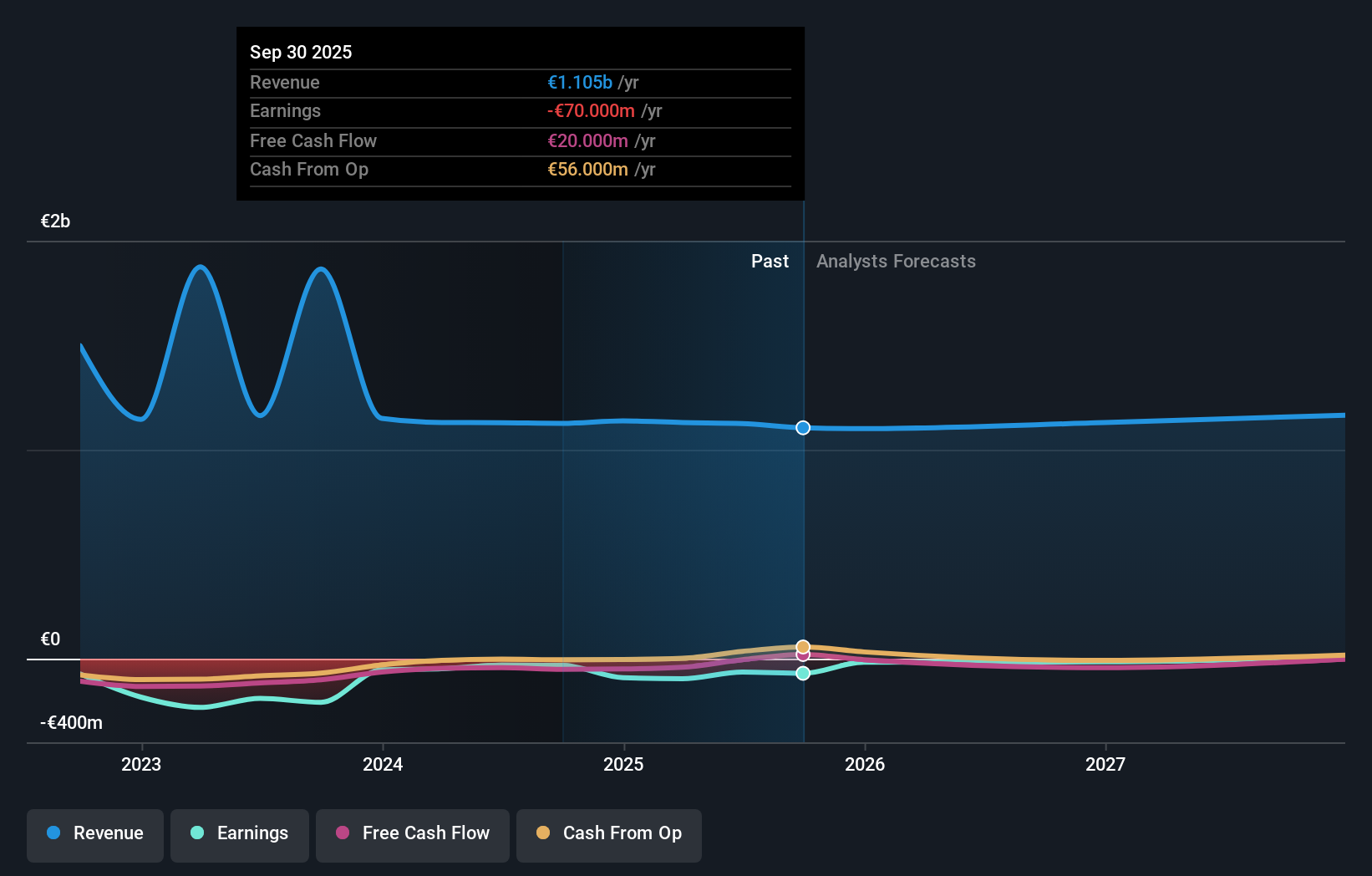

- Agfa-Gevaert NV recently reported its third quarter 2025 earnings, revealing sales of €257 million and a net loss of €19 million, both down compared to the same period last year.

- Although the company's nine-month net loss improved versus the previous year, the quarterly results point to continued operational headwinds affecting Agfa-Gevaert's performance.

- We'll explore how the combination of declining quarterly sales and a widening net loss is shaping Agfa-Gevaert's investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Agfa-Gevaert's Investment Narrative?

If you're considering Agfa-Gevaert today, the big picture remains that belief in a turnaround is essential. The latest third quarter results added to the uncertainty, with sales and losses both deteriorating versus last year, a reversal from the improved nine-month net loss that had appeared to signal progress. In the near term, the main catalysts had been hopes of benefiting from board and executive changes, recent product launches, and the goal of stabilizing losses. However, with the Q3 setback and sharp share price drop, investors may need to reassess how quickly or reliably these efforts can translate into operational recovery. The largest risks now are further revenue declines and the company's continued lack of profitability, alongside the challenge of regaining investor confidence after recent index exclusion. Whether the latest results signal persistent weakness or a temporary stumble is likely to shape sentiment in the coming quarters.

But investors should be aware of how quickly negative results can sway sentiment. The analysis detailed in our Agfa-Gevaert valuation report hints at an deflated share price compared to its estimated value.Exploring Other Perspectives

Explore 4 other fair value estimates on Agfa-Gevaert - why the stock might be worth over 8x more than the current price!

Build Your Own Agfa-Gevaert Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Agfa-Gevaert research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Agfa-Gevaert research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Agfa-Gevaert's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:AGFB

Agfa-Gevaert

Develops, manufactures, and markets various analog and digital systems worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives