As the European market experiences a robust upswing, with the pan-European STOXX Europe 600 Index rising by 2.11% due to strong corporate earnings and optimism around geopolitical resolutions, investors are increasingly on the lookout for promising opportunities within this dynamic environment. In such a climate, identifying lesser-known stocks with solid fundamentals and growth potential becomes crucial for those seeking to capitalize on Europe's evolving economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Freetrailer Group | 0.04% | 22.75% | 33.30% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Dekpol | 63.20% | 11.99% | 14.08% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Sipef (ENXTBR:SIP)

Simply Wall St Value Rating: ★★★★★★

Overview: Sipef NV is an agro-industrial company with a market capitalization of €772.96 million.

Operations: Sipef NV generates revenue primarily from its agro-industrial operations. The company's financial performance is characterized by a focus on efficiency in cost management, impacting its net profit margin.

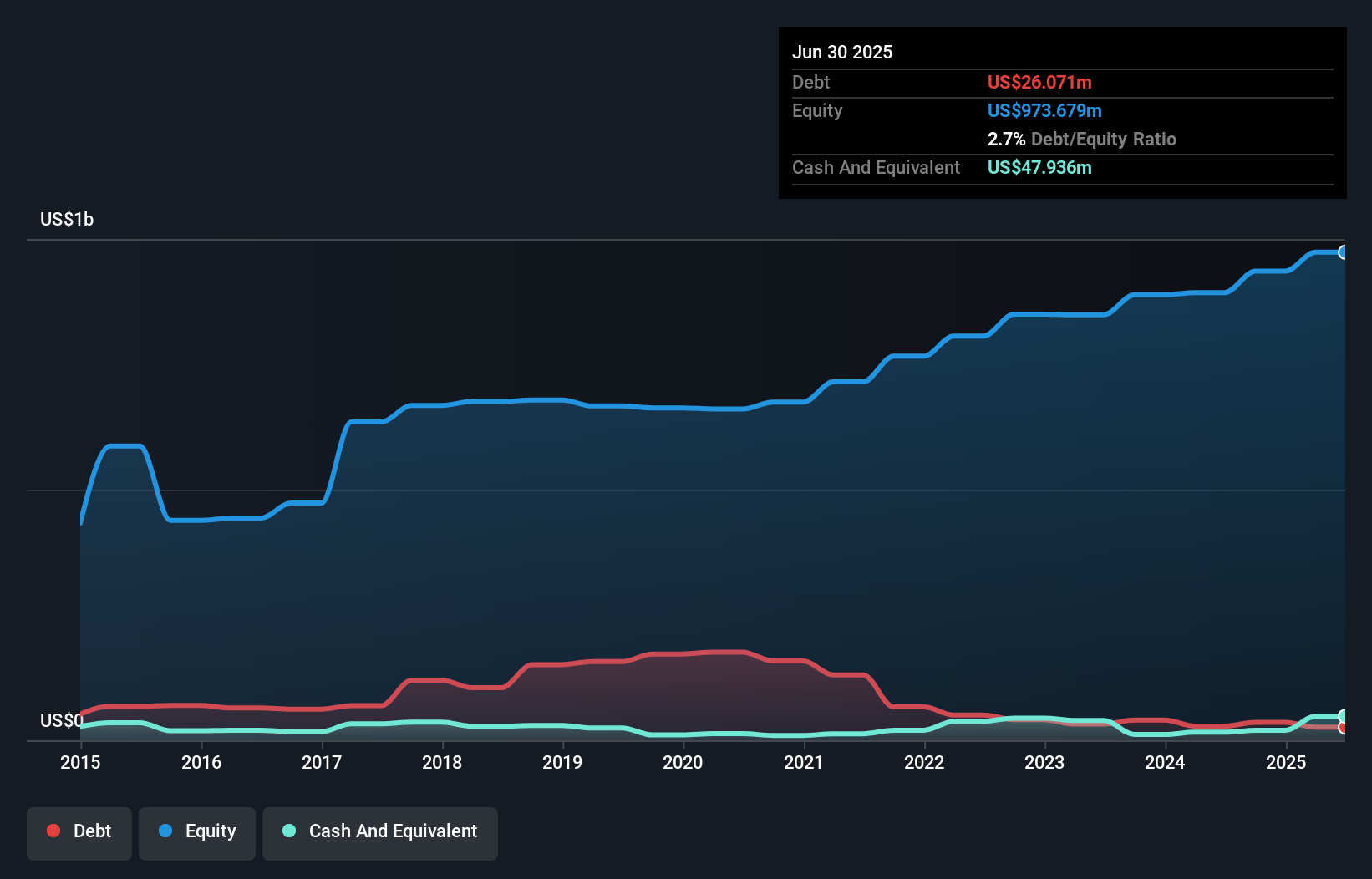

Sipef, a nimble player in the agricultural sector, showcases a debt-free balance sheet, contrasting its 26.6% debt to equity ratio five years ago. Trading at 69.5% below its estimated fair value, it offers good relative value compared to peers. Over the past five years, earnings have grown annually by 15.3%. Recent results highlight robust performance with sales reaching US$250.43 million for the half-year ending June 2025 and net income of US$57.72 million, nearly doubling from last year’s figures. Despite high-quality past earnings and positive free cash flow, future earnings are expected to decrease by an average of 2.8% per year over the next three years due to industry challenges.

- Navigate through the intricacies of Sipef with our comprehensive health report here.

Assess Sipef's past performance with our detailed historical performance reports.

ZCCM Investments Holdings (ENXTPA:MLZAM)

Simply Wall St Value Rating: ★★★★★☆

Overview: ZCCM Investments Holdings Plc is a diversified mining investment and operations company based in Zambia with a market capitalization of €318.48 million, engaging in various mining activities both domestically and internationally.

Operations: ZCCM Investments Holdings generates revenue primarily from its mining and processing operations, with significant contributions from Mopani Copper Mine Plc at ZMW 3.09 billion and Limestone Resources Limited at ZMW 72.32 million. The company has a market capitalization of €318.48 million.

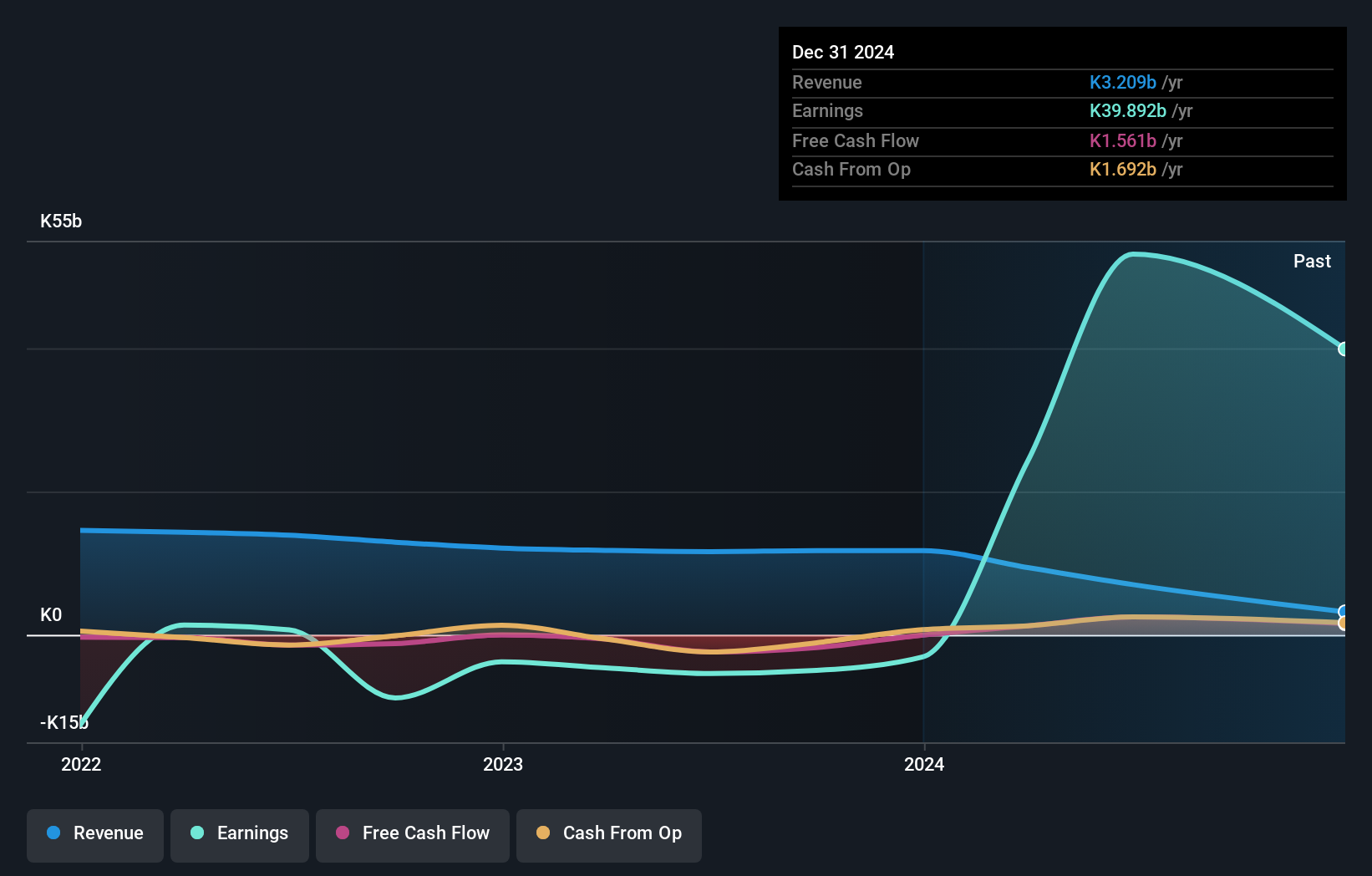

ZCCM Investments Holdings, a notable player in Zambia's mining sector, has recently turned profitable, contrasting with the broader industry's -1% earnings trend. This company is trading at 65.9% below its estimated fair value, presenting an intriguing opportunity for investors. Despite a volatile share price over the past three months, ZCCM holds more cash than total debt and has achieved positive free cash flow. However, their debt-to-equity ratio rose from 0.02% to 6.4% over five years. Recent leadership changes and ongoing arbitration with Trafigura add complexity to its investment profile but highlight strategic shifts underway.

- Delve into the full analysis health report here for a deeper understanding of ZCCM Investments Holdings.

Learn about ZCCM Investments Holdings' historical performance.

naturenergie holding (SWX:NEAG)

Simply Wall St Value Rating: ★★★★★★

Overview: Naturenergie Holding AG, with a market cap of CHF1.10 billion, operates through its subsidiaries to produce, distribute, and sell electricity under the naturenergie brand both in Switzerland and internationally.

Operations: Naturenergie Holding AG generates revenue primarily from Customer-Oriented Energy Solutions (€912.90 million), Renewable Generation Infrastructure (€845.40 million), and System Relevant Infrastructure (€482.50 million). The company focuses on electricity production, distribution, and sales across Switzerland and internationally through its subsidiaries.

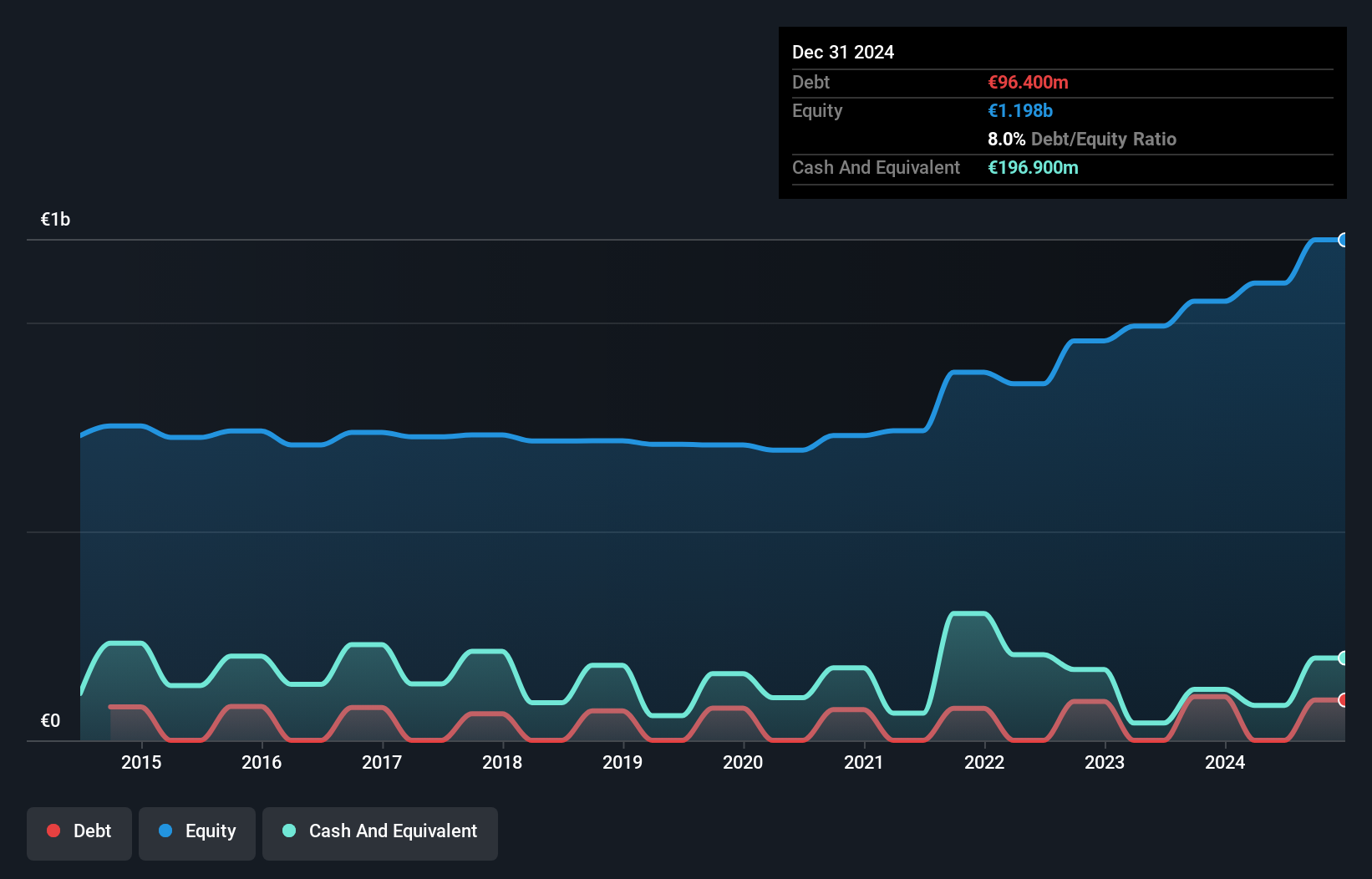

Naturenergie Holding, a small player in the European energy sector, showcases robust financial health with no debt on its books. Over the past year, earnings surged by 48%, outpacing the industry average of 1%. Despite this impressive growth, recent reports indicate a dip in sales to €810 million from €869 million last year and net income falling to €70 million from €77 million. Trading at about 41% below estimated fair value suggests potential upside for investors. However, future earnings are forecasted to decline by an average of 8.5% annually over the next three years, presenting a mixed outlook.

- Click here to discover the nuances of naturenergie holding with our detailed analytical health report.

Explore historical data to track naturenergie holding's performance over time in our Past section.

Next Steps

- Investigate our full lineup of 322 European Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:SIP

Flawless balance sheet and undervalued.

Market Insights

Community Narratives