As European markets navigate the challenges posed by inflated AI stock valuations and shifting interest rate expectations, investors are increasingly focused on identifying growth opportunities that can withstand such volatility. In this context, companies with high insider ownership often signal strong alignment between management and shareholder interests, making them potentially attractive in today's uncertain economic landscape.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 109.1% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.5% |

| CD Projekt (WSE:CDR) | 29.7% | 50.7% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Let's dive into some prime choices out of the screener.

Floridienne (ENXTBR:FLOB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Floridienne S.A. operates through its subsidiaries in the life sciences, food, and chemistry sectors both in Belgium and internationally, with a market cap of €563.21 million.

Operations: The company's revenue is derived from its Food segment (€152.24 million), Chemicals Division (€34.79 million), and Life Sciences Division (€530.26 million).

Insider Ownership: 15.8%

Earnings Growth Forecast: 40.2% p.a.

Floridienne demonstrates potential as a growth company with high insider ownership, trading significantly below its estimated fair value. The company's earnings are expected to grow substantially at 40.2% annually, outpacing the Belgian market's average. Revenue growth is forecasted at 10.5% per year, exceeding the local market's rate of 8.6%. However, its return on equity is projected to remain low at 8.4%, and the share price has been highly volatile recently.

- Take a closer look at Floridienne's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Floridienne shares in the market.

Humble Group (OM:HUMBLE)

Simply Wall St Growth Rating: ★★★★☆☆

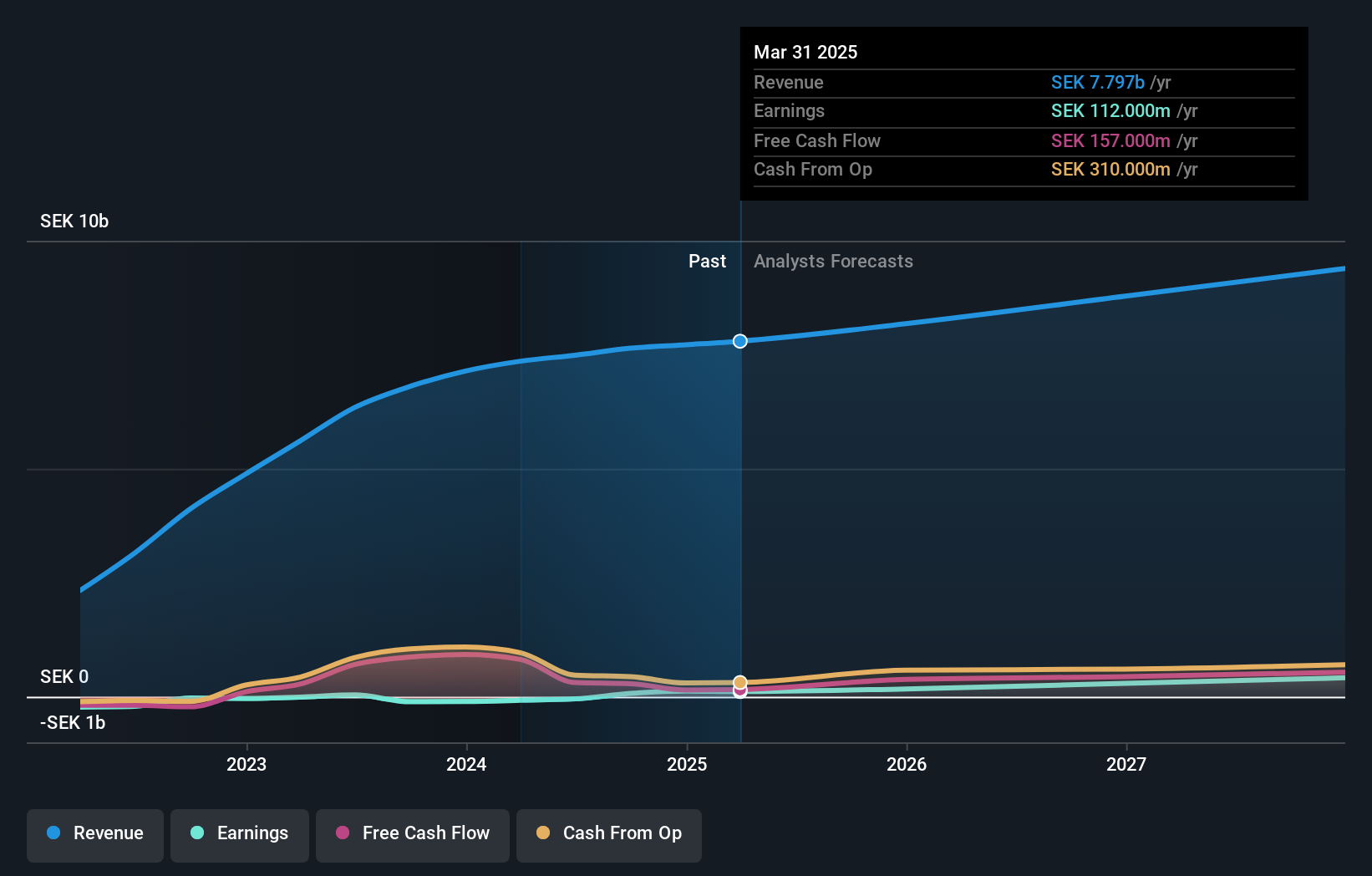

Overview: Humble Group AB (publ) is involved in the development, refinement, and distribution of fast-moving consumer products both in Sweden and internationally, with a market cap of SEK3.29 billion.

Operations: The company's revenue segments include Future Snacking at SEK1.12 billion, Sustainable Care at SEK2.37 billion, Quality Nutrition at SEK1.55 billion, and Nordic Distribution at SEK3.03 billion.

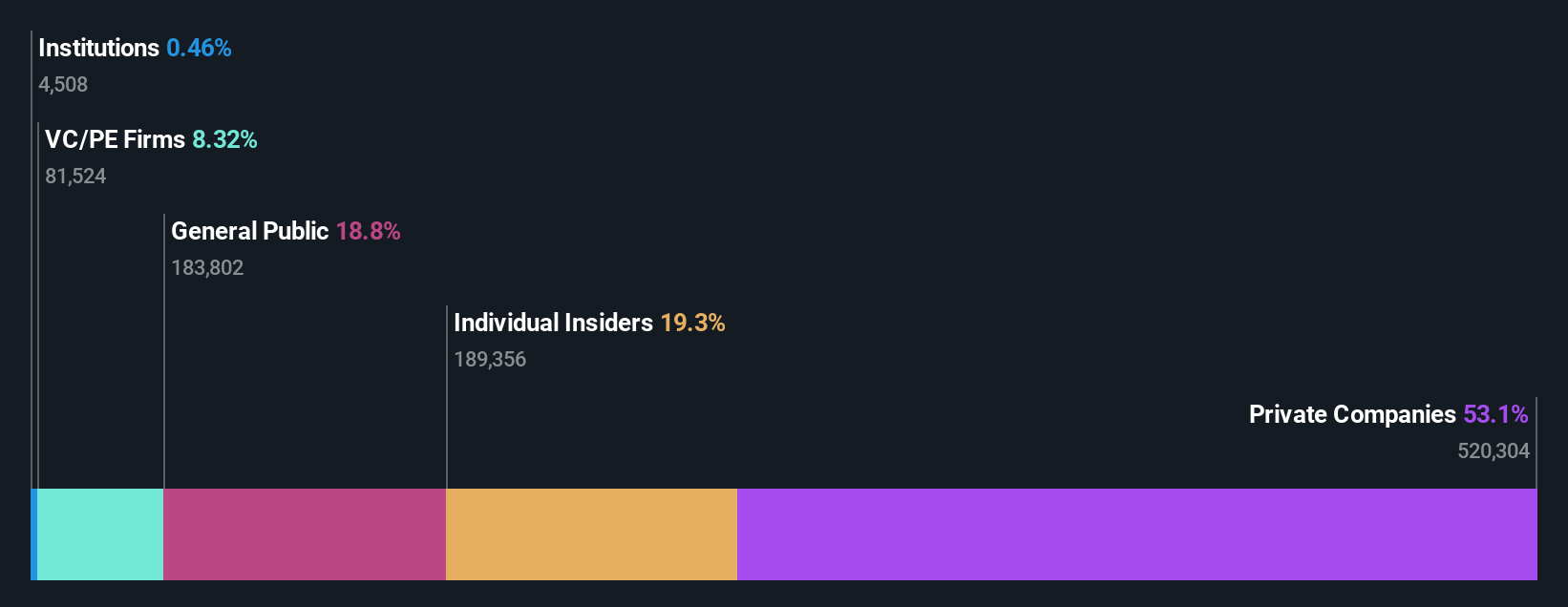

Insider Ownership: 19.6%

Earnings Growth Forecast: 84% p.a.

Humble Group shows promise with substantial insider buying and is trading well below its estimated fair value. Despite recent executive changes, the company forecasts significant earnings growth of 84% annually, outpacing the Swedish market. Revenue is expected to grow at 5.9% per year, higher than the local average but not exceptionally high. However, recent financials reveal a net loss for Q3 2025 and a decrease in profit margins compared to last year.

- Dive into the specifics of Humble Group here with our thorough growth forecast report.

- Our expertly prepared valuation report Humble Group implies its share price may be too high.

Volati (OM:VOLO)

Simply Wall St Growth Rating: ★★★★★☆

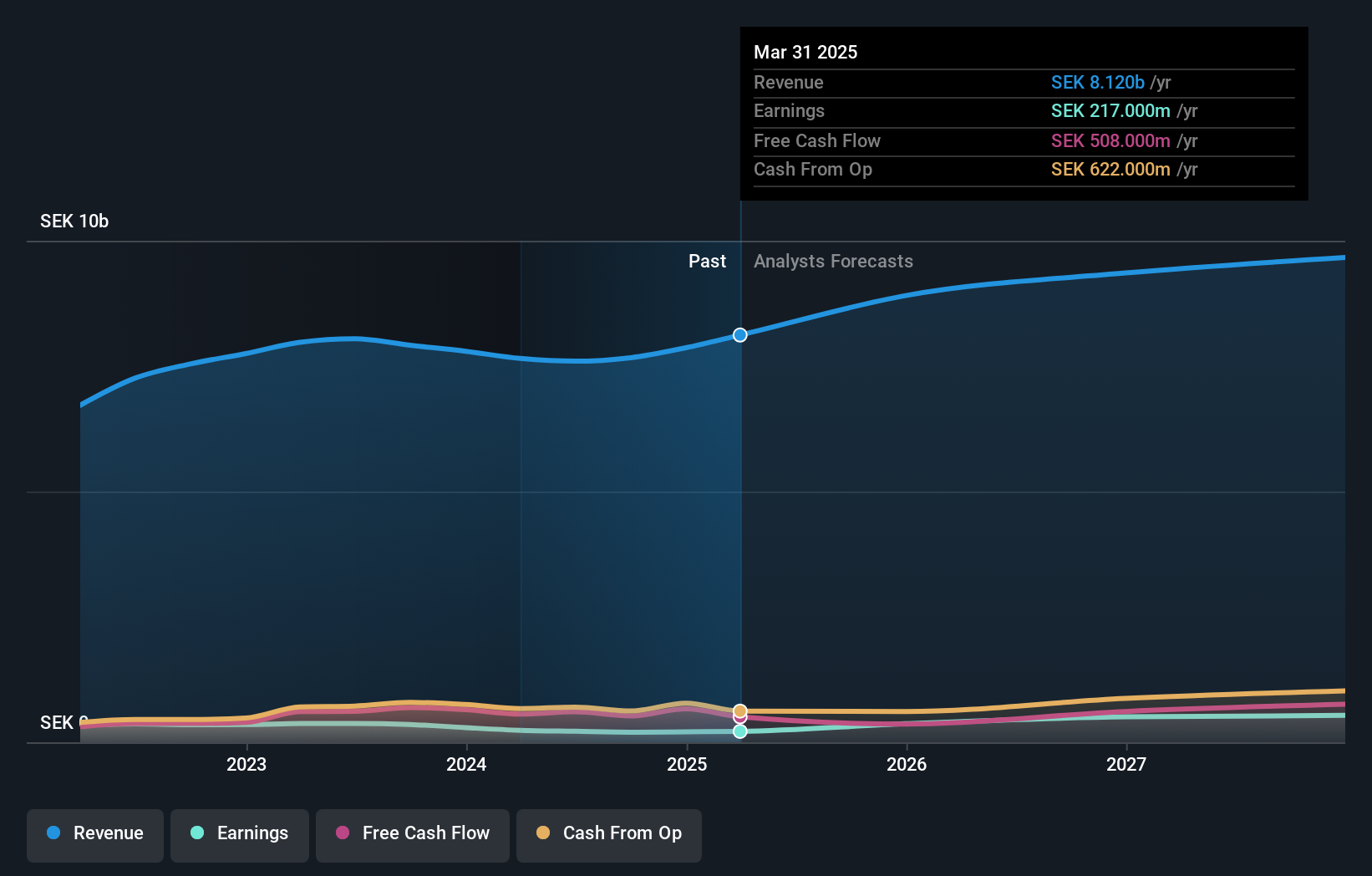

Overview: Volati AB (publ) is a private equity firm that focuses on growth capital, buyouts, and add-on acquisitions in mature and middle-market companies, with a market cap of SEK8.42 billion.

Operations: Volati's revenue is primarily derived from its Salix Group at SEK4.05 billion, Ettiketto Group at SEK1.15 billion, and Industry segment (excluding Ettiketto) at SEK3.21 billion.

Insider Ownership: 28.4%

Earnings Growth Forecast: 35.9% p.a.

Volati demonstrates potential with recent insider buying and trades 53% below its estimated fair value. The company reported Q3 2025 sales of SEK 2.08 billion, up from SEK 1.92 billion the previous year, and net income increased to SEK 99 million. Earnings are forecasted to grow significantly at an annual rate of over 35%, surpassing the Swedish market average, despite a slower revenue growth projection of 5.4% per year and a high level of debt.

- Get an in-depth perspective on Volati's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Volati implies its share price may be lower than expected.

Where To Now?

- Discover the full array of 200 Fast Growing European Companies With High Insider Ownership right here.

- Ready To Venture Into Other Investment Styles? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:FLOB

Floridienne

Through its subsidiaries, operates in the life sciences, food, and chemistry sectors in Belgium and internationally.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives