Amidst renewed concerns about inflated AI stock valuations and receding expectations for a U.S. interest rate cut, European markets have experienced a downturn, with the STOXX Europe 600 Index dropping 2.21%. Despite these challenges, dividend stocks in Europe continue to attract investors seeking stable returns; they offer potential income even when market conditions are uncertain.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.44% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.49% | ★★★★★☆ |

| Sulzer (SWX:SUN) | 3.26% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.40% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.08% | ★★★★★★ |

| Evolution (OM:EVO) | 4.87% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.25% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.67% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.69% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 5.52% | ★★★★★☆ |

Click here to see the full list of 223 stocks from our Top European Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Gimv (ENXTBR:GIMB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gimv NV is a private equity and venture capital firm that focuses on direct and fund of funds investments, with a market cap of €1.69 billion.

Operations: Gimv NV's revenue segments are not specified in the provided text.

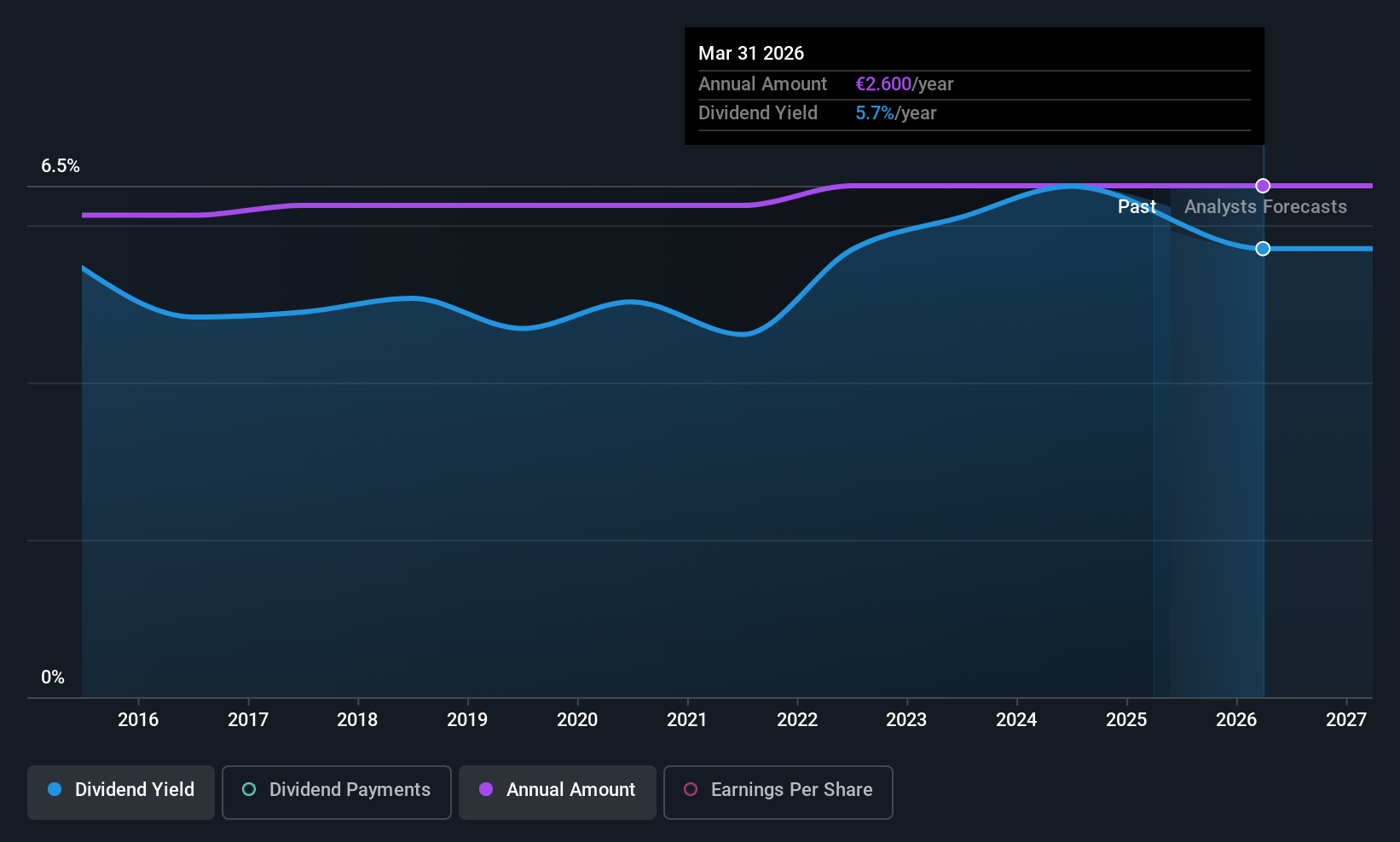

Dividend Yield: 5.7%

Gimv has maintained stable and reliable dividend payments over the past decade, with growth and minimal volatility. However, its dividends are not supported by free cash flows, raising sustainability concerns despite a low payout ratio of 34.8% covered by earnings. Trading at 45.9% below estimated fair value may present an opportunity for investors seeking undervalued stocks, though recent shareholder dilution and a net income drop to €126.93 million highlight potential risks.

- Take a closer look at Gimv's potential here in our dividend report.

- According our valuation report, there's an indication that Gimv's share price might be on the cheaper side.

Corticeira Amorim S.G.P.S (ENXTLS:COR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Corticeira Amorim S.G.P.S. is involved in acquiring and transforming cork into various products across Europe, the United States, Rest of America, Australasia, and Africa with a market cap of €887.11 million.

Operations: Corticeira Amorim S.G.P.S. generates revenue through its segments, with Amorim Cork contributing €724.50 million and Amorim Florestal adding €221.33 million.

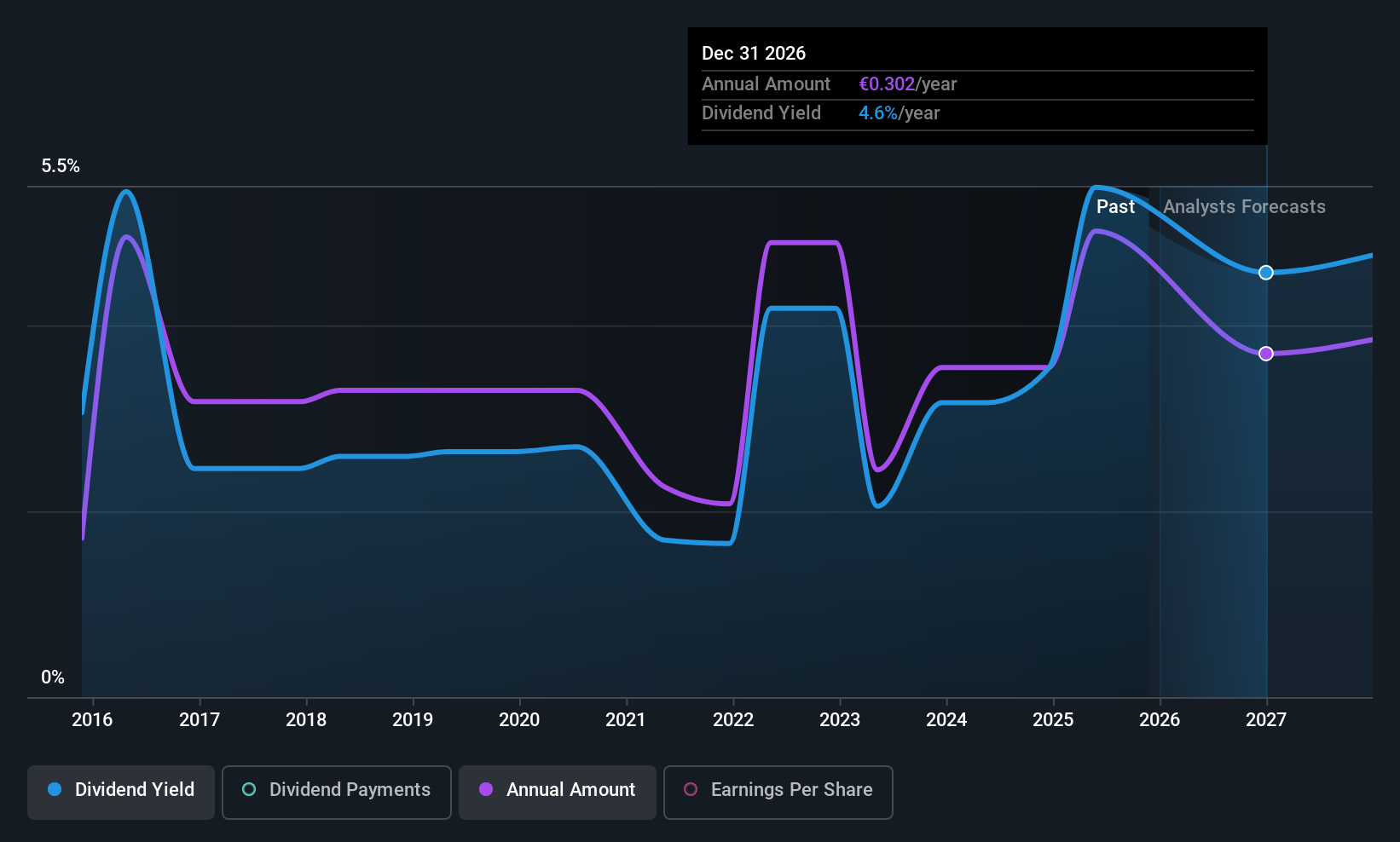

Dividend Yield: 6.1%

Corticeira Amorim's dividend payments are supported by both earnings and cash flows, with payout ratios of 60.8% and 40.5%, respectively, placing it among the top 25% of Portuguese dividend payers at a yield of 6.15%. However, its dividends have been volatile over the past decade. Recent earnings show a slight decline in net income to €45.7 million for the nine months ended September 2025, but analysts expect future stock price appreciation due to current undervaluation by approximately 37.2%.

- Navigate through the intricacies of Corticeira Amorim S.G.P.S with our comprehensive dividend report here.

- Our valuation report here indicates Corticeira Amorim S.G.P.S may be undervalued.

Olvi Oyj (HLSE:OLVAS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Olvi Oyj is a beverage company that manufactures and sells alcoholic and non-alcoholic beverages across Finland, Estonia, Latvia, Lithuania, Denmark, and Belarus with a market cap of €605.63 million.

Operations: Olvi Oyj generates revenue from its alcoholic beverages segment, amounting to €661.03 million.

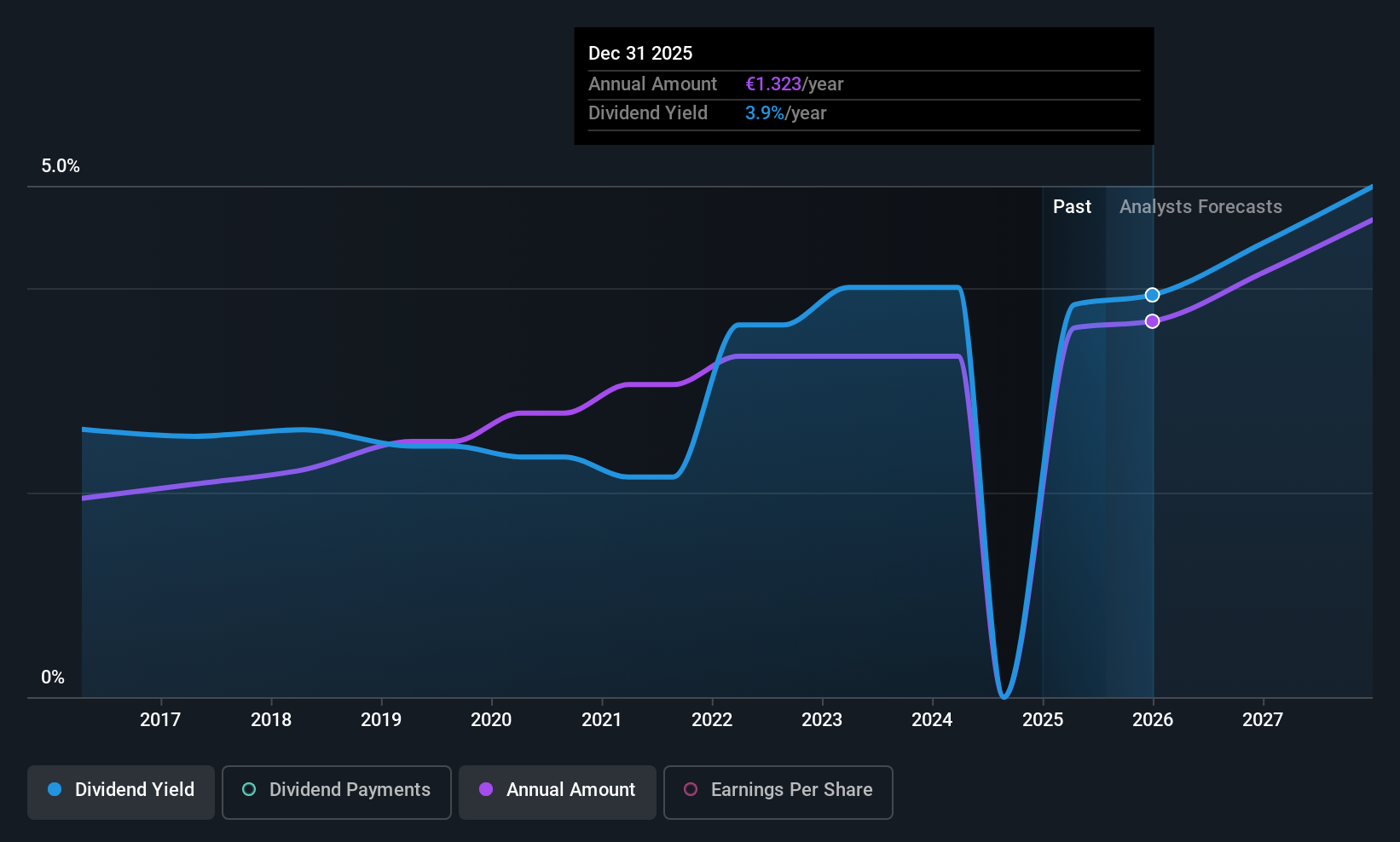

Dividend Yield: 4.4%

Olvi Oyj's dividend payments are well covered by earnings with a payout ratio of 49.5%, yet not supported by free cash flows due to a high cash payout ratio of 90.3%. The dividend yield is relatively low at 4.44% compared to the Finnish market's top tier, but dividends have been stable and growing over the past decade. Recent earnings showed slight revenue growth, though net income decreased, leading to revised lower guidance for 2025 amid demand uncertainties.

- Dive into the specifics of Olvi Oyj here with our thorough dividend report.

- The valuation report we've compiled suggests that Olvi Oyj's current price could be quite moderate.

Next Steps

- Reveal the 223 hidden gems among our Top European Dividend Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:COR

Corticeira Amorim S.G.P.S

Engages in the acquisition and transformation of cork into various cork and cork-related products in Europe, the United States, Rest of America, Australasia, and Africa.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success