- Belgium

- /

- Commercial Services

- /

- ENXTBR:EKOP

Ekopak NV's (EBR:EKOP) P/S Is Still On The Mark Following 28% Share Price Bounce

The Ekopak NV (EBR:EKOP) share price has done very well over the last month, posting an excellent gain of 28%. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 57% share price drop in the last twelve months.

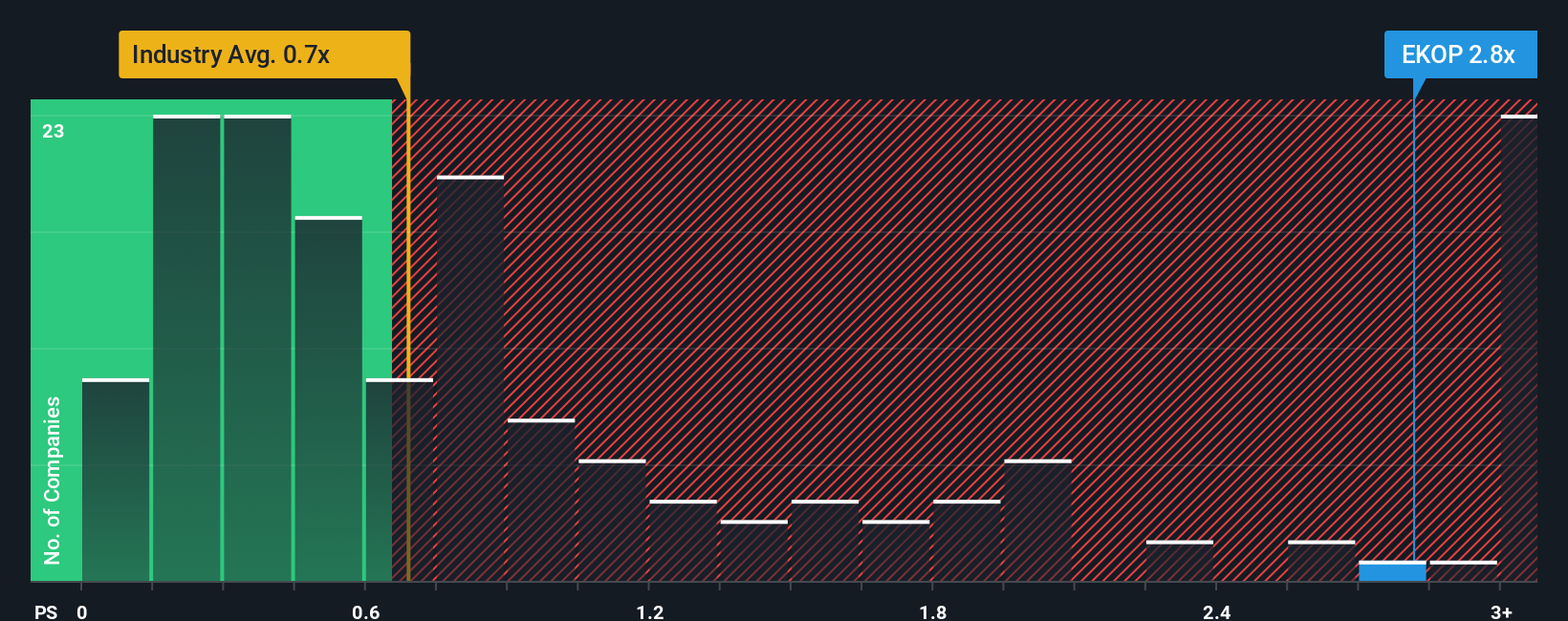

After such a large jump in price, you could be forgiven for thinking Ekopak is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 2.8x, considering almost half the companies in Belgium's Commercial Services industry have P/S ratios below 0.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Ekopak

How Ekopak Has Been Performing

With revenue growth that's superior to most other companies of late, Ekopak has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ekopak.Is There Enough Revenue Growth Forecasted For Ekopak?

The only time you'd be truly comfortable seeing a P/S as steep as Ekopak's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 32%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 29% each year during the coming three years according to the two analysts following the company. With the industry only predicted to deliver 8.3% per annum, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Ekopak's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in Ekopak have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Ekopak's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 3 warning signs for Ekopak (2 are significant!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Ekopak might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:EKOP

Ekopak

Designs, builds, finances, maintains, and operates industrial water processing installation solutions in Europe, the Asia Pacific, Africa, and the Americas.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives