- Belgium

- /

- Electrical

- /

- ENXTBR:CENER

A Fresh Look at Cenergy Holdings (ENXTBR:CENER) Valuation Following Its Recent 71% Shareholder Return

Reviewed by Simply Wall St

Cenergy Holdings (ENXTBR:CENER) has quietly posted some eye-catching returns over the past year, with shares climbing more than 70%. This strong momentum puts the stock in focus for investors who want to understand what is driving its performance.

See our latest analysis for Cenergy Holdings.

Cenergy Holdings’ 71% total shareholder return over the past year stands out against a backdrop of accelerating momentum. The company has also seen a 36.7% share price return in the last 90 days and strong multi-year performance. This recent surge suggests investors are responding favorably to the company’s growth outlook and improving fundamentals, keeping the energy and industrials specialist firmly in the spotlight.

If you’re tracking impressive moves like these, now’s a perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares up sharply and analyst price targets already in sight, the key question now is whether Cenergy Holdings remains undervalued or if the recent rally means future growth is fully reflected in the price.

Most Popular Narrative: 4.5% Overvalued

With Cenergy Holdings’ last close at €14.22 and a narrative fair value of €13.61, the current price sits slightly above the most-followed forecast. Let’s examine a key justification driving that target.

Strategic capacity expansions across submarine and land cable facilities, including the upcoming Thiva and Baltimore (U.S.) plants, position Cenergy to address growing addressable markets and further benefit from long-term grid enhancement needs. This is expected to lift sales volumes and operating leverage, which could positively impact margins and earnings.

What’s the secret behind this ambitious valuation? It centers on how scale upgrades could potentially alter this company’s growth outlook. Want to see how future earnings, margins, and market opportunities are combined to arrive at that number? Dive in for the financial story hiding just beneath the headline price.

Result: Fair Value of €13.61 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps in the U.S. capacity expansions or a downturn in steel demand could quickly undermine these bullish expectations.

Find out about the key risks to this Cenergy Holdings narrative.

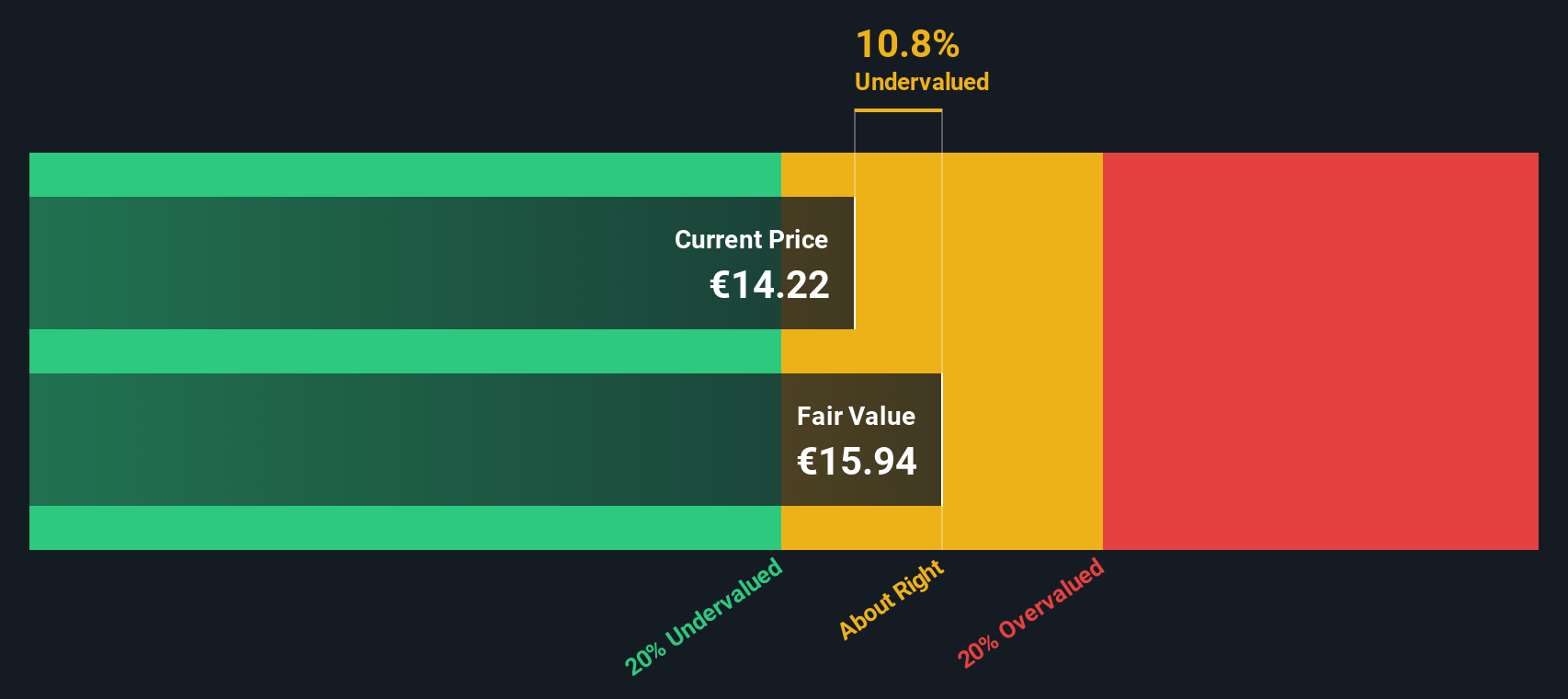

Another Perspective: DCF Model Signals Value

While the current multiples suggest Cenergy Holdings is slightly overvalued compared to fair value, our SWS DCF model indicates the opposite. The model estimates a fair value of €15.94 per share, which is around 12% above today's price. Could deeper cash flow potential be getting overlooked here?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cenergy Holdings Narrative

If you have a different take or want to see where your own research leads, you can shape your own perspective in just a few minutes. So why not Do it your way

A great starting point for your Cenergy Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Go beyond a single stock to find strategies others overlook and get ahead of market trends by checking out these handpicked opportunities now, before the next wave breaks.

- Spot high-yield potential and secure your portfolio with these 24 dividend stocks with yields > 3%, offering attractive yields above 3% and robust fundamentals.

- Ride the frontier of artificial intelligence innovation by starting with these 26 AI penny stocks, which are transforming industries and driving smart automation.

- Enhance your tech exposure and position for tomorrow’s breakthroughs through these 28 quantum computing stocks, revealing companies at the cutting edge of computing power and discovery.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:CENER

Cenergy Holdings

Manufactures and sells aluminium, copper, cables, steel and steel pipes, and other related products in Belgium, Greece, Other European Union countries, Other European countries, the United States, and internationally.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives