The board of TPC Consolidated Limited (ASX:TPC) has announced that it will pay a dividend of A$0.20 per share on the 13th of March. This takes the dividend yield to 8.9%, which shareholders will be pleased with.

Check out our latest analysis for TPC Consolidated

TPC Consolidated's Dividend Is Well Covered By Earnings

If the payments aren't sustainable, a high yield for a few years won't matter that much. Prior to this announcement, TPC Consolidated's earnings easily covered the dividend, but free cash flows were negative. Since a dividend means the company is paying out cash to investors, this could prove to be a problem in the future.

If the trend of the last few years continues, EPS will grow by 28.0% over the next 12 months. If the dividend continues on this path, the payout ratio could be 66% by next year, which we think can be pretty sustainable going forward.

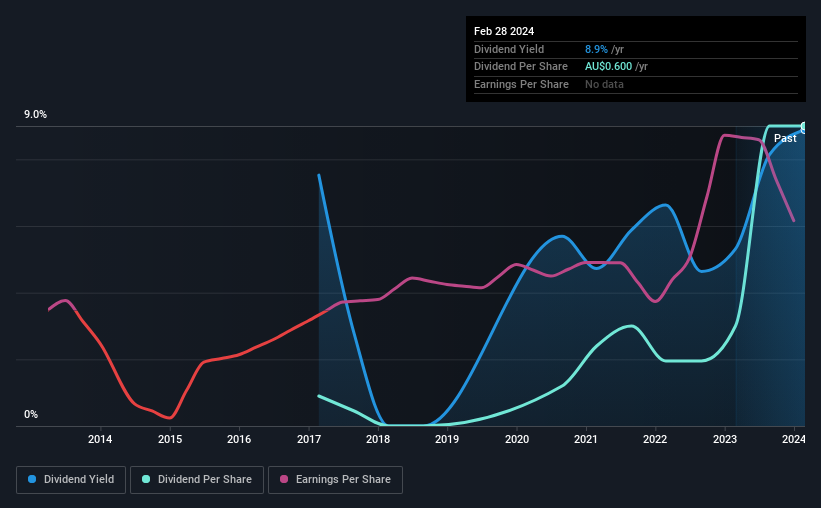

TPC Consolidated's Dividend Has Lacked Consistency

Looking back, TPC Consolidated's dividend hasn't been particularly consistent. This makes us cautious about the consistency of the dividend over a full economic cycle. The annual payment during the last 7 years was A$0.06 in 2017, and the most recent fiscal year payment was A$0.60. This implies that the company grew its distributions at a yearly rate of about 39% over that duration. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. It's encouraging to see that TPC Consolidated has been growing its earnings per share at 28% a year over the past five years. TPC Consolidated is clearly able to grow rapidly while still returning cash to shareholders, positioning it to become a strong dividend payer in the future.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. While TPC Consolidated is earning enough to cover the payments, the cash flows are lacking. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. To that end, TPC Consolidated has 4 warning signs (and 1 which can't be ignored) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TPC Consolidated might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:TPC

TPC Consolidated

Provides retail electricity and gas services to residential, commercial, and industrial customers in Australia.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion