The Australian market has been experiencing cautious movements, with ASX futures slightly down overnight, reflecting concerns from a recent hotter-than-expected CPI read. In this environment of uncertainty and mixed global signals, growth companies with high insider ownership can be particularly attractive as they often indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 10.4% | 96.4% |

| Titomic (ASX:TTT) | 11.2% | 74.9% |

| Pure Hydrogen (ASX:PH2) | 10.4% | 114.6% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| IRIS Metals (ASX:IR1) | 26% | 144.4% |

| Elsight (ASX:ELS) | 17.3% | 77% |

| Echo IQ (ASX:EIQ) | 19% | 51.4% |

| BlinkLab (ASX:BB1) | 35.4% | 101.4% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

Let's explore several standout options from the results in the screener.

Elsight (ASX:ELS)

Simply Wall St Growth Rating: ★★★★★★

Overview: Elsight Limited offers connectivity solutions in Israel, the United States, and internationally with a market cap of A$408.31 million.

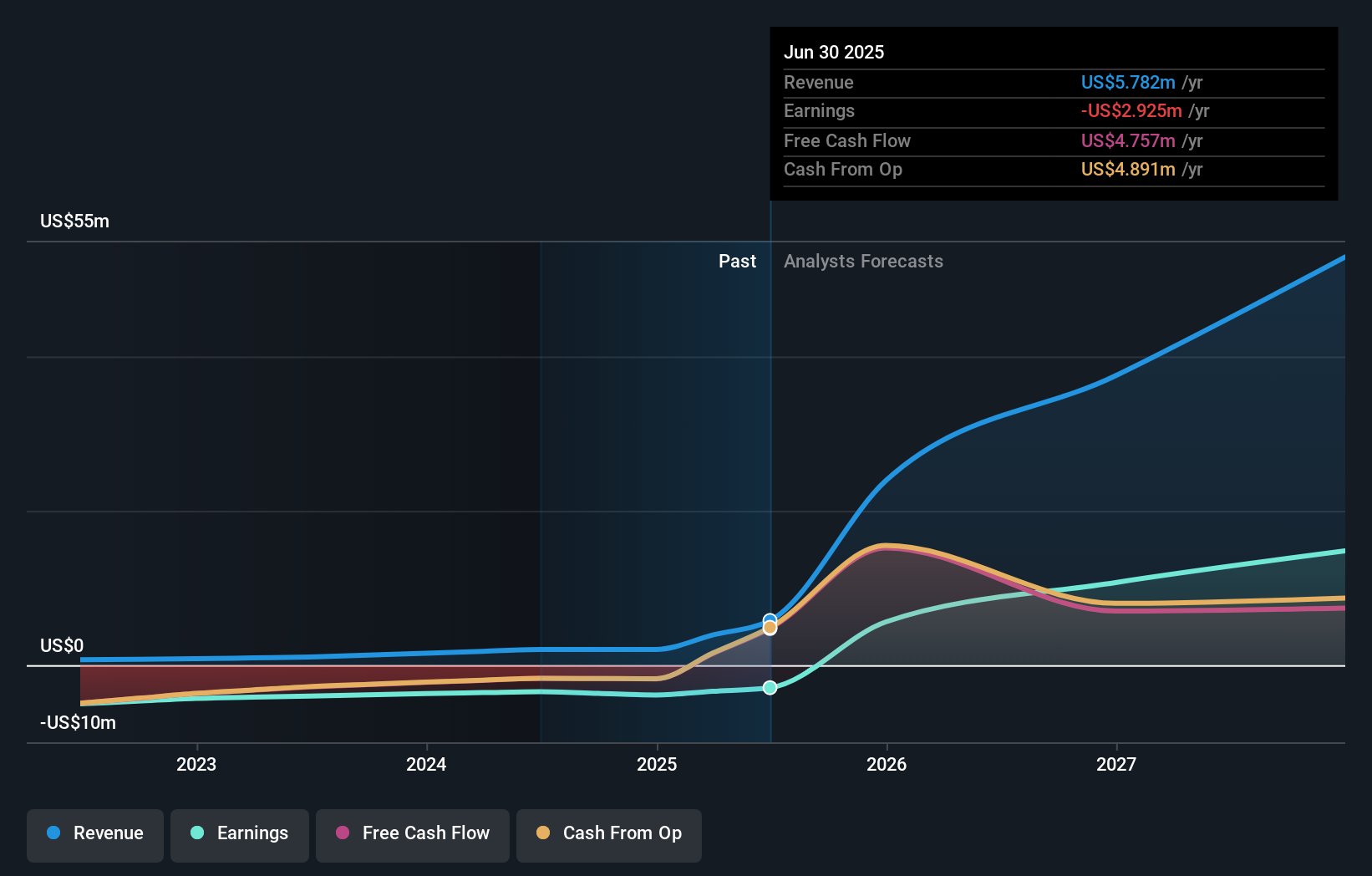

Operations: The company generates revenue from its Electronic Security Devices segment, amounting to $5.78 million.

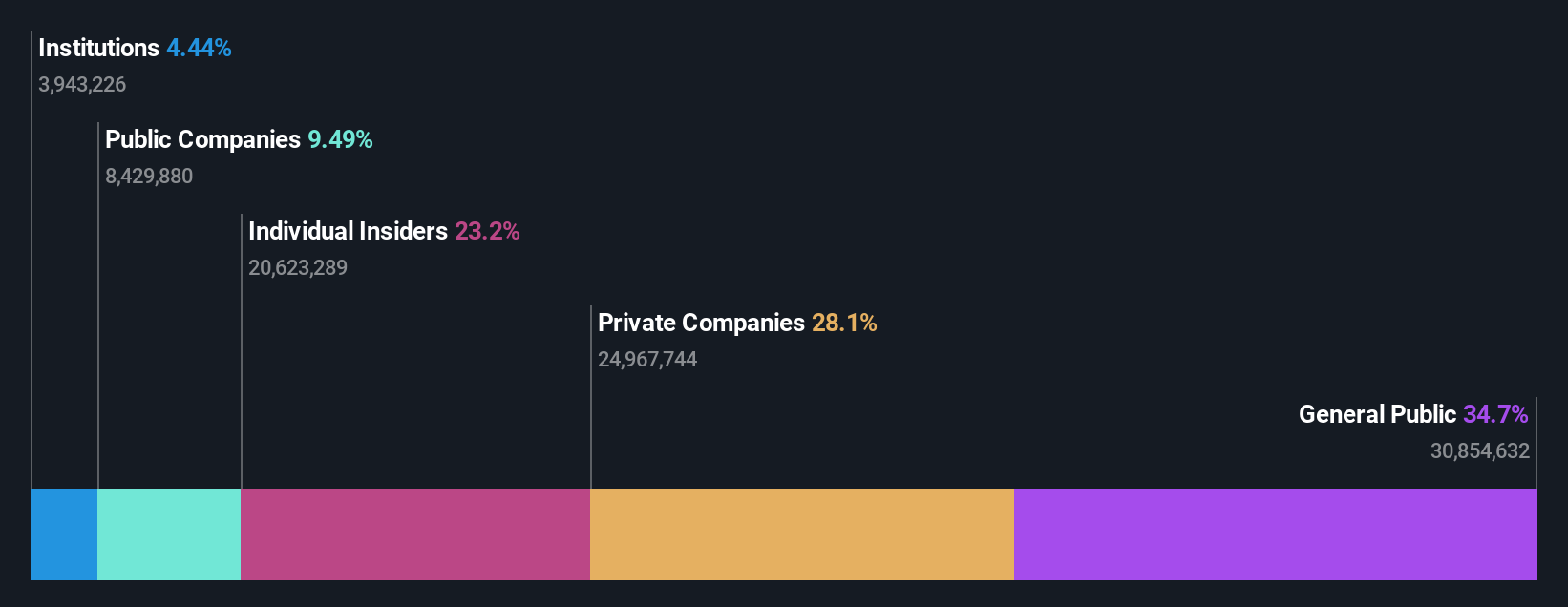

Insider Ownership: 17.3%

Elsight is poised for significant growth with forecasts indicating revenue expansion of 59% annually, outpacing the Australian market. Despite recent shareholder dilution, its earnings are expected to grow by nearly 77% per year. The company's HALO platform has gained traction in defense sectors, evidenced by its advancement in a U.S. Defense Innovation Unit challenge and securing substantial contracts totaling A$35.6 million YTD. However, share price volatility remains a concern for potential investors.

- Dive into the specifics of Elsight here with our thorough growth forecast report.

- According our valuation report, there's an indication that Elsight's share price might be on the expensive side.

LGI (ASX:LGI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LGI Limited operates in Australia, offering carbon abatement and renewable energy solutions using biogas from landfill, with a market cap of A$445.34 million.

Operations: The company's revenue is derived from carbon abatement (A$17.29 million), renewable energy (A$17.08 million), and infrastructure construction and management (A$2.37 million).

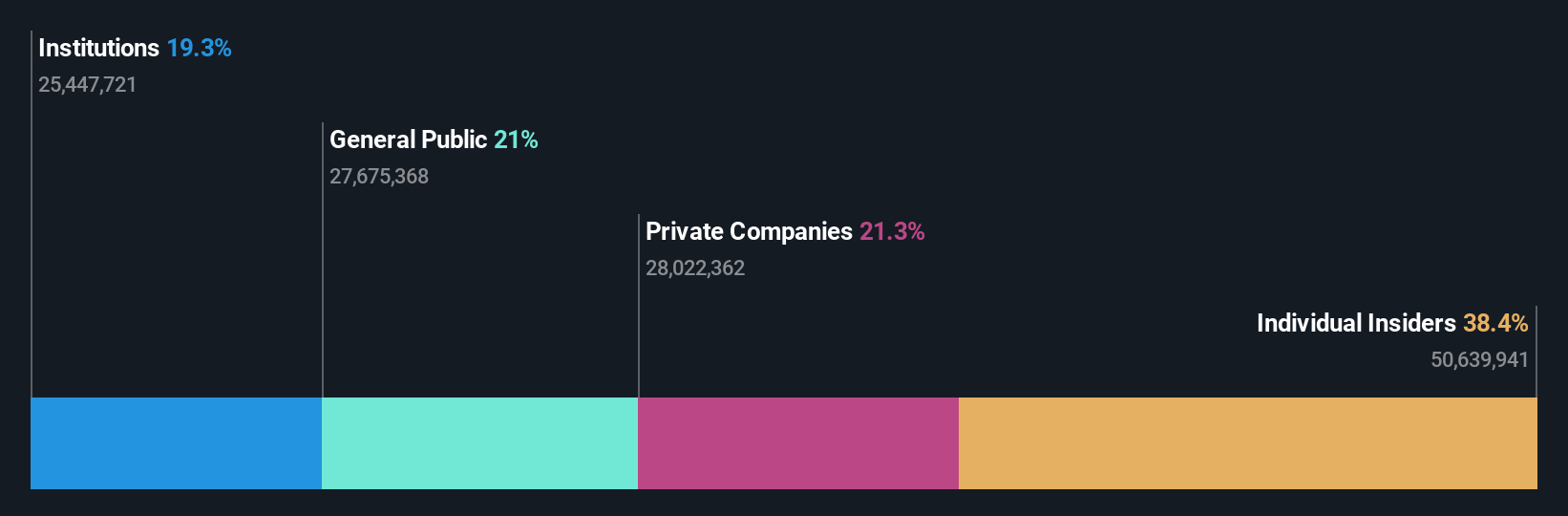

Insider Ownership: 20.2%

LGI Limited exhibits strong growth potential with earnings forecasted to rise by 28.63% annually, surpassing the Australian market's average. Despite recent shareholder dilution through follow-on equity offerings totaling A$56.29 million, LGI's revenue is expected to grow at 16.9% per year, faster than the market rate of 6%. The company has implemented constitutional changes to enhance flexibility in virtual meetings, reflecting a commitment to modern governance practices and potentially improving shareholder engagement.

- Click here and access our complete growth analysis report to understand the dynamics of LGI.

- Our expertly prepared valuation report LGI implies its share price may be too high.

Vulcan Steel (ASX:VSL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vulcan Steel Limited, with a market cap of A$1.06 billion, operates in New Zealand and Australia, focusing on the sale and distribution of steel and metal products through its subsidiaries.

Operations: The company's revenue segments include NZ$409.74 million from steel and NZ$538.41 million from metals.

Insider Ownership: 33.9%

Vulcan Steel demonstrates significant growth potential, with earnings projected to increase by 34.15% annually, outpacing the Australian market's average. Insiders have been active buyers recently, indicating confidence in the company's prospects. Despite a recent follow-on equity offering raising A$87.13 million and lower profit margins compared to last year, revenue is expected to grow faster than the market at 10.3% per year. However, interest payments remain insufficiently covered by earnings, highlighting financial challenges ahead.

- Navigate through the intricacies of Vulcan Steel with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Vulcan Steel is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Dive into all 109 of the Fast Growing ASX Companies With High Insider Ownership we have identified here.

- Seeking Other Investments? This technology could replace computers: discover the 28 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Elsight might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ELS

Elsight

Provides connectivity solutions in Israel, the United States, and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026