- Australia

- /

- Renewable Energy

- /

- ASX:EWC

The Returns On Capital At Energy World (ASX:EWC) Don't Inspire Confidence

Ignoring the stock price of a company, what are the underlying trends that tell us a business is past the growth phase? Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. Ultimately this means that the company is earning less per dollar invested and on top of that, it's shrinking its base of capital employed. Having said that, after a brief look, Energy World (ASX:EWC) we aren't filled with optimism, but let's investigate further.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Energy World, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0042 = US$6.6m ÷ (US$1.6b - US$44m) (Based on the trailing twelve months to December 2023).

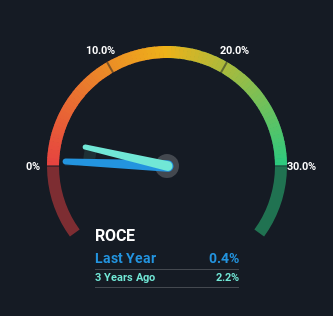

So, Energy World has an ROCE of 0.4%. In absolute terms, that's a low return and it also under-performs the Renewable Energy industry average of 1.8%.

Check out our latest analysis for Energy World

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how Energy World has performed in the past in other metrics, you can view this free graph of Energy World's past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

We are a bit worried about the trend of returns on capital at Energy World. To be more specific, the ROCE was 2.5% five years ago, but since then it has dropped noticeably. On top of that, it's worth noting that the amount of capital employed within the business has remained relatively steady. Since returns are falling and the business has the same amount of assets employed, this can suggest it's a mature business that hasn't had much growth in the last five years. So because these trends aren't typically conducive to creating a multi-bagger, we wouldn't hold our breath on Energy World becoming one if things continue as they have.

On a side note, Energy World has done well to pay down its current liabilities to 2.8% of total assets. That could partly explain why the ROCE has dropped. Effectively this means their suppliers or short-term creditors are funding less of the business, which reduces some elements of risk. Some would claim this reduces the business' efficiency at generating ROCE since it is now funding more of the operations with its own money.

In Conclusion...

All in all, the lower returns from the same amount of capital employed aren't exactly signs of a compounding machine. We expect this has contributed to the stock plummeting 86% during the last five years. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 4 warning signs for Energy World (of which 3 can't be ignored!) that you should know about.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if Energy World might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EWC

Energy World

An independent energy company, engages in the development, production, and sale of power and liquefied natural gas in the Asia Pacific region.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success