- Australia

- /

- Other Utilities

- /

- ASX:AGL

AGL Energy (ASX:AGL) Valuation Spotlight as Solar Sharer Programme Sparks Dividend and Margin Concerns

Reviewed by Simply Wall St

AGL Energy (ASX:AGL) is in the spotlight after the Australian government introduced its Solar Sharer programme, which mandates three hours of free daily electricity for consumers from July 2026. Investors are weighing how these regulatory changes could affect AGL’s earnings and dividend outlook.

See our latest analysis for AGL Energy.

Following the Solar Sharer announcement, AGL Energy’s shares slipped further, capping off a tough year marked by regulatory uncertainty and sector pressure. Despite a strong three-year total shareholder return of 34%, momentum has faded lately, with a year-to-date share price return of -22%.

If you’re interested in what else the market has to offer right now, this could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With AGL now trading at a sizable discount to analyst price targets after recent declines, investors must ask if market pessimism has gone too far or if this pricing simply reflects the tough road ahead for future earnings. Is there a buying opportunity here, or has the market already accounted for all the challenges and future growth?

Most Popular Narrative: 25.5% Undervalued

With AGL Energy's narrative fair value set at A$11.91 and the last close at A$8.87, the gap between sentiment and price has rarely been so wide. The market's discount points to a disconnect, one potentially explained by future catalysts rather than current headlines.

Significant investment in grid-scale battery developments and firming capacity is positioning AGL to capture revenue and earnings growth as electricity demand rises from electrification of homes, industry, and transport. As these assets come online through FY26 to FY28, they are expected to more than offset the decline in coal and gas earnings from asset retirements and contract expiries, supporting future EBITDA growth and earnings stability.

Want to peek behind the curtain? The boldest growth bets and margin rebuilds hinge on a handful of ambitious infrastructure rollouts and next-gen technologies. The entire case leans on these coming online exactly as expected. Curious just how aggressive the long-term forecasts are? See what else is fueling that big valuation gap.

Result: Fair Value of $11.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risk from heavy battery investments and margin pressure from fierce retail competition could present challenges to AGL’s ambitious growth assumptions in the years ahead.

Find out about the key risks to this AGL Energy narrative.

Another View: What Does the SWS DCF Model Say?

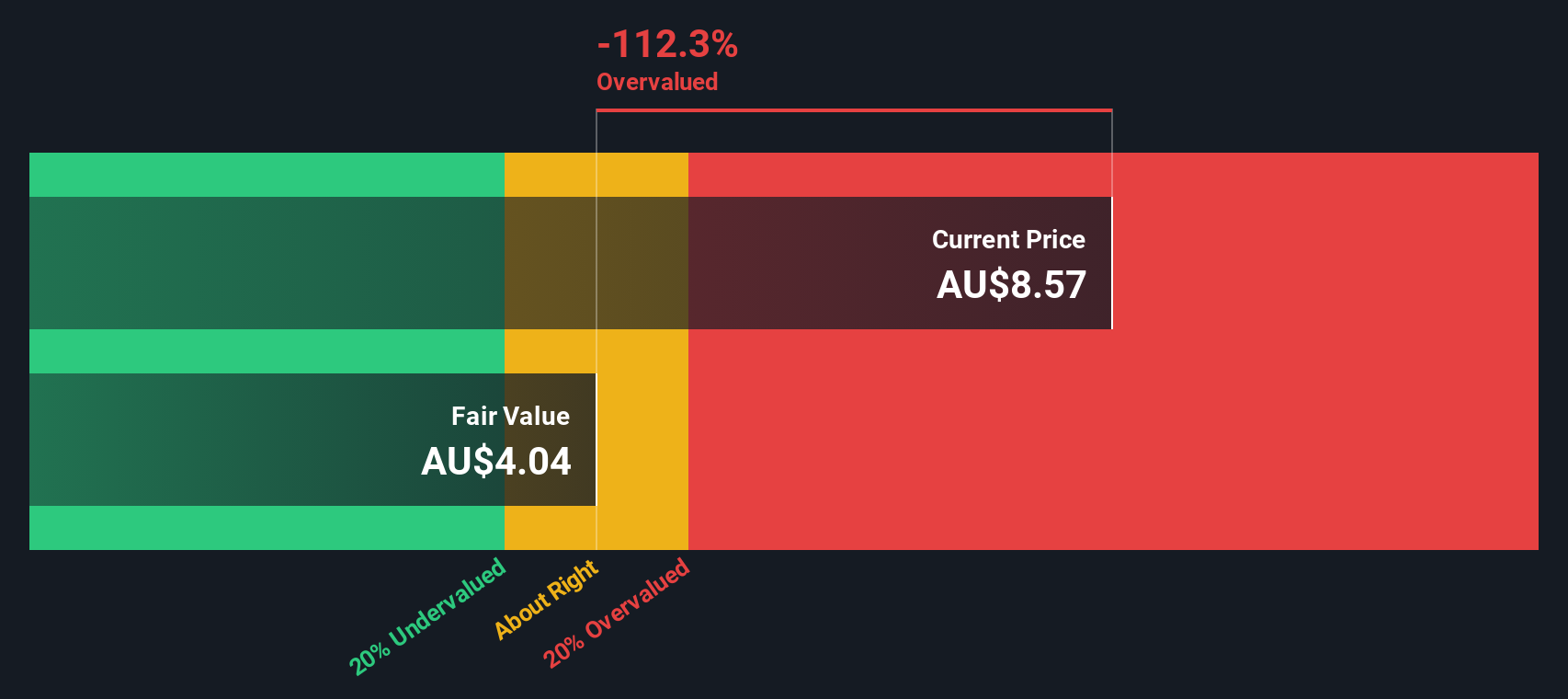

While analysts see upside based on earnings potential and narrative fair value, the SWS DCF model tells a different story. According to our discounted cash flow approach, AGL is trading above its estimated fair value. This challenges the bullish case and raises the question: Has the market already priced in too much optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AGL Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AGL Energy Narrative

Not convinced by the current views or want a fresh angle? It only takes a few minutes to dive into the facts and craft your own narrative. Do it your way.

A great starting point for your AGL Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit yourself to just one opportunity. Take control and get ahead of the market by using these handpicked SWS screens focused on high-potential themes.

- Unlock income potential and make the most of compounding with these 20 dividend stocks with yields > 3%, which offers yields above 3% and strong histories of shareholder rewards.

- Tap into innovation by browsing these 26 AI penny stocks, featuring companies that are setting the pace in artificial intelligence, automation, and transformative tech solutions.

- Capitalize on deep value by searching these 840 undervalued stocks based on cash flows for stocks that stand out due to attractive pricing relative to future cash flows and growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AGL

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives