The harsh reality for Traffic Technologies Limited (ASX:TTI) shareholders is that its auditors, Grant Thornton, expressed doubts about its ability to continue as a going concern, in its reported results to June 2021. This means that, based on the financial results to that date, the company arguably should raise capital, or otherwise strengthen the balance sheet, as soon as possible.

Since the company probably needs cash fairly quickly, it may be in a position where it has to accept whatever terms it can get. So it is suddenly extremely important to consider whether the company is taking too much risk on its balance sheet. The big consideration is whether it can repay its debt, since in the worst case scenario, creditors could force the company to bankruptcy.

See our latest analysis for Traffic Technologies

How Much Debt Does Traffic Technologies Carry?

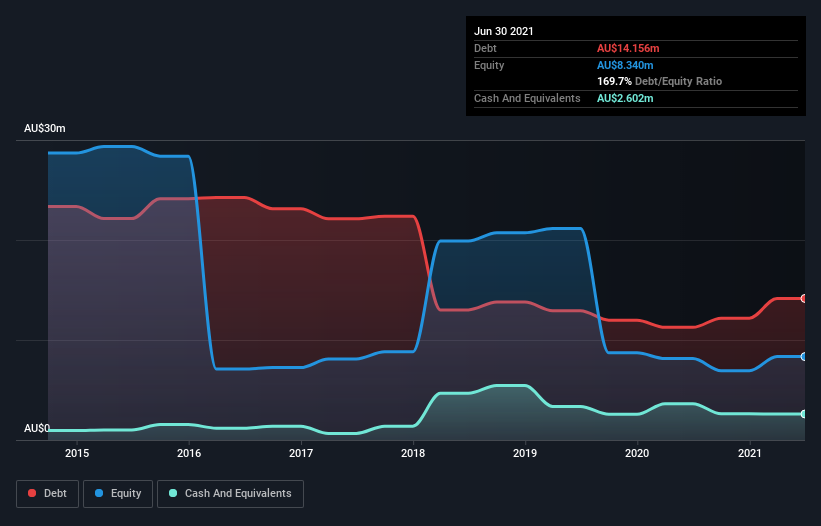

The image below, which you can click on for greater detail, shows that at June 2021 Traffic Technologies had debt of AU$14.2m, up from AU$11.3m in one year. However, because it has a cash reserve of AU$2.60m, its net debt is less, at about AU$11.6m.

How Strong Is Traffic Technologies' Balance Sheet?

We can see from the most recent balance sheet that Traffic Technologies had liabilities of AU$25.1m falling due within a year, and liabilities of AU$3.91m due beyond that. On the other hand, it had cash of AU$2.60m and AU$7.45m worth of receivables due within a year. So it has liabilities totalling AU$19.0m more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of AU$22.7m. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 0.92 times and a disturbingly high net debt to EBITDA ratio of 5.3 hit our confidence in Traffic Technologies like a one-two punch to the gut. The debt burden here is substantial. One redeeming factor for Traffic Technologies is that it turned last year's EBIT loss into a gain of AU$1.9m, over the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Traffic Technologies will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. During the last year, Traffic Technologies burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Traffic Technologies's interest cover and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. Having said that, its ability to grow its EBIT isn't such a worry. Overall, it seems to us that Traffic Technologies's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. Although its industry, the Infrastructure industry, is often considered defensive, we wouldn't be keen to invest in Traffic Technologies because of its auditor's view on its financial position. It's just too risky for us. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 3 warning signs we've spotted with Traffic Technologies (including 1 which is a bit unpleasant) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Traffic Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Traffic Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:TTI

Traffic Technologies

Provides traffic solutions in Australia and internationally.

Moderate and slightly overvalued.

Market Insights

Community Narratives