- Australia

- /

- Infrastructure

- /

- ASX:DBI

Dalrymple Bay Infrastructure (ASX:DBI) Valuation in Focus Following Board Changes and Brookfield Exit

Reviewed by Kshitija Bhandaru

Dalrymple Bay Infrastructure (ASX:DBI) is navigating a governance transition after announcing CEO Michael Riches will now serve as Managing Director as well, following the resignation of two non-executive directors linked to Brookfield Infrastructure Group.

See our latest analysis for Dalrymple Bay Infrastructure.

Recent boardroom changes at Dalrymple Bay Infrastructure arrive during a period of noticeable momentum for shareholders, with a 24% year-to-date share price return and an impressive 39% total return over the past twelve months. The stock’s long-term gains, reflected in a 137% total return over three years, reinforce growing optimism about its future. At the same time, leadership reshuffles signal a new chapter for the company.

If shifting leadership stories like this have you thinking broader, it might be the perfect time to discover fast growing stocks with high insider ownership

With the stock trading just below analyst targets despite robust returns, investors might wonder if Dalrymple Bay Infrastructure remains undervalued, or if the market is already pricing in the company’s next phase of growth.

Most Popular Narrative: 8.5% Undervalued

Taking the latest narrative fair value of A$4.84 and Dalrymple Bay Infrastructure’s last close at A$4.43, there is a notable gap between where analysts believe the shares could go and where they trade today. This highlights the underlying assumptions and catalysts that shape a bullish outlook.

Structural long-term demand for high-grade metallurgical coal in Asian markets, fueled by ongoing urbanization, industrialization, and infrastructure investment (notably steel production for emerging market development), ensures volume stability and enduring utilization for Dalrymple Bay's export infrastructure. This supports terminal throughput and long-term earnings growth.

Want to know what powers this valuation premium? It all comes down to long-horizon contracts, a market monopoly, and financial targets that turn heavy assets into future cash machines. Curious about the actual numbers that analysts are betting on? Get the full narrative and discover the bold projections behind this price target.

Result: Fair Value of $4.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on coal exports and potential shifts in global decarbonization policy could disrupt Dalrymple Bay Infrastructure’s growth outlook in the years ahead.

Find out about the key risks to this Dalrymple Bay Infrastructure narrative.

Another View: Looking Through the Valuation Lens

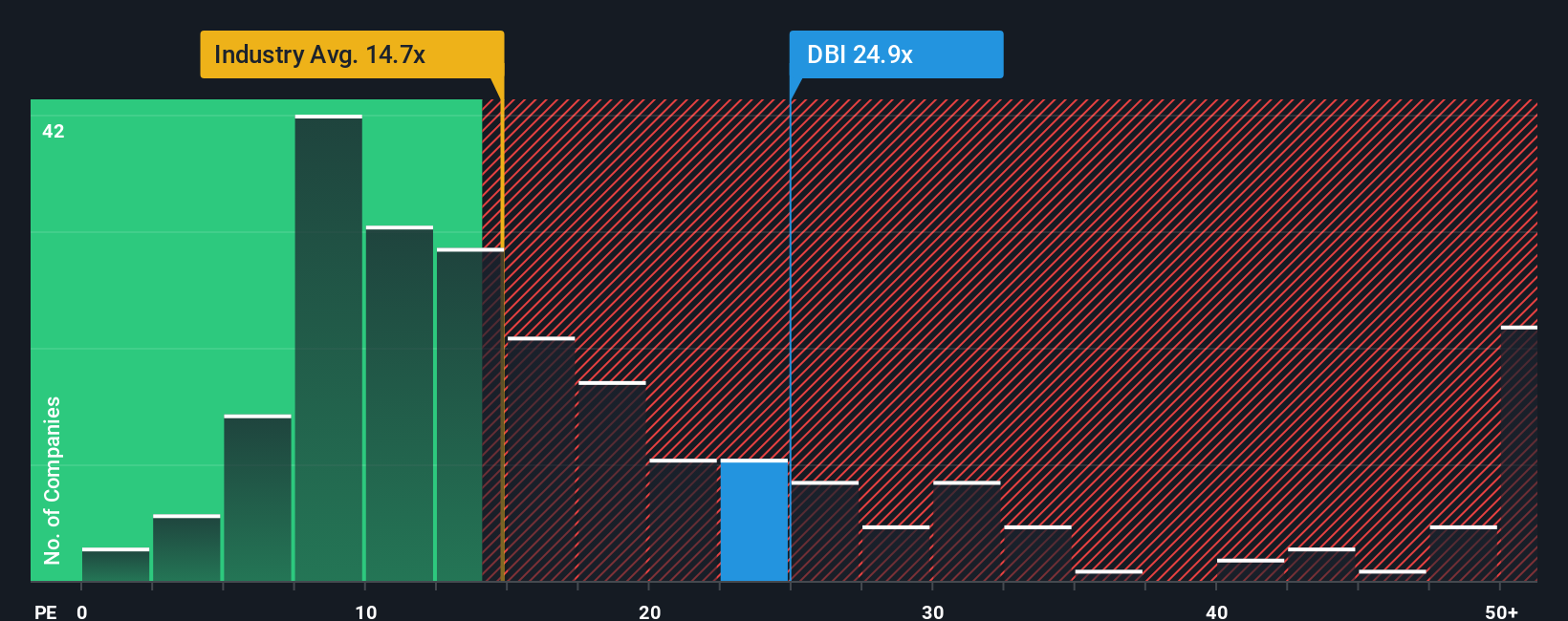

There is another side to the story. When comparing Dalrymple Bay Infrastructure’s price-to-earnings ratio of 24.9x, it is higher than the global infrastructure industry average of 14.6x and above its own fair ratio of 14.4x. This suggests the market could be at risk of overpaying, even though it trades just below analyst targets. Could current optimism be stretched a little too far, or is there more upside left to tap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dalrymple Bay Infrastructure Narrative

If you see things differently or want to dig into the numbers yourself, you can craft a personalized narrative in just a few minutes. Do it your way

A great starting point for your Dalrymple Bay Infrastructure research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take your investing strategy to the next level. Don't let standout opportunities pass you by when you could be ahead of the curve with these handpicked ideas:

- Boost your potential returns by targeting high-yield opportunities with these 19 dividend stocks with yields > 3% and lock in reliable income streams for your portfolio.

- Tap into the relentless growth of artificial intelligence by reviewing these 24 AI penny stocks that are pushing boundaries in automation, data insights, and disruptive tech.

- Get ahead of the crowd by searching these 898 undervalued stocks based on cash flows stocks that are poised for strategic rebounds and strong fundamentals waiting to be recognized.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DBI

Dalrymple Bay Infrastructure

Owns the lease of and right to operate the Dalrymple Bay terminal, a metallurgical coal export facility in Bowen Basin in Queensland, Australia.

Proven track record with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success