- Australia

- /

- Infrastructure

- /

- ASX:DBI

Dalrymple Bay Infrastructure (ASX:DBI) Is Increasing Its Dividend To A$0.0538

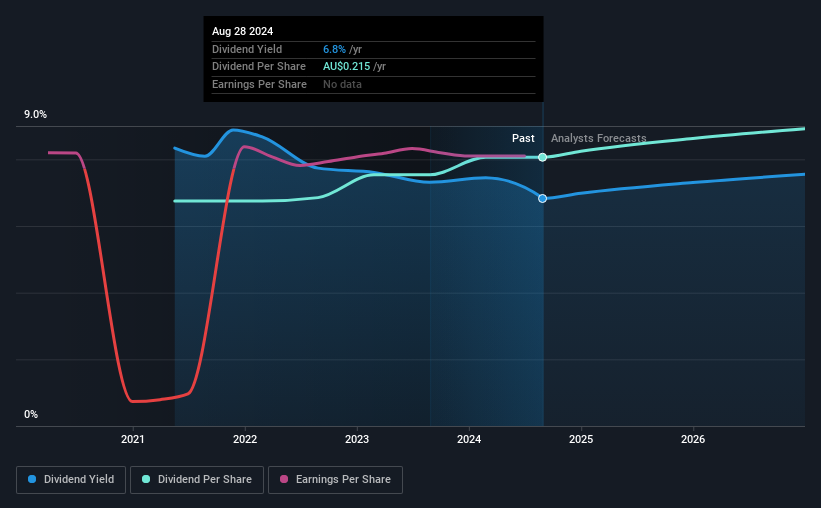

The board of Dalrymple Bay Infrastructure Limited (ASX:DBI) has announced that it will be paying its dividend of A$0.0538 on the 17th of September, an increased payment from last year's comparable dividend. This will take the dividend yield to an attractive 6.8%, providing a nice boost to shareholder returns.

View our latest analysis for Dalrymple Bay Infrastructure

Dalrymple Bay Infrastructure Doesn't Earn Enough To Cover Its Payments

A big dividend yield for a few years doesn't mean much if it can't be sustained. Based on the last payment, the dividend made up 79% of cash flows, but a higher proportion of net income. The company could be more focused on returning cash to shareholders, but this could indicate that growth opportunities are few and far between.

Over the next year, EPS is forecast to expand by 42.5%. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 97% over the next year.

Dalrymple Bay Infrastructure Is Still Building Its Track Record

Looking back, the dividend has been stable, but the company hasn't been paying a dividend for very long so we can't be confident that the dividend will remain stable through all economic environments. The dividend has gone from an annual total of A$0.18 in 2021 to the most recent total annual payment of A$0.215. This implies that the company grew its distributions at a yearly rate of about 6.1% over that duration. Dalrymple Bay Infrastructure has a nice track record of dividend growth but we would wait until we see a longer track record before getting too confident.

Dividend Growth Could Be Constrained

The company's investors will be pleased to have been receiving dividend income for some time. We are encouraged to see that Dalrymple Bay Infrastructure has grown earnings per share at 128% per year over the past three years. EPS has been growing well, but Dalrymple Bay Infrastructure has been paying out a massive proportion of its earnings, which can make the dividend tough to maintain.

Dalrymple Bay Infrastructure's Dividend Doesn't Look Sustainable

In summary, while it's always good to see the dividend being raised, we don't think Dalrymple Bay Infrastructure's payments are rock solid. Strong earnings growth means Dalrymple Bay Infrastructure has the potential to be a good dividend stock in the future, despite the current payments being at elevated levels. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 2 warning signs for Dalrymple Bay Infrastructure (of which 1 doesn't sit too well with us!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:DBI

Dalrymple Bay Infrastructure

Owns the lease of and right to operate the Dalrymple Bay terminal, a metallurgical coal export facility in Bowen Basin in Queensland, Australia.

Proven track record with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026