How Will Tuas’ A$50 Million Equity Raise Shape Its Capital Allocation Strategy (ASX:TUA)?

Reviewed by Sasha Jovanovic

- Tuas Limited recently completed a follow-on equity offering, raising approximately A$50.00 million by issuing 9,075,170 new ordinary shares at A$5.51 each.

- This capital raising highlights the company’s focus on securing additional funds, which can play a key role in its future initiatives and operational flexibility.

- We will explore how this completed equity offering, and its potential impact on capital allocation, shapes the current investment narrative for Tuas.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Tuas' Investment Narrative?

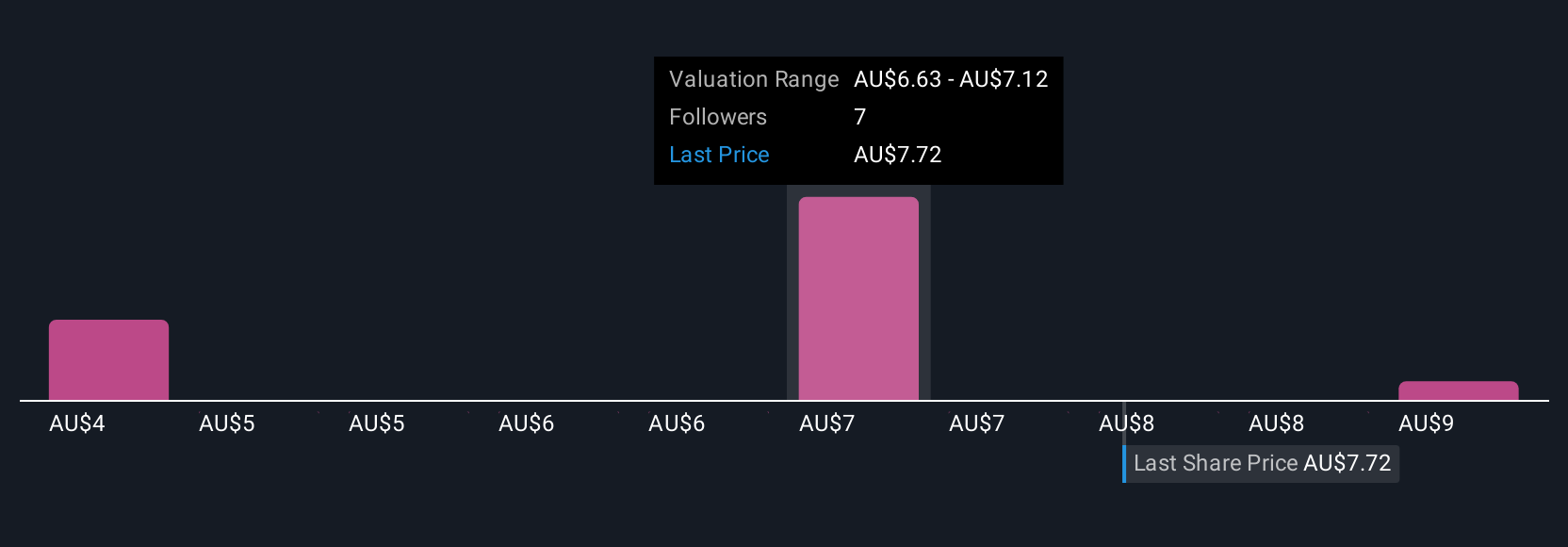

For most shareholders, the big picture with Tuas is about believing in its transformation from a small operator to a profitable, fast-growing telecom with solid revenue momentum and inclusion in major indices. The recent A$50.0 million equity raise, completed at A$5.51 per share, adds near-term financial flexibility and could support new initiatives, infrastructure investments, or help buffer any operational headwinds, but it does incrementally increase dilution risk given previous share issuances. This fresh capital may support short-term catalysts like continued expansion or acquisitions, which could help sustain revenue growth forecasts, but also adds to valuation concerns, as the stock already trades richly versus peers. For now, the risk of ongoing share dilution is even more front of mind for investors, and may affect sentiment, despite the company turning profitable and new leadership joining the board.

Yet, the risk of further dilution is something investors should not ignore.

Exploring Other Perspectives

Explore 3 other fair value estimates on Tuas - why the stock might be worth as much as 46% more than the current price!

Build Your Own Tuas Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tuas research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tuas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tuas' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tuas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TUA

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion