3 ASX Stocks That Investors Might Be Undervaluing Based On Current Market Conditions

Reviewed by Simply Wall St

As the Australian market navigates a period of anticipation ahead of the upcoming quarterly CPI data, the ASX200 saw minimal movement, closing down slightly by 0.06%. While sectors like Information Technology and Health Care showed resilience, others such as Staples and Industrials lagged behind, highlighting a mixed performance across the board. In this environment, identifying undervalued stocks can be crucial for investors seeking opportunities that may not yet be fully recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Data#3 (ASX:DTL) | A$7.21 | A$13.43 | 46.3% |

| Mader Group (ASX:MAD) | A$5.65 | A$10.44 | 45.9% |

| Westgold Resources (ASX:WGX) | A$3.29 | A$6.25 | 47.4% |

| Telix Pharmaceuticals (ASX:TLX) | A$20.90 | A$41.66 | 49.8% |

| Ansell (ASX:ANN) | A$31.17 | A$58.28 | 46.5% |

| Ingenia Communities Group (ASX:INA) | A$4.90 | A$9.39 | 47.8% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Megaport (ASX:MP1) | A$6.93 | A$13.42 | 48.4% |

| Genesis Minerals (ASX:GMD) | A$2.53 | A$4.78 | 47.1% |

| Energy One (ASX:EOL) | A$5.65 | A$11.07 | 48.9% |

Here we highlight a subset of our preferred stocks from the screener.

Aussie Broadband (ASX:ABB)

Overview: Aussie Broadband Limited offers telecommunications and technology services in Australia, with a market cap of A$1.15 billion.

Operations: The company's revenue segments include Business (A$96.97 million), Wholesale (A$159.73 million), Residential (A$585.07 million), Symbio Group (A$69.93 million), and Enterprise and Government (A$88.04 million).

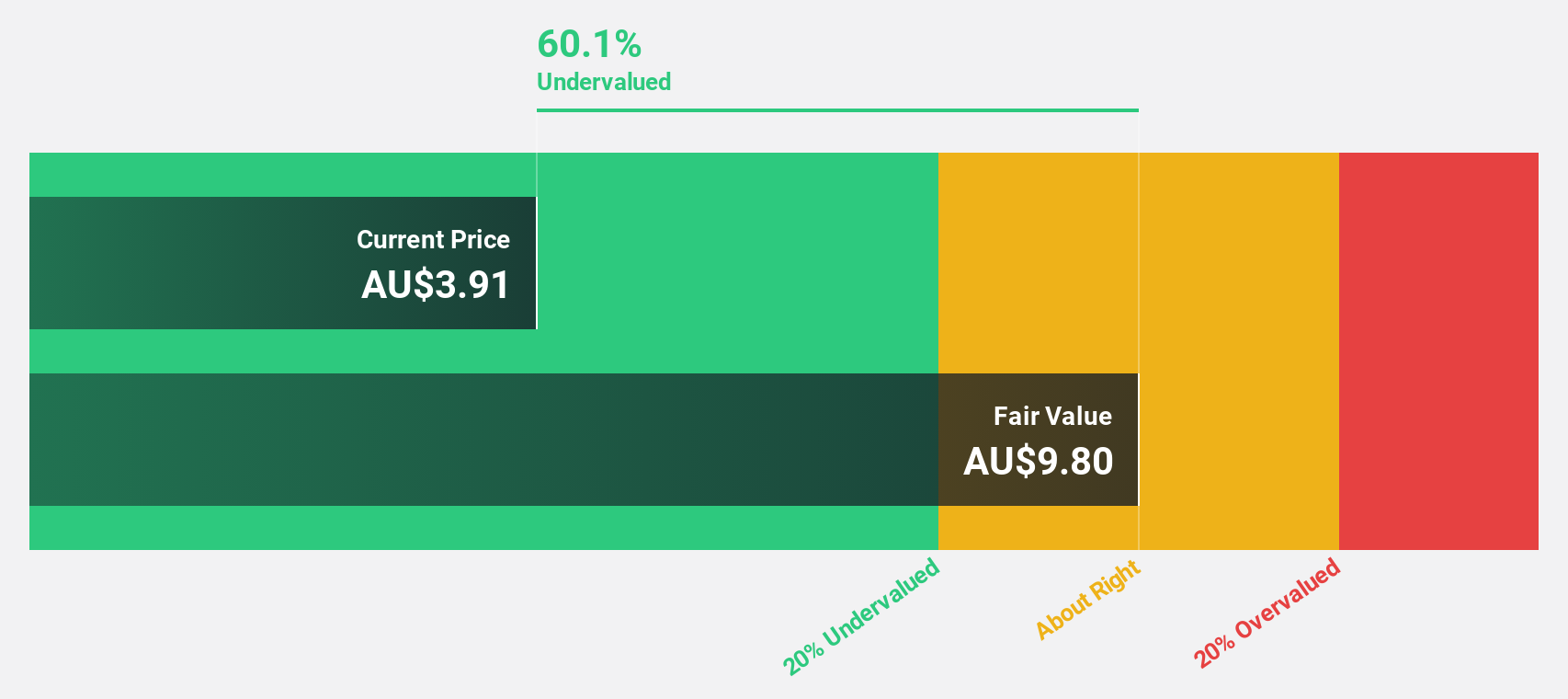

Estimated Discount To Fair Value: 42.2%

Aussie Broadband is trading at A$3.9, significantly below its estimated fair value of A$6.74, indicating it may be undervalued based on cash flows. Despite shareholder dilution in the past year, earnings are expected to grow significantly at 27.3% annually, outpacing the Australian market's growth rate of 12.3%. Recent changes include leadership transitions and achieving over A$1 billion in revenue and market capitalization milestones in 2024.

- Insights from our recent growth report point to a promising forecast for Aussie Broadband's business outlook.

- Take a closer look at Aussie Broadband's balance sheet health here in our report.

SiteMinder (ASX:SDR)

Overview: SiteMinder Limited develops, markets, and sells online guest acquisition platforms and commerce solutions for accommodation providers in Australia and internationally, with a market cap of A$1.80 billion.

Operations: The company generates revenue from its Software & Programming segment, amounting to A$190.84 million.

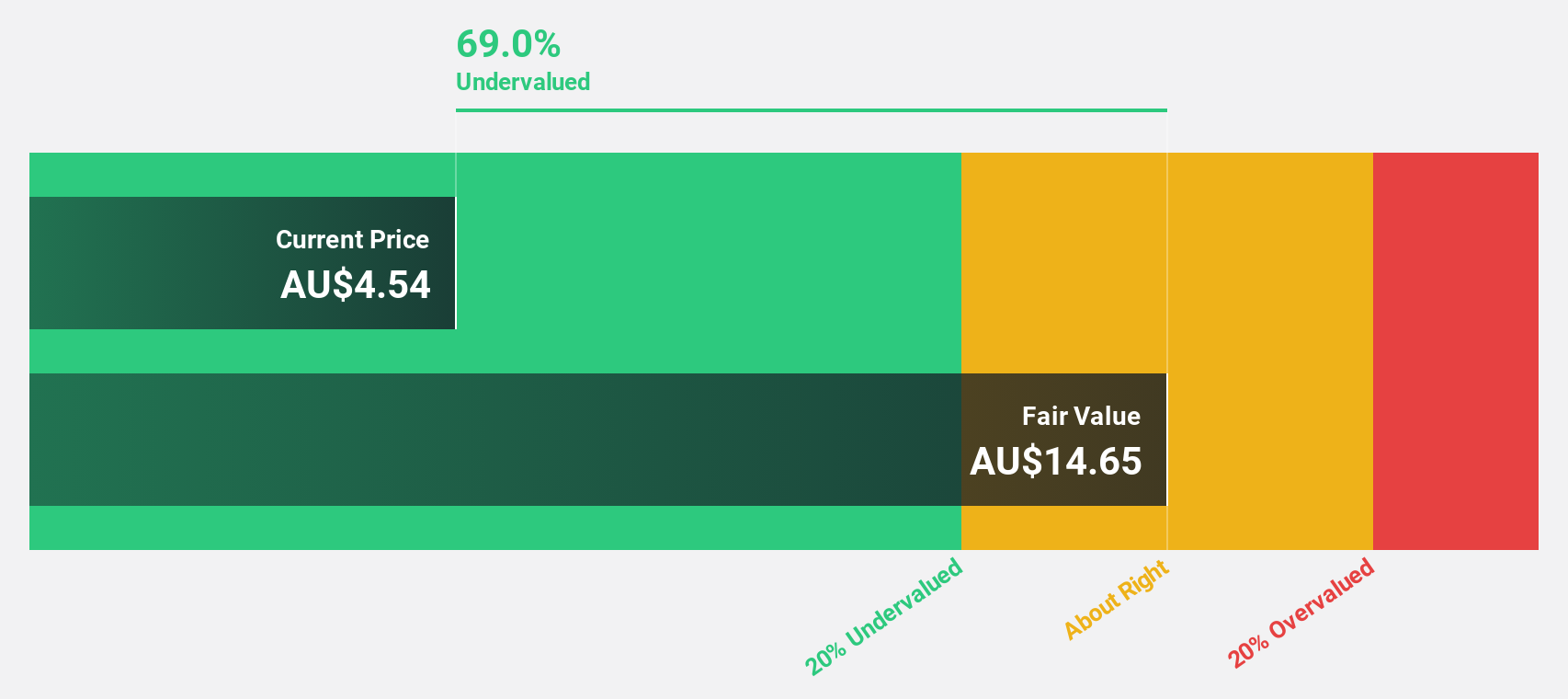

Estimated Discount To Fair Value: 10.8%

SiteMinder is trading at A$6.51, slightly below its estimated fair value of A$7.3, suggesting it might be undervalued based on cash flows. The company reported a net loss of A$25.13 million for the year ending June 2024, an improvement from the previous year's loss of A$49.3 million. Revenue grew to A$190.67 million from A$151.38 million, with further growth expected to outpace the broader Australian market significantly over the next few years.

- According our earnings growth report, there's an indication that SiteMinder might be ready to expand.

- Click to explore a detailed breakdown of our findings in SiteMinder's balance sheet health report.

Superloop (ASX:SLC)

Overview: Superloop Limited, with a market cap of A$994.51 million, operates as a telecommunications and internet service provider in Australia.

Operations: The company's revenue segments consist of A$104.04 million from Business, A$264.56 million from Consumer, and A$48.03 million from Wholesale operations.

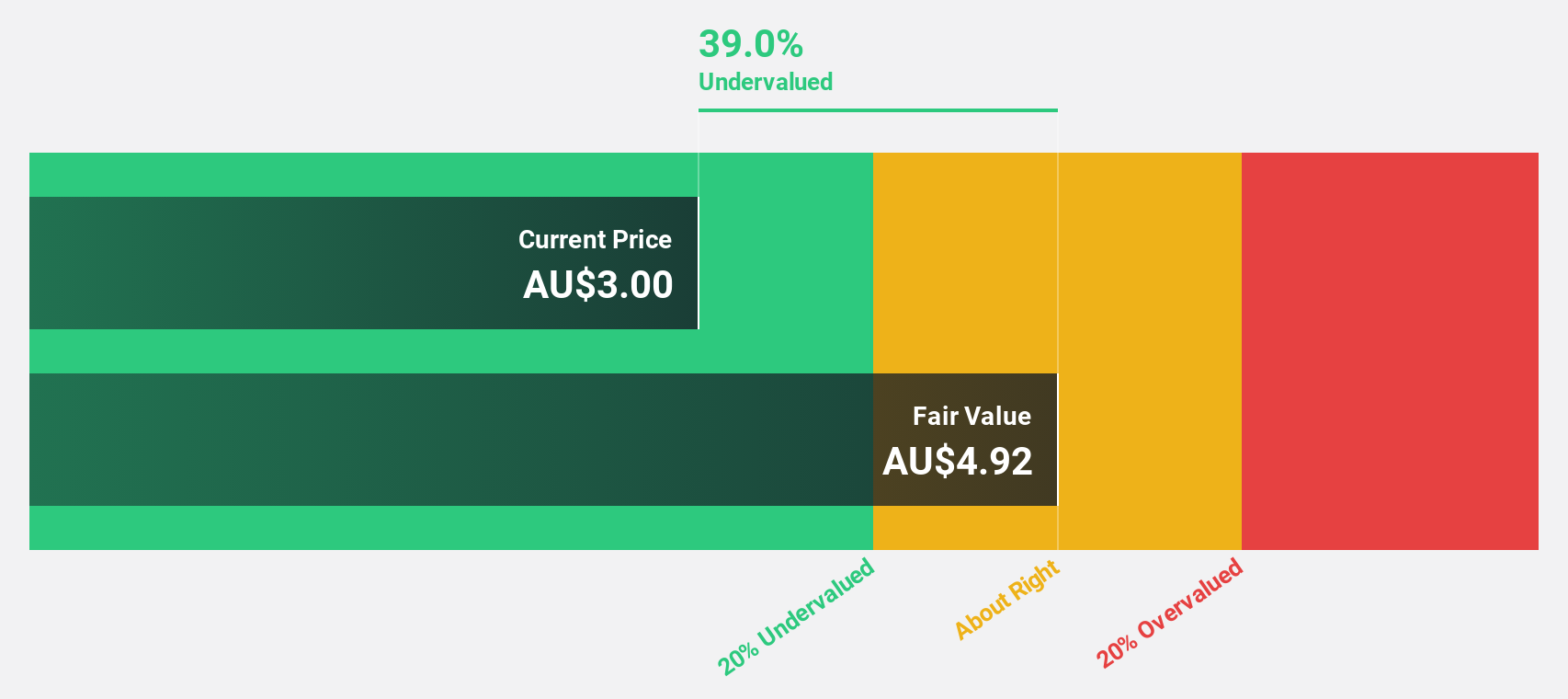

Estimated Discount To Fair Value: 40.1%

Superloop, trading at A$1.95, is significantly undervalued compared to its estimated fair value of A$3.26, based on discounted cash flow analysis. Recent earnings showed a reduced net loss of A$14.74 million from the previous year's A$43.2 million, with revenue increasing to A$420.52 million from A$323.52 million. Despite shareholder dilution and low forecasted return on equity, Superloop's projected revenue growth rate surpasses the Australian market average over the next few years.

- The analysis detailed in our Superloop growth report hints at robust future financial performance.

- Navigate through the intricacies of Superloop with our comprehensive financial health report here.

Turning Ideas Into Actions

- Navigate through the entire inventory of 43 Undervalued ASX Stocks Based On Cash Flows here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SLC

Superloop

Operates as a telecommunications and internet service provider in Australia.

Excellent balance sheet with reasonable growth potential.