- Australia

- /

- Communications

- /

- ASX:SEN

Shareholders May Be A Bit More Conservative With Senetas Corporation Limited's (ASX:SEN) CEO Compensation For Now

Key Insights

- Senetas' Annual General Meeting to take place on 29th of November

- Salary of AU$492.0k is part of CEO Andrew Wilson's total remuneration

- The total compensation is similar to the average for the industry

- Senetas' EPS declined by 51% over the past three years while total shareholder loss over the past three years was 68%

The underwhelming share price performance of Senetas Corporation Limited (ASX:SEN) in the past three years would have disappointed many shareholders. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. The AGM coming up on 29th of November will be an opportunity for shareholders to have their concerns addressed by the board and for them to exercise their influence on management through voting on resolutions such as executive remuneration. We think shareholders may be cautious of approving a pay rise for the CEO at the moment, based on our analysis below.

View our latest analysis for Senetas

Comparing Senetas Corporation Limited's CEO Compensation With The Industry

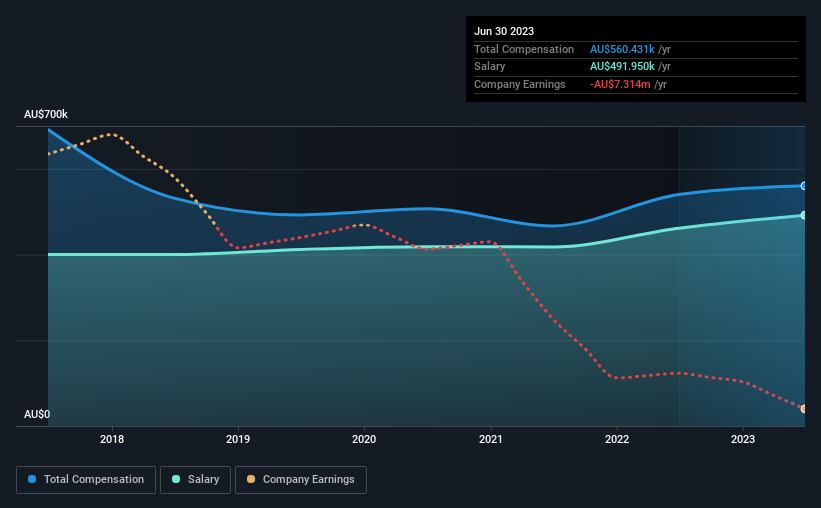

According to our data, Senetas Corporation Limited has a market capitalization of AU$22m, and paid its CEO total annual compensation worth AU$560k over the year to June 2023. That's a modest increase of 3.8% on the prior year. We note that the salary portion, which stands at AU$492.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Australia Communications industry with market capitalizations below AU$305m, reported a median total CEO compensation of AU$454k. This suggests that Senetas remunerates its CEO largely in line with the industry average.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | AU$492k | AU$461k | 88% |

| Other | AU$68k | AU$79k | 12% |

| Total Compensation | AU$560k | AU$540k | 100% |

Talking in terms of the industry, salary represented approximately 53% of total compensation out of all the companies we analyzed, while other remuneration made up 47% of the pie. Senetas pays out 88% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Senetas Corporation Limited's Growth

Over the last three years, Senetas Corporation Limited has shrunk its earnings per share by 51% per year. It achieved revenue growth of 17% over the last year.

Investors would be a bit wary of companies that have lower EPS But in contrast the revenue growth is strong, suggesting future potential for EPS growth. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Senetas Corporation Limited Been A Good Investment?

The return of -68% over three years would not have pleased Senetas Corporation Limited shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The loss to shareholders over the past three years is certainly concerning and possibly has something to do with the fact that the company's earnings haven't grown. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 2 warning signs (and 1 which makes us a bit uncomfortable) in Senetas we think you should know about.

Important note: Senetas is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SEN

Senetas

Engages in the development, manufacture, and sale of information technology products which provide network data security solutions to businesses and governments worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion