Did Changing Sentiment Drive Nanoveu's (ASX:NVU) Share Price Down A Worrying 63%?

Nanoveu Limited (ASX:NVU) shareholders should be happy to see the share price up 20% in the last week. But that doesn't change the fact that the returns over the last year have been disappointing. Specifically, the stock price slipped by 63% in that time. The share price recovery is not so impressive when you consider the fall. You could argue that the sell-off was too severe.

See our latest analysis for Nanoveu

With just AU$61,023 worth of revenue in twelve months, we don't think the market considers Nanoveu to have proven its business plan. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). Investors will be hoping that Nanoveu can make progress and gain better traction for the business, before it runs low on cash.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. It certainly is a dangerous place to invest, as Nanoveu investors might realise.

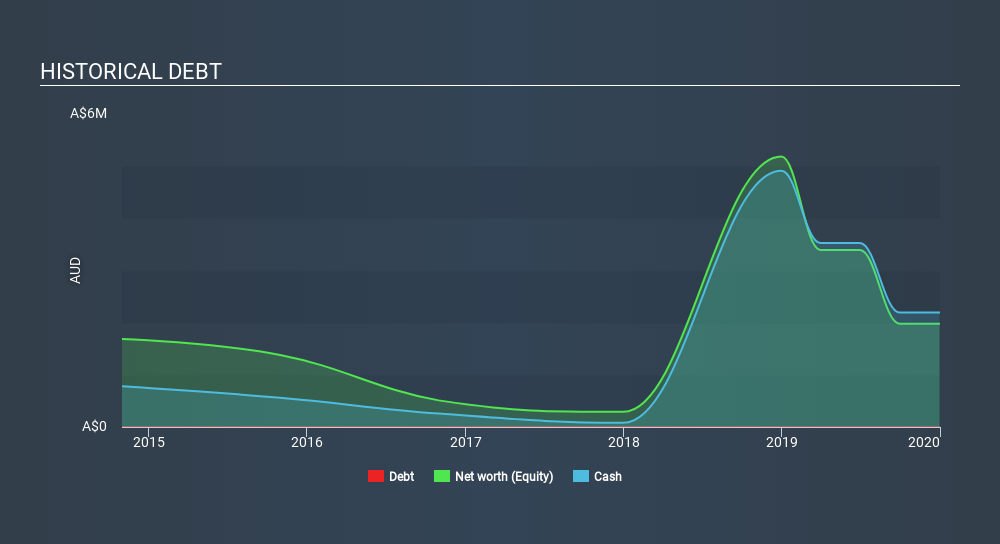

When it reported in December 2019 Nanoveu had minimal cash in excess of all liabilities consider its expenditure: just AU$1.6m to be specific. So if it has not already moved to replenish reserves, we think the near-term chances of a capital raising event are pretty high. That probably explains why the share price is down 63% in the last year. You can see in the image below, how Nanoveu's cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

Nanoveu shareholders are down 63% for the year, even worse than the market loss of 14%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 33%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It's always interesting to track share price performance over the longer term. But to understand Nanoveu better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 7 warning signs for Nanoveu (of which 5 are a bit concerning!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:NVU

Nanoveu

A technology company, engages in the deployment of nanotechnology for consumer applications in the Americas and Asia.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives