- Australia

- /

- Communications

- /

- ASX:MOB

Did Changing Sentiment Drive Mobilicom's (ASX:MOB) Share Price Down A Worrying 62%?

Investing in stocks comes with the risk that the share price will fall. Anyone who held Mobilicom Limited (ASX:MOB) over the last year knows what a loser feels like. The share price has slid 62% in that time. Mobilicom may have better days ahead, of course; we've only looked at a one year period. Shareholders have had an even rougher run lately, with the share price down 56% in the last 90 days. Of course, this share price action may well have been influenced by the 23% decline in the broader market, throughout the period.

View our latest analysis for Mobilicom

Given that Mobilicom didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Mobilicom saw its revenue grow by 30%. That's definitely a respectable growth rate. Unfortunately it seems investors wanted more, because the share price is down 62% in that time. It may well be that the business remains approximately on track, but its revenue growth has simply been delayed. To our minds it isn't enough to just look at revenue, anyway. Always consider when profits will flow.

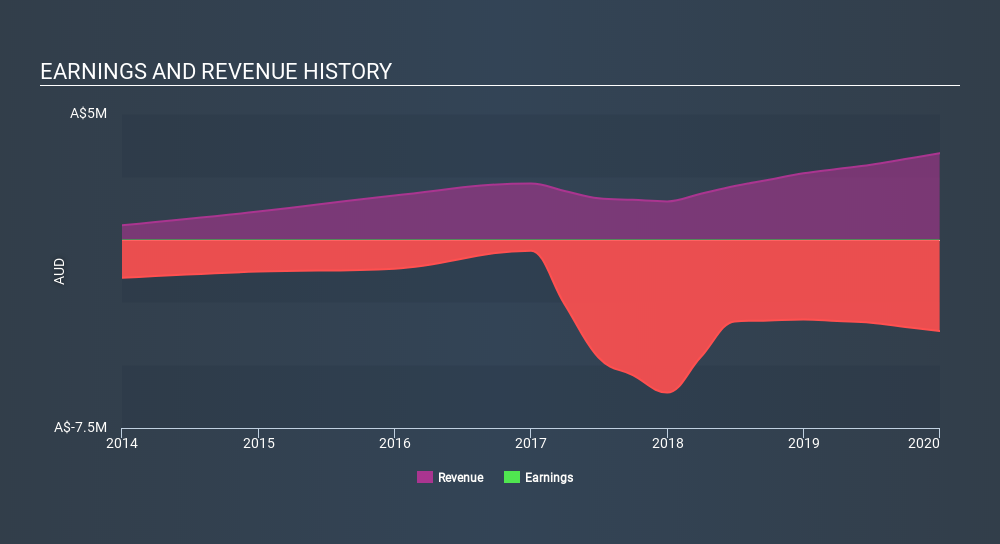

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. It might be well worthwhile taking a look at our free report on Mobilicom's earnings, revenue and cash flow.

A Different Perspective

We doubt Mobilicom shareholders are happy with the loss of 62% over twelve months. That falls short of the market, which lost 11%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 56% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Mobilicom better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 6 warning signs with Mobilicom (at least 2 which can't be ignored) , and understanding them should be part of your investment process.

Mobilicom is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:MOB

Mobilicom

Engages in the provision of hardware products and software and cybersecurity solutions for drones, small-sized unmanned aerial vehicles (SUAV), and robotics in Israel, the United States, Canada, and internationally.

Flawless balance sheet low.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion