Should You Buy Dicker Data Limited (ASX:DDR) For Its 3.2% Dividend?

Today we'll take a closer look at Dicker Data Limited ( ASX:DDR ) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

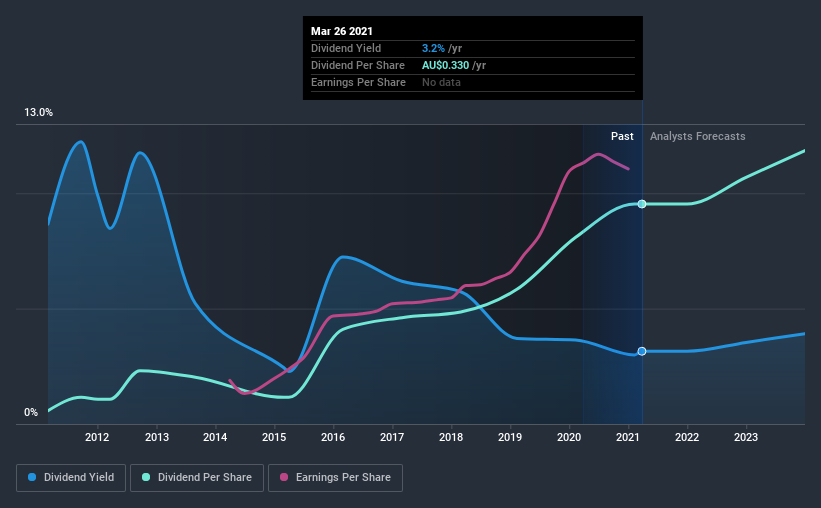

In this case, Dicker Data likely looks attractive to investors, given its 3.2% dividend yield and a payment history of over ten years. We'd guess that plenty of investors have purchased it for the income. There are a few simple ways to reduce the risks of buying Dicker Data for its dividend, and we'll go through these below.

Explore this interactive chart for our latest analysis on Dicker Data!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Looking at the data, we can see that 97% of Dicker Data's profits were paid out as dividends in the last 12 months. This is quite a high payout ratio that we normally consider to be not well covered by earnings. However, it is worth noting that Dicker Data has a 100% dividend payout policy where it pays out three equal dividends throughout the year and a final dividend in the fourth quarter after earnings is declared to make up the difference. So this payout is in line with that policy.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Dicker Data paid out 479% of its free cash last year. Cash flows can be lumpy, but this dividend was not well covered by cash flow. Paying out more than 100% of your free cash flow in dividends is generally not a long-term, sustainable state of affairs, so we think shareholders should watch this metric closely. Cash is slightly more important than profit from a dividend perspective, but given Dicker Data's payments were not well covered by either earnings or cash flow, we are concerned about the sustainability of this dividend.

We update our data on Dicker Data every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Dicker Data has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. This dividend has been unstable, which we define as having been cut one or more times over this time. During the past 10-year period, the first annual payment was AU$0.02 in 2011, compared to AU$0.3 last year. This works out to be a compound annual growth rate (CAGR) of approximately 32% a year over that time. The growth in dividends has not been linear, but the CAGR is a decent approximation of the rate of change over this time frame.

Dicker Data has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Dicker Data's unique dividend policy of paying out three equal dividends over the year and a fourth to take them to a payout ratio of 100% results in the company sometimes cutting the dividend "on paper" from quarter to quarter.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? It's good to see Dicker Data has been growing its earnings per share at 19% a year over the past five years. Although earnings per share are up nicely Dicker Data is paying out 97% of its earnings as dividends, which we feel is borderline unsustainable without extenuating circumstances.

We'd also point out that Dicker Data issued a meaningful number of new shares in the past year. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Dicker Data paid out almost all of its cash flow and profit as dividends, leaving little to reinvest in the business. We were also glad to see it growing earnings, but it was concerning to see the dividend has been cut at least once in the past. With this information in mind, we think Dicker Data may not be an ideal dividend stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come accross 5 warning signs for Dicker Data you should be aware of, and 1 of them is a bit concerning.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you’re looking to trade Dicker Data, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers . Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

* Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:DDR

Dicker Data

Engages in the wholesale distribution of computer hardware, software, and related products for corporate and commercial markets in Australia and New Zealand.

Adequate balance sheet average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion