Stock Analysis

The Australian market has been flat in the last week but is up 20% over the past year, with earnings forecast to grow by 12% annually. In this context, identifying high growth tech stocks involves looking for companies that demonstrate strong potential for expansion and innovation, aligning with these positive market trends.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.16% | ★★★★★☆ |

| Pureprofile | 14.94% | 80.73% | ★★★★★☆ |

| Adherium | 86.80% | 73.66% | ★★★★★★ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| Telix Pharmaceuticals | 21.54% | 38.31% | ★★★★★★ |

| AVA Risk Group | 32.56% | 118.83% | ★★★★★★ |

| Careteq | 37.17% | 126.21% | ★★★★★☆ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Wrkr | 36.31% | 100.29% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

Click here to see the full list of 65 stocks from our ASX High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Codan (ASX:CDA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Codan Limited develops technology solutions for a diverse clientele including United Nations organizations, security and military groups, government departments, individuals, and small-scale miners, with a market cap of A$2.88 billion.

Operations: Codan Limited generates revenue primarily through its Communications and Metal Detection segments, with Communications contributing A$326.91 million and Metal Detection A$219.85 million. The company serves a wide range of clients, including international organizations and government bodies.

Codan, recently added to the S&P/ASX 200 Index, is demonstrating robust growth within Australia's tech sector. In the past year, Codan's earnings surged by 20.1%, outpacing the electronic industry’s average decline of 3.8%. This growth trajectory is supported by a significant R&D investment focus, aligning with a forecasted annual earnings increase of 17.4% and revenue growth at 10.2% per year—both rates exceeding broader market expectations. Moreover, their strategic emphasis on innovation is evident from their latest financial statements for FY2024, showing a jump in sales to AUD 550.46 million from AUD 456.5 million in the previous year and an uplift in net income to AUD 81.39 million. Despite these promising figures and recent index inclusion enhancing its market visibility, Codan faces challenges like maintaining this momentum amidst competitive pressures and evolving technology landscapes. Their forward-looking approach with substantial R&D spending positions them well for sustained growth but monitoring how these investments translate into scalable products will be crucial for their continued success in high-tech sectors.

- Click here and access our complete health analysis report to understand the dynamics of Codan.

Gain insights into Codan's historical performance by reviewing our past performance report.

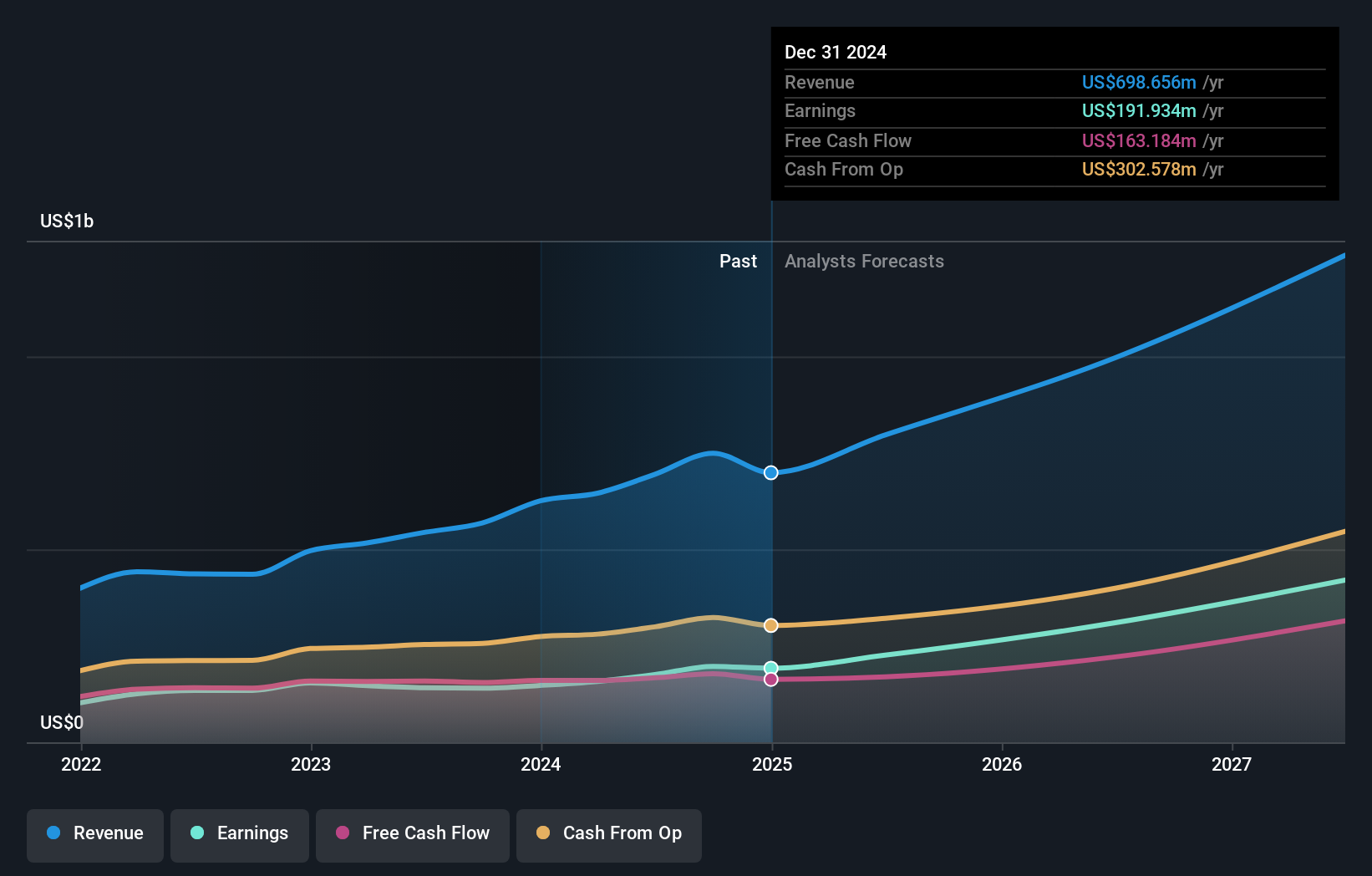

REA Group (ASX:REA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: REA Group Limited operates an online property advertising business across Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam, and other international markets with a market capitalization of approximately A$30.62 billion.

Operations: The company generates revenue primarily through its property and online advertising segment in Australia, which accounts for A$1.25 billion, alongside financial services contributing A$320.60 million. Additionally, the India segment adds A$103.10 million to its revenue streams.

REA Group, amidst a challenging backdrop, has managed to position itself as a resilient player in Australia's tech landscape. With revenue growth forecasted at 6.6% annually, it outpaces the national market average of 5.6%, reflecting its robust market presence and strategic operations that cater effectively to dynamic consumer demands. Furthermore, the company's commitment to innovation is underscored by its R&D spending trends which are crucial for maintaining competitive advantage; this is evident as earnings are expected to grow by an impressive 16.8% per year, significantly higher than the broader Australian market's forecast of 12.3%. Additionally, REA Group’s recent decision to increase its dividend by 23% signals strong financial health and confidence in sustained profitability, providing a clear reflection of its operational success and forward-looking management practices.

WiseTech Global (ASX:WTC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: WiseTech Global Limited develops and provides software solutions for the logistics execution industry across various regions including the Americas, Asia Pacific, Europe, the Middle East, and Africa, with a market cap of A$37.48 billion.

Operations: WiseTech Global Limited primarily generates revenue from its Internet Software & Services segment, amounting to A$1.04 billion. The company's operations span multiple regions, focusing on software solutions tailored for the logistics execution industry.

WiseTech Global, navigating a transformative phase with CEO Richard White transitioning to a consulting role, underscores its robust strategic focus. Despite leadership changes, the firm reported a notable revenue increase to AUD 1.04 billion from AUD 816.8 million year-over-year and anticipates further growth between 25% to 30%, targeting revenues up to AUD 1.35 billion for FY2025. This financial trajectory is bolstered by an R&D commitment that notably aligns with its ambitious revenue targets, reflecting a deep investment in innovation crucial for sustaining its competitive edge in global logistics software solutions.

- Delve into the full analysis health report here for a deeper understanding of WiseTech Global.

Gain insights into WiseTech Global's past trends and performance with our Past report.

Turning Ideas Into Actions

- Click here to access our complete index of 65 ASX High Growth Tech and AI Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CDA

Codan

Develops technology solutions for United Nations organizations, security and military groups, government departments, individuals, and small-scale miners.