The Compensation For Audinate Group Limited's (ASX:AD8) CEO Looks Deserved And Here's Why

Key Insights

- Audinate Group's Annual General Meeting to take place on 23rd of October

- Salary of AU$502.5k is part of CEO Aidan Williams's total remuneration

- Total compensation is similar to the industry average

- Over the past three years, Audinate Group's EPS grew by 70% and over the past three years, the total shareholder return was 84%

We have been pretty impressed with the performance at Audinate Group Limited (ASX:AD8) recently and CEO Aidan Williams deserves a mention for their role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 23rd of October. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

View our latest analysis for Audinate Group

How Does Total Compensation For Aidan Williams Compare With Other Companies In The Industry?

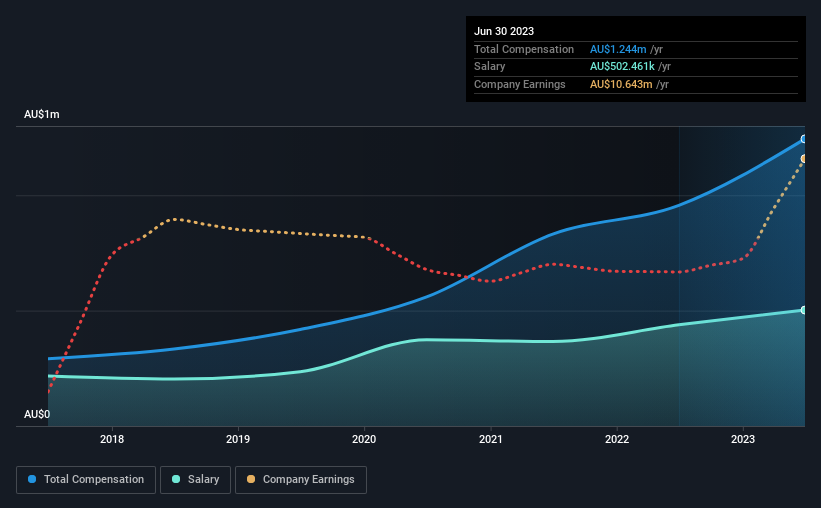

According to our data, Audinate Group Limited has a market capitalization of AU$1.1b, and paid its CEO total annual compensation worth AU$1.2m over the year to June 2023. Notably, that's an increase of 30% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at AU$502k.

In comparison with other companies in the Australian Electronic industry with market capitalizations ranging from AU$628m to AU$2.5b, the reported median CEO total compensation was AU$1.2m. So it looks like Audinate Group compensates Aidan Williams in line with the median for the industry. Furthermore, Aidan Williams directly owns AU$26m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | AU$502k | AU$439k | 40% |

| Other | AU$742k | AU$517k | 60% |

| Total Compensation | AU$1.2m | AU$956k | 100% |

On an industry level, roughly 66% of total compensation represents salary and 34% is other remuneration. Audinate Group pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Audinate Group Limited's Growth Numbers

Audinate Group Limited's earnings per share (EPS) grew 70% per year over the last three years. Its revenue is up 51% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Audinate Group Limited Been A Good Investment?

We think that the total shareholder return of 84%, over three years, would leave most Audinate Group Limited shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Some shareholders will probably be more lenient on CEO compensation in the upcoming AGM given the pleasing performance of the company recently. Seeing that earnings growth and share price performance seems to be on the right path, the more pressing focus for shareholders at the AGM may be how the board and management plans to turn the company into a sustainably profitable one.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 3 warning signs (and 1 which is concerning) in Audinate Group we think you should know about.

Important note: Audinate Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AD8

Audinate Group

Engages in develops and sells digital audio visual (AV) networking solutions Australia and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026