The Australian market recently closed almost flat at around 7,815 points, reflecting a divided sentiment among investors amidst headline fatigue from global economic events. In this environment, where IT stocks have notably declined by over 2.2%, identifying high growth tech stocks requires focusing on companies with robust innovation strategies and resilience to broader market volatility.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gratifii | 42.14% | 113.99% | ★★★★★★ |

| Pro Medicus | 22.19% | 23.49% | ★★★★★★ |

| WiseTech Global | 20.37% | 25.23% | ★★★★★★ |

| Wrkr | 57.01% | 116.83% | ★★★★★★ |

| AVA Risk Group | 29.15% | 108.15% | ★★★★★★ |

| BlinkLab | 65.54% | 64.35% | ★★★★★★ |

| Pointerra | 50.42% | 159.12% | ★★★★★☆ |

| Echo IQ | 84.54% | 87.08% | ★★★★★★ |

| SiteMinder | 21.09% | 65.36% | ★★★★★★ |

| Advanced Health Intelligence | 166.58% | 178.92% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our ASX High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Audinate Group (ASX:AD8)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Audinate Group Limited develops and sells digital audio visual networking solutions in Australia and internationally, with a market cap of A$478.47 million.

Operations: Audinate Group generates revenue primarily through its Contract Electronics Manufacturing Services, which accounts for A$73.60 million. The company focuses on providing digital audio visual networking solutions both domestically and internationally.

Despite a challenging year with earnings dropping significantly, Audinate Group's commitment to innovation is evident in its R&D spending, which remained robust at 15% of total revenue. This strategic focus on development is crucial as the company navigates recent setbacks, including its removal from the S&P/ASX 200 Index. Looking ahead, Audinate's substantial forecasted earnings growth of 50.6% per annum positions it well within Australia's tech sector, potentially offsetting past performance dips and leveraging its R&D investments to capture emerging market opportunities in digital audio networking.

- Click here to discover the nuances of Audinate Group with our detailed analytical health report.

Explore historical data to track Audinate Group's performance over time in our Past section.

Data#3 (ASX:DTL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Data#3 Limited is an IT solutions and services provider operating in Australia, Fiji, and the Pacific Islands with a market cap of A$1.11 billion.

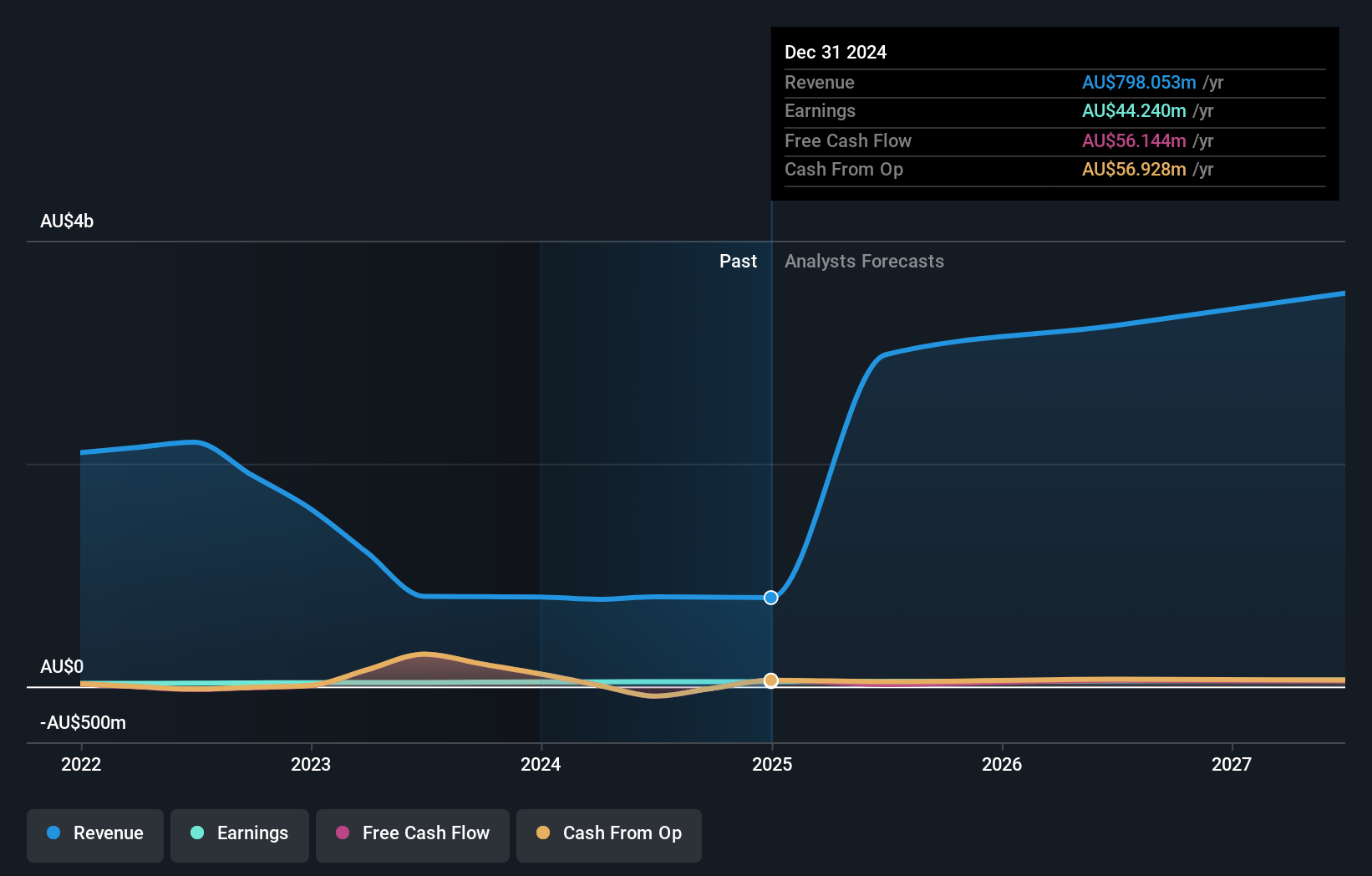

Operations: Data#3 generates revenue primarily through its role as a value-added IT reseller and IT solutions provider, with this segment contributing A$798.05 million. The company's business operations focus on delivering comprehensive IT services across Australia, Fiji, and the Pacific Islands.

Data#3, a prominent figure in Australia's tech landscape, is navigating a dynamic market with strategic finesse. Despite a slight dip in half-year sales to AUD 391.18 million from AUD 398.88 million, the firm maintains robust revenue growth at an annual rate of 24.4%, outpacing the broader Australian market's 5.9%. This performance is underpinned by significant R&D investments that fuel innovation and sustain competitive edges in evolving tech sectors. Furthermore, Data#3’s commitment to shareholder returns is evident from its recent dividend increase to AUD 0.131 per share, aligning with its financial health and future prospects as indicated by an expected earnings growth of 10.5% per annum and a projected exceptional Return on Equity of 60.3% in three years’ time.

- Click to explore a detailed breakdown of our findings in Data#3's health report.

Examine Data#3's past performance report to understand how it has performed in the past.

Nuix (ASX:NXL)

Simply Wall St Growth Rating: ★★★★☆☆

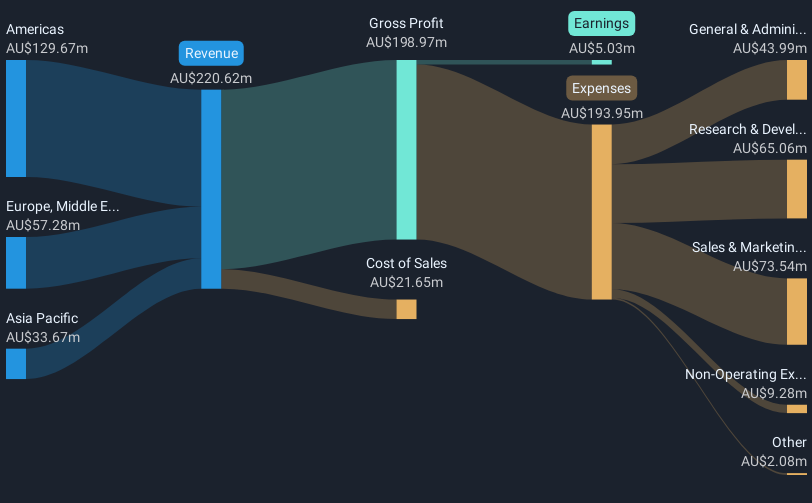

Overview: Nuix Limited offers investigative analytics and intelligence software solutions across various regions, including the Asia Pacific, the Americas, Europe, the Middle East, and Africa, with a market cap of A$750.76 million.

Operations: Nuix Limited generates revenue primarily from its Software & Programming segment, which contributes A$227.37 million.

Nuix, a participant in Australia's tech sector, recently joined the S&P/ASX 200 Index, underscoring its increasing market presence. Despite a net loss widening to AUD 10.4 million from AUD 4.83 million in the latest half-year report, Nuix anticipates statutory revenue between AUD 104 million and AUD 106 million for the same period. The company's strategic focus on R&D is evident as it continues to innovate within the software industry, aligning with broader trends towards SaaS models and recurring revenue streams. This approach may bolster future profitability, evidenced by an expected annual earnings growth of 53.5%, significantly outpacing the industry average of 4.9%.

- Unlock comprehensive insights into our analysis of Nuix stock in this health report.

Review our historical performance report to gain insights into Nuix's's past performance.

Turning Ideas Into Actions

- Unlock more gems! Our ASX High Growth Tech and AI Stocks screener has unearthed 44 more companies for you to explore.Click here to unveil our expertly curated list of 47 ASX High Growth Tech and AI Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AD8

Audinate Group

Engages in develops and sells digital audio visual (AV) networking solutions Australia and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion