Can You Imagine How Chuffed Audinate Group's (ASX:AD8) Shareholders Feel About Its 154% Share Price Gain?

Unfortunately, investing is risky - companies can and do go bankrupt. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! Take, for example Audinate Group Limited (ASX:AD8). Its share price is already up an impressive 154% in the last twelve months. And in the last month, the share price has gained -1.7%. We'll need to follow Audinate Group for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

View our latest analysis for Audinate Group

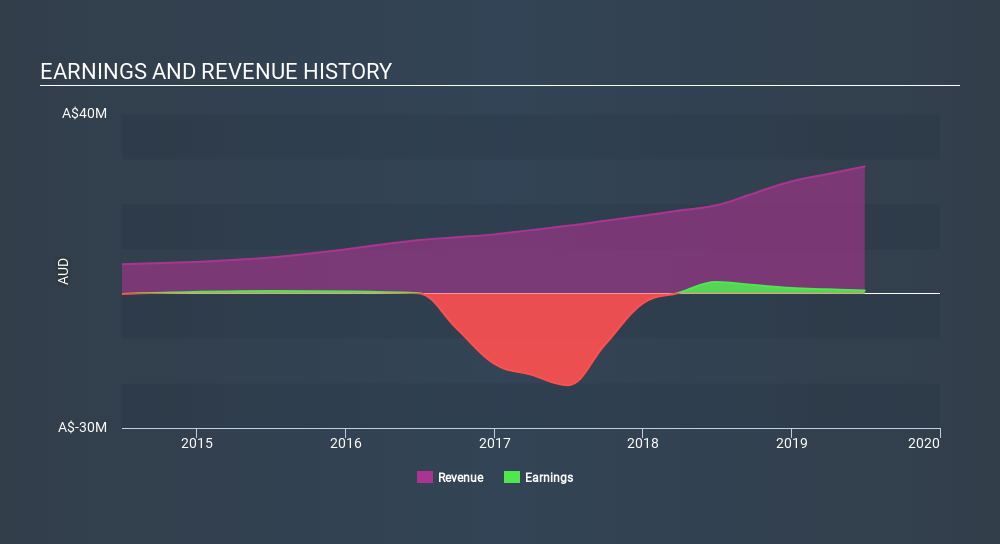

We don't think that Audinate Group's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last year Audinate Group saw its revenue grow by 44%. We respect that sort of growth, no doubt. While that revenue growth is pretty good the share price performance outshone it, with a lift of 154% as mentioned above. Given that the business has made good progress on the top line, it would be worth taking a look at its path to profitability. Of course, we are always cautious about succumbing to 'fear of missing out' when a stock has shot up strongly.

You can see below how revenue has changed over time.

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Audinate Group stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Audinate Group shareholders should be happy with the total gain of 154% over the last twelve months. That's better than the more recent three month gain of 14%, implying that share price has plateaued recently. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

We will like Audinate Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:AD8

Audinate Group

Engages in develops and sells digital audio visual (AV) networking solutions Australia and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives