Xero (ASX:XRO) Launches Inventory Plus, Enhances US Market Position with Strategic Partnerships

Reviewed by Simply Wall St

Click here to discover the nuances of Xero with our detailed analytical report.

Strengths: Core Advantages Driving Sustained Success For Xero

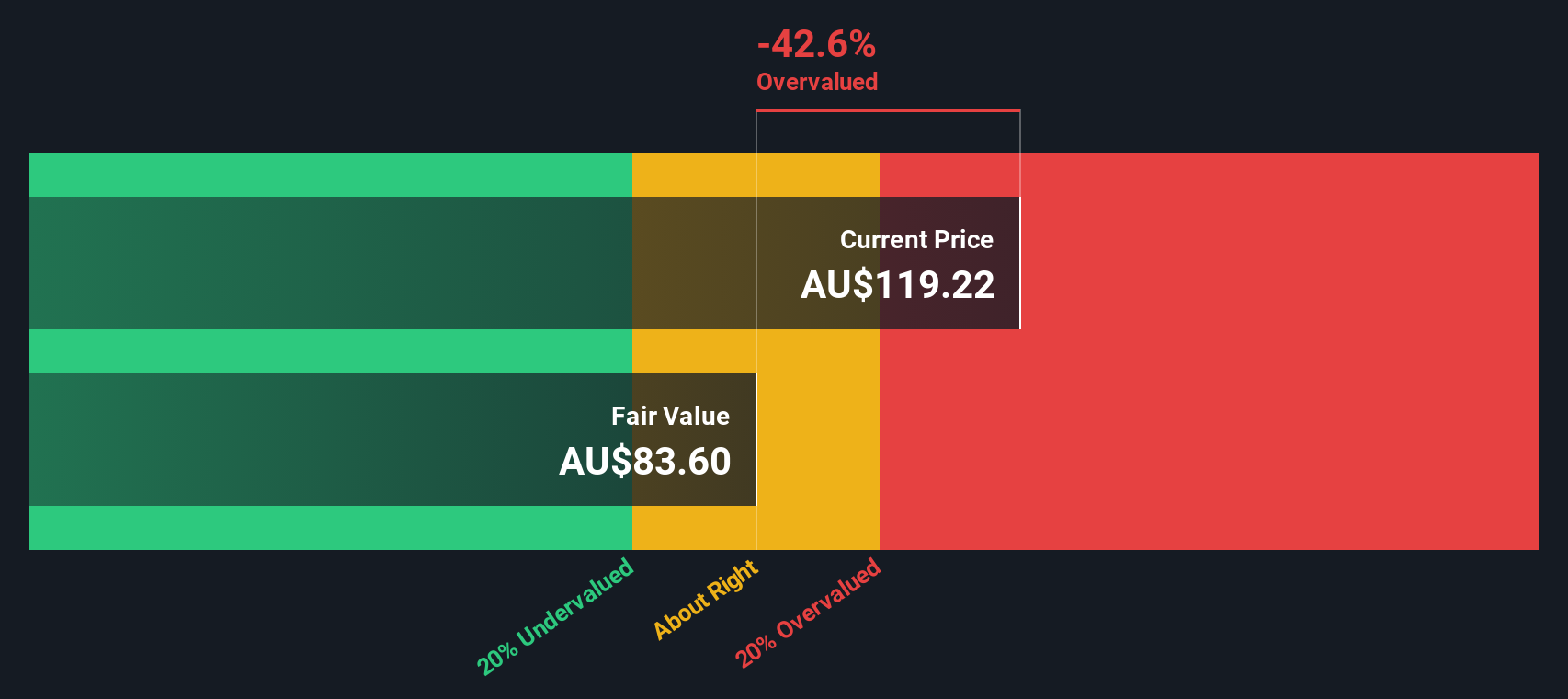

Xero has demonstrated strong revenue growth, with a 22% increase to A$1.714 million, or 21% on constant currency terms, as highlighted by CEO Sukhinder Cassidy. This growth is complemented by significant profitability improvements, achieving a Rule of 40 outcome, indicating a balance of growth and profitability. Subscriber growth of 11% year-over-year and an ARPU increase of 14% underscore the company's robust market presence. Adjusted EBITDA surged by 75% to A$527 million, reflecting strong financial health. Additionally, Xero's strategic investments in product offerings, such as the new inventory management software, and partnerships, like the one with Deputy, are poised to enhance its market position. Despite its high Price-To-Earnings Ratio of 143.3x, Xero is trading slightly below its estimated fair value of A$153.17, indicating potential for value realization.

Weaknesses: Critical Issues Affecting Xero's Performance and Areas For Growth

Xero's high Price-To-Earnings Ratio of 143.3x, compared to the industry average of 67.4x and peer average of 94x, positions it as an expensive stock. The company faces performance challenges in North America, with revenue growth of only 17% affected by various factors. An uptick in partner product churn and subdued growth in Canada, due to a lack of adoption tailwinds, further highlight areas needing improvement. Additionally, a decline in other revenues, primarily due to a reduction in indiscernible revenue from fewer events, underscores the need for diversification. The management team, with an average tenure of 1.7 years, is relatively new, which may impact strategic continuity.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Xero's commitment to product investments, such as the launch of Xero Inventory Plus, positions it well for future growth. This new software aims to help small businesses manage inventory more efficiently, integrating with platforms like Amazon's FBA and Shopify. Strategic partnerships, including the recent collaboration with Caseware, enhance Xero's service offerings and streamline processes for accountants and bookkeepers. The company's focus on market expansion through localized bookkeeping and compliance features can drive further adoption. Additionally, experimenting with generative AI in customer support and learning platforms presents opportunities for innovation and improved customer experience.

Threats: Key Risks and Challenges That Could Impact Xero's Success

Competition remains a significant threat, with Xero closely monitoring feedback on recent pricing and product plan changes. Economic factors, such as wage inflation, could impact profitability and operational costs. Regulatory challenges, including compliance with Making Tax Digital Phase III, present ongoing hurdles. Market risks, including the need for systemic M&A to support the build-buyer partner strategy, could lead to operational complexities. These factors, combined with potential external pressures, underscore the importance of strategic agility in maintaining market share and growth momentum.

Conclusion

Xero's impressive revenue growth and profitability improvements highlight its strong market presence and financial health, which are critical for sustaining its competitive edge. However, its high Price-To-Earnings Ratio of 143.3x, compared to industry and peer averages, suggests that the market has high expectations for its future performance. The company's strategic investments in product offerings and partnerships, coupled with its focus on market expansion and innovation, present significant opportunities for growth. Nonetheless, challenges such as performance issues in North America, partner product churn, and economic and regulatory risks necessitate strategic agility to maintain momentum. Overall, while Xero's current trading price indicates potential for value realization, its ability to navigate these challenges will be pivotal for its future success.

Key Takeaways

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ASX:XRO

Xero

A software as a service company, provides online business solutions for small businesses and their advisors in Australia, New Zealand, and internationally.

Flawless balance sheet with reasonable growth potential.