Xero (ASX:XRO): Evaluating Valuation After Strong Half-Year Revenue and Income Growth

Reviewed by Simply Wall St

Xero (ASX:XRO) just released its half-year financial results, posting higher revenue and net income compared to last year. These earnings often attract attention from investors who are eager to gauge business momentum.

See our latest analysis for Xero.

Despite the upbeat earnings headline, Xero's shares have struggled lately, with a 1-month share price return of -22.8% and a year-to-date decline near 29%. Still, investors looking at the big picture will note that its three-year total shareholder return sits well above 70%. This highlights how quickly momentum can shift as sentiment cycles between optimism and risk-aversion.

Interested in more tech stories or growth opportunities? Now's a great time to broaden your search and discover fast growing stocks with high insider ownership

With financials that continue to impress on paper but a share price that tells a different story, the big question now is whether Xero shares are undervalued at these levels or if the market has already factored in everything ahead. Is there a chance for investors to buy in before the next leg up, or is future growth already accounted for?

Most Popular Narrative: 37.8% Undervalued

Xero’s most followed narrative suggests the fair value is considerably above today’s closing price, hinting at a sharp disconnect between market sentiment and analyst expectations. This gap raises questions about what is driving the long-term upside and sets up a key catalyst for investor attention.

The integration of advanced product features, such as the newly launched embedded bill payment solution and AI functionalities like Just Ask Xero, is expected to enhance Xero's service offerings and boost revenue via improved user satisfaction and retention. Xero's strategic acquisition of Syft Analytics aims to enhance its product suite, offering superior insights, reporting, and analytics. This move could increase Xero's attractiveness to new and existing subscribers, potentially driving future revenue increases.

Curious how ambitious product upgrades, bold expansion strategies, and margin breakthroughs could justify such a high fair value? Dive in to discover the audacious earnings, revenue growth, and profitability leaps this narrative is banking on. What if subscriber growth turns out even stronger?

Result: Fair Value of $191.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in subscriber growth or setbacks from regulatory changes could quickly alter market sentiment and challenge optimistic forecasts for Xero's valuation.

Find out about the key risks to this Xero narrative.

Another View: Looking Through a Different Lens

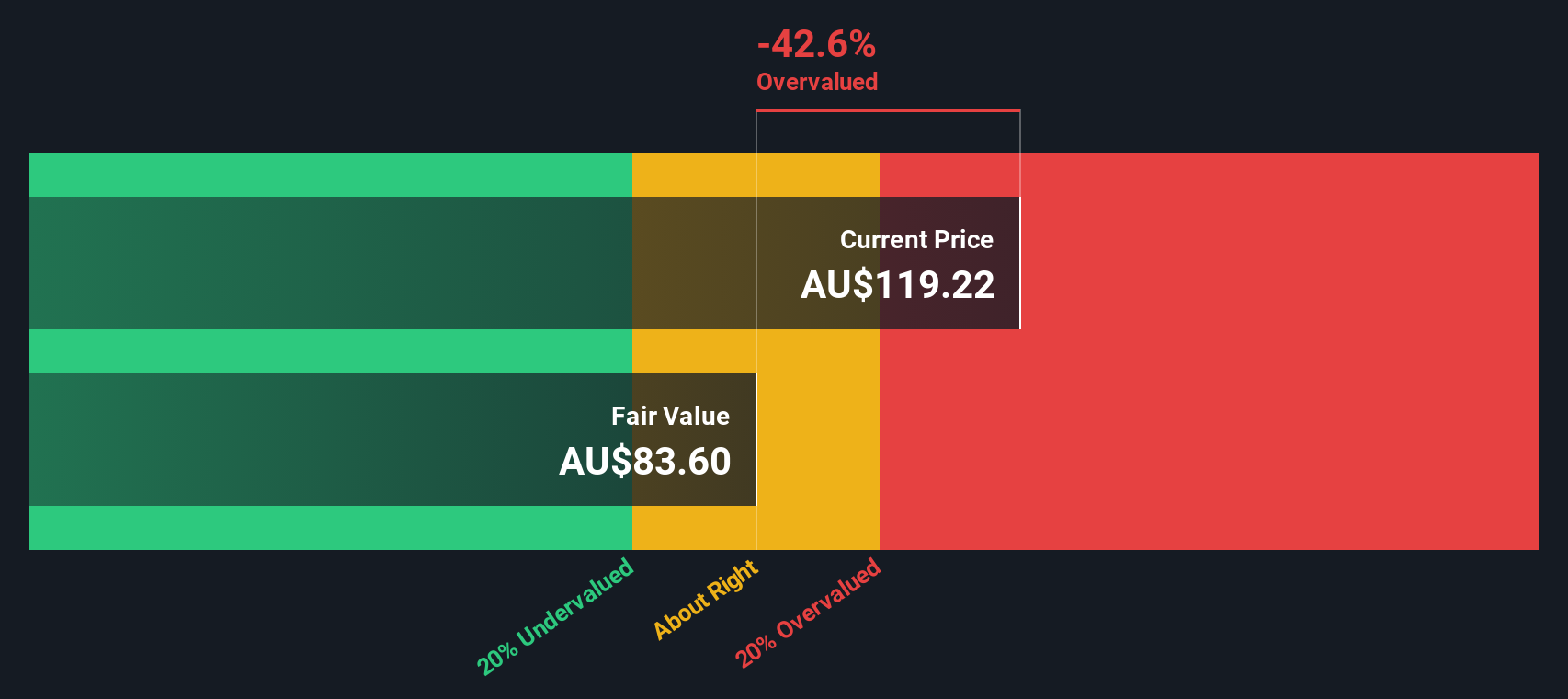

While analysts see strong growth ahead, our DCF model sets Xero’s fair value at just A$83.46, well below the market price. This method weighs up future cash flows, suggesting Xero may actually be overvalued based on fundamentals alone. Which view makes the most sense for today’s investors?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Xero Narrative

If you have a different perspective or want to explore the numbers firsthand, you can shape your own Xero story in just a few minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Xero.

Looking for More Winning Investment Ideas?

Don’t limit your portfolio’s potential to just one stock. Seize new opportunities with thoughtfully curated lists designed to match the trends shaping tomorrow’s markets.

- Uncover impressive yields and secure cash flow by tapping into these 16 dividend stocks with yields > 3% with consistent payouts and robust financials.

- Position yourself at the forefront of innovation by tracking the rapid ascent of these 25 AI penny stocks, which are fueling breakthroughs in artificial intelligence.

- Build wealth with less hype by targeting these 923 undervalued stocks based on cash flows, which are primed for long-term growth and trading below their true value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:XRO

Xero

Provides online business solutions for small businesses and their advisors in Australia, New Zealand, the United Kingdom, North America, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives