Xero (ASX:XRO): Assessing Valuation After Strong ASX 200 Performance and Digital Transformation Gains

Reviewed by Simply Wall St

Recent coverage has drawn attention to Xero (ASX:XRO) and its sustained performance within the ASX 200. It highlights both its consistent market fundamentals and its impact on digital transformation for Australian small and medium businesses.

See our latest analysis for Xero.

After a strong year of innovation and sustained relevance within the ASX 200, Xero’s share price has eased to A$145.98, with recent volatility, such as a -5.07% slide over the last week and a -9.3% dip for the month, hinting at shifting sentiment. Still, the three-year total shareholder return of 102.16% puts its long-term growth in perspective and suggests momentum may be gathering for the next phase.

If you're tracking standout technology movers or seeking fresh ideas, now’s the perfect time to discover See the full list for free.

With shares currently trading below analyst price targets despite consistent revenue and net income growth, investors are left to consider whether Xero is trading at a discount or if the market has already factored in future gains.

Most Popular Narrative: 24.1% Undervalued

The narrative’s fair value of A$192.36 stands noticeably above Xero's last close at A$145.98, setting the stage for a debate over just how much future growth is already priced in.

The integration of advanced product features, such as the newly launched embedded bill payment solution and AI functionalities like Just Ask Xero, is expected to enhance Xero's service offerings and boost revenue via improved user satisfaction and retention. Xero's strategic acquisition of Syft Analytics aims to enhance its product suite, offering superior insights, reporting, and analytics. This move could increase Xero's attractiveness to new and existing subscribers, potentially driving future revenue increases.

Curious about the bold bets behind this valuation? There is a wild mix of high-growth forecasts, ambitious margin targets, and big plans for global expansion woven into the numbers. Want to see what really justifies such a premium? Dive in and see what could turn this software giant’s prospects into investor gold or a mirage.

Result: Fair Value of $192.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected subscriber churn or regulatory roadblocks in key markets could quickly change the situation. This could challenge current growth assumptions and analyst optimism.

Find out about the key risks to this Xero narrative.

Another View: Market Ratios Raise Red Flags

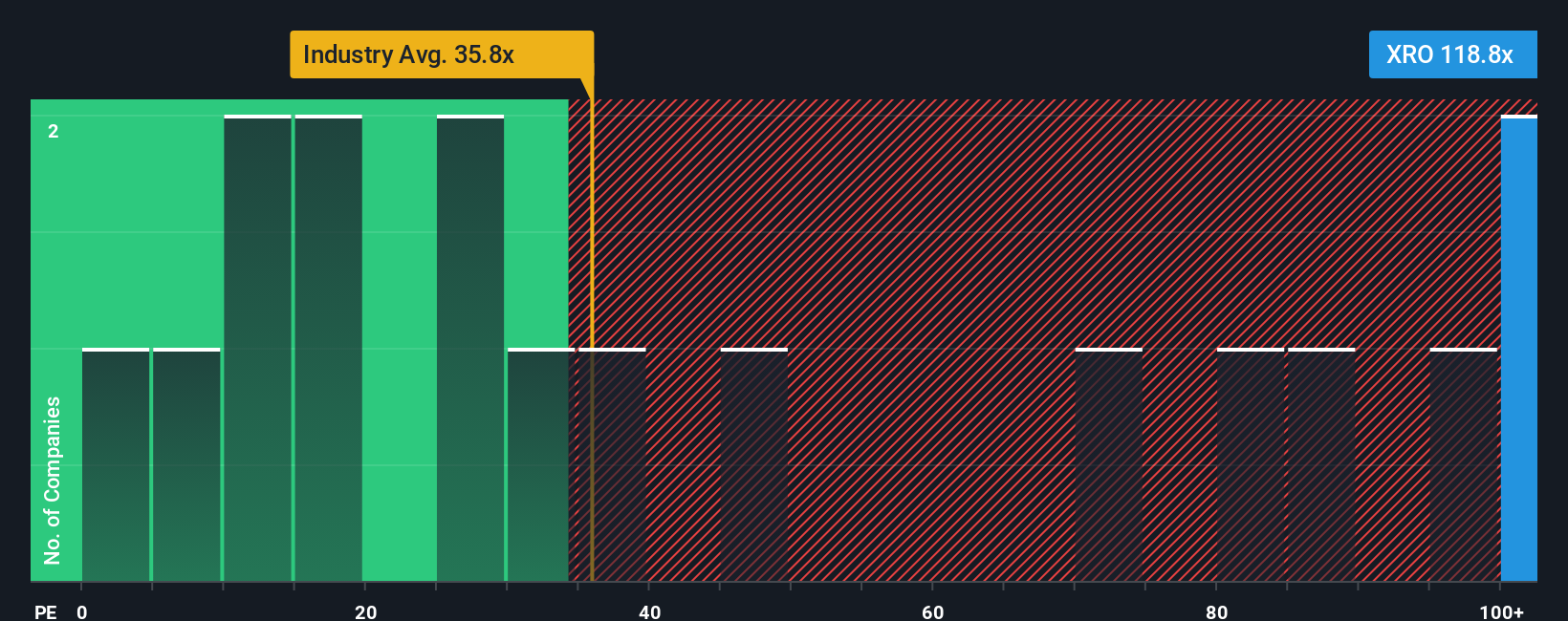

Looking beyond forecasts, Xero is currently trading at a price-to-earnings ratio of 121.7, well above both the Oceanic Software industry’s 36.1 and the peer average of 58.3. Even compared to a fair ratio of 47.8, the gap is striking. Does this premium signal hidden strength or possible downside risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xero Narrative

If you want a different angle or just trust your own analysis, it’s easy to dig into the numbers yourself and shape your own story in no time, so why not Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Xero.

Looking for More Smart Investing Angles?

Don’t sit on the sidelines while others snap up tomorrow’s winners. Use the Simply Wall Street Screener now to uncover sectors and opportunities most investors overlook.

- Spot high-potential opportunities by checking out these 3614 penny stocks with strong financials with robust financial health and growth outlooks that bright minds are watching closely.

- Tap into tomorrow’s breakthroughs by browsing these 28 quantum computing stocks, which is home to companies advancing quantum tech for the next era of computing.

- Boost your passive income strategy and see which companies are offering reliable cash flow through these 20 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:XRO

Xero

Provides online business solutions for small businesses and their advisors in Australia, New Zealand, the United Kingdom, North America, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives