In recent times, the Australian market has experienced mixed sentiments with sectors like energy seeing significant fluctuations due to geopolitical tensions, while other areas such as small-cap stocks face challenges from volatile commodity prices. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate resilience and innovation amidst broader market uncertainties, making them potential standout performers in a dynamic economic landscape.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gratifii | 42.14% | 113.99% | ★★★★★★ |

| Pro Medicus | 22.19% | 23.49% | ★★★★★★ |

| WiseTech Global | 20.15% | 25.52% | ★★★★★★ |

| Wrkr | 57.01% | 116.83% | ★★★★★★ |

| AVA Risk Group | 29.15% | 108.15% | ★★★★★★ |

| BlinkLab | 65.54% | 64.35% | ★★★★★★ |

| Echo IQ | 61.50% | 65.86% | ★★★★★★ |

| Immutep | 70.42% | 42.39% | ★★★★★☆ |

| Adveritas | 52.34% | 88.83% | ★★★★★★ |

| SiteMinder | 19.81% | 70.04% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our ASX High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Megaport (ASX:MP1)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Megaport Limited offers on-demand interconnection and internet exchange services to enterprises and service providers across several regions including Australia, New Zealand, Hong Kong, Singapore, Japan, North America, Italy, and Europe with a market capitalization of A$2.26 billion.

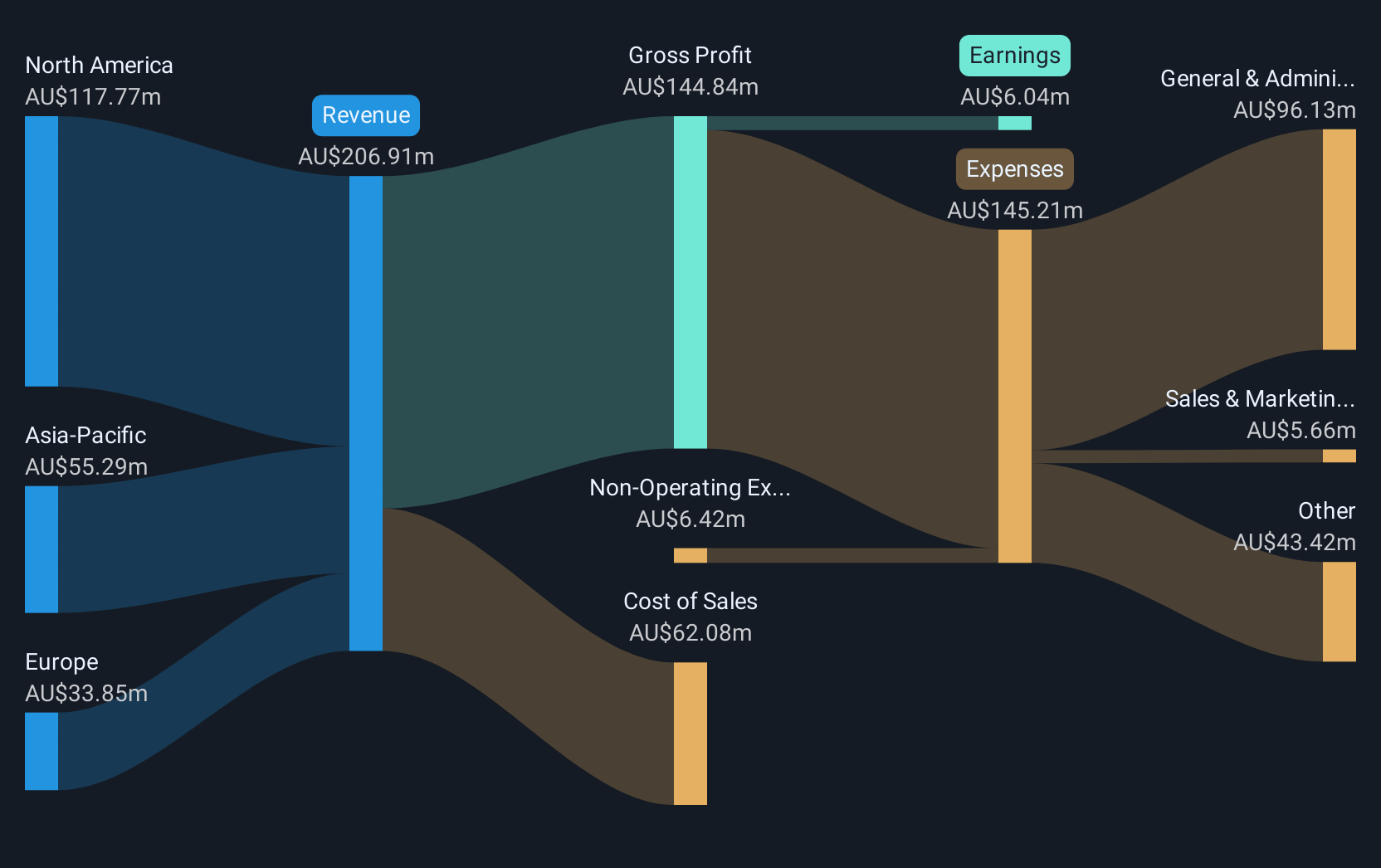

Operations: The company generates revenue primarily from its on-demand interconnection and internet exchange services, with significant contributions from North America (A$117.77 million), Asia-Pacific (A$55.29 million), and Europe (A$33.85 million).

Megaport, a leader in Network-as-a-Service (NaaS), is leveraging strategic partnerships and technological innovations to enhance its offerings and market position. Recently, it integrated with Connectbase's The Connected World platform, significantly expanding its serviceability by automating processes for cloud connectivity and data center interconnects. This move not only broadens real-time access to Megaport's services across 150+ countries but also aligns with the growing demand for efficient, secure digital infrastructure in the face of increasing cyber threats. Furthermore, in collaboration with Aviatrix, Megaport has rolled out a high-performance encryption solution across its global network fabric—a timely response to heightened security risks and regulatory demands for encrypted traffic within hybrid networks. These developments are crucial as they improve Megaport’s competitive edge in a rapidly evolving tech landscape where annual revenue growth is projected at 12.6% and earnings growth at an impressive 40.2%. Despite challenges like a recent dip in profit margins from 4.6% to 2.9%, these strategic initiatives could significantly influence future performance by enhancing security measures and operational efficiencies across multiple cloud platforms.

- Take a closer look at Megaport's potential here in our health report.

Gain insights into Megaport's historical performance by reviewing our past performance report.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is an Australian company that develops, markets, sells, implements, and supports integrated enterprise business software solutions both domestically and internationally with a market cap of A$13.46 billion.

Operations: Technology One Limited generates revenue primarily through its software segment, which accounts for A$378.25 million, followed by corporate and consulting services contributing A$90.55 million and A$82.87 million respectively.

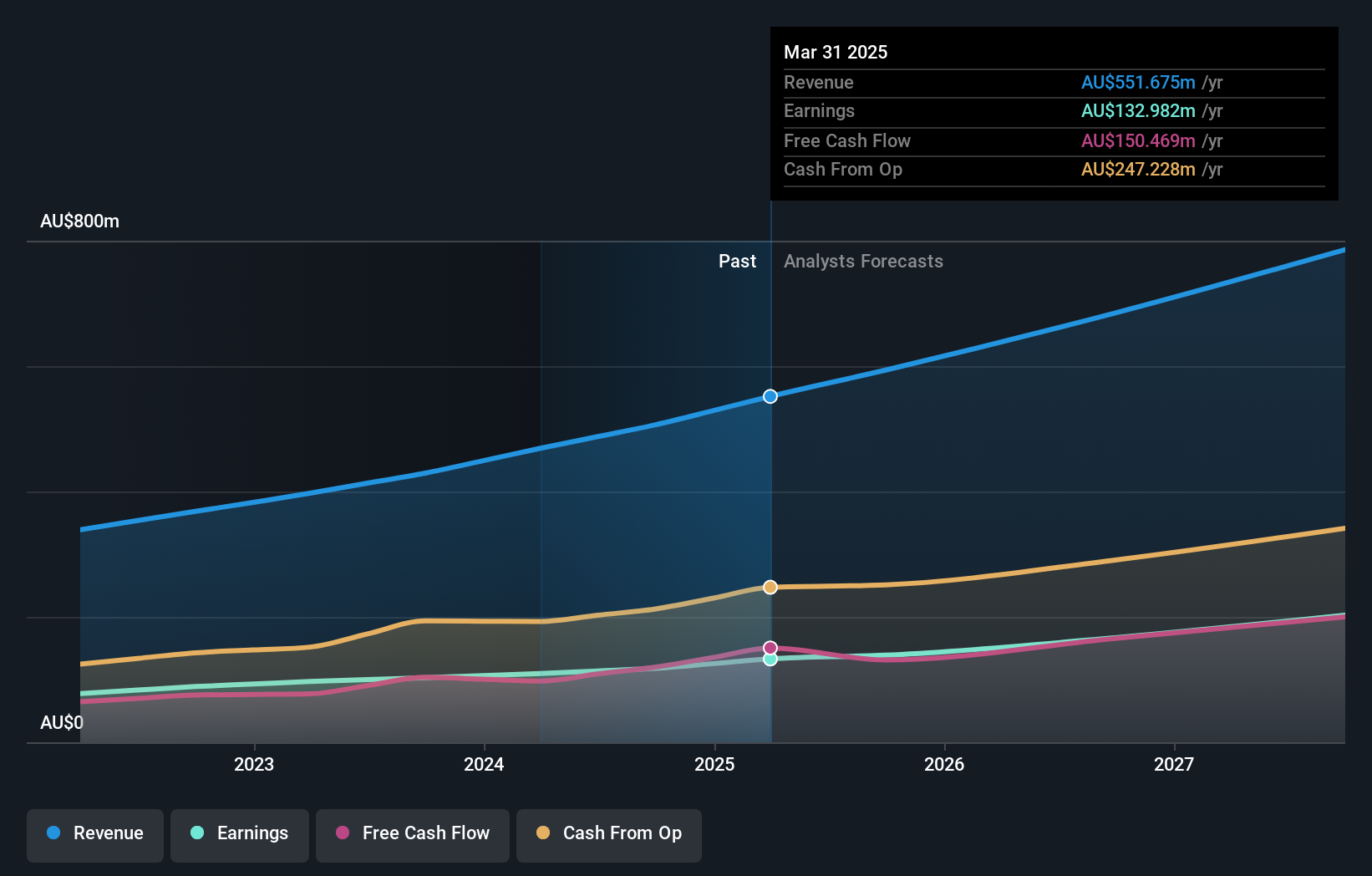

Technology One, a prominent Australian software firm, is making significant strides in high-growth sectors with a robust focus on innovation and market expansion. The company's recent financial performance underscores its upward trajectory, reporting a 21.3% increase in earnings over the past year, outpacing the software industry's growth of 5.6%. This growth is complemented by an annual revenue increase of 13.1%, which exceeds the broader Australian market's rate of 5.5%. Additionally, Technology One invests heavily in R&D to fuel its future developments; this commitment is evidenced by its latest R&D expenditure which represents a substantial portion of its revenue, aligning with industry trends towards enhanced digital solutions and services. Recent strategic moves include joining the FTSE All-World Index and rolling out new dividend policies reflecting confidence in sustained profitability and cash flow generation.

- Click here and access our complete health analysis report to understand the dynamics of Technology One.

Examine Technology One's past performance report to understand how it has performed in the past.

Xero (ASX:XRO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xero Limited, along with its subsidiaries, offers online business solutions for small businesses and their advisors across Australia, New Zealand, the United Kingdom, North America, and other international markets with a market cap of A$29.11 billion.

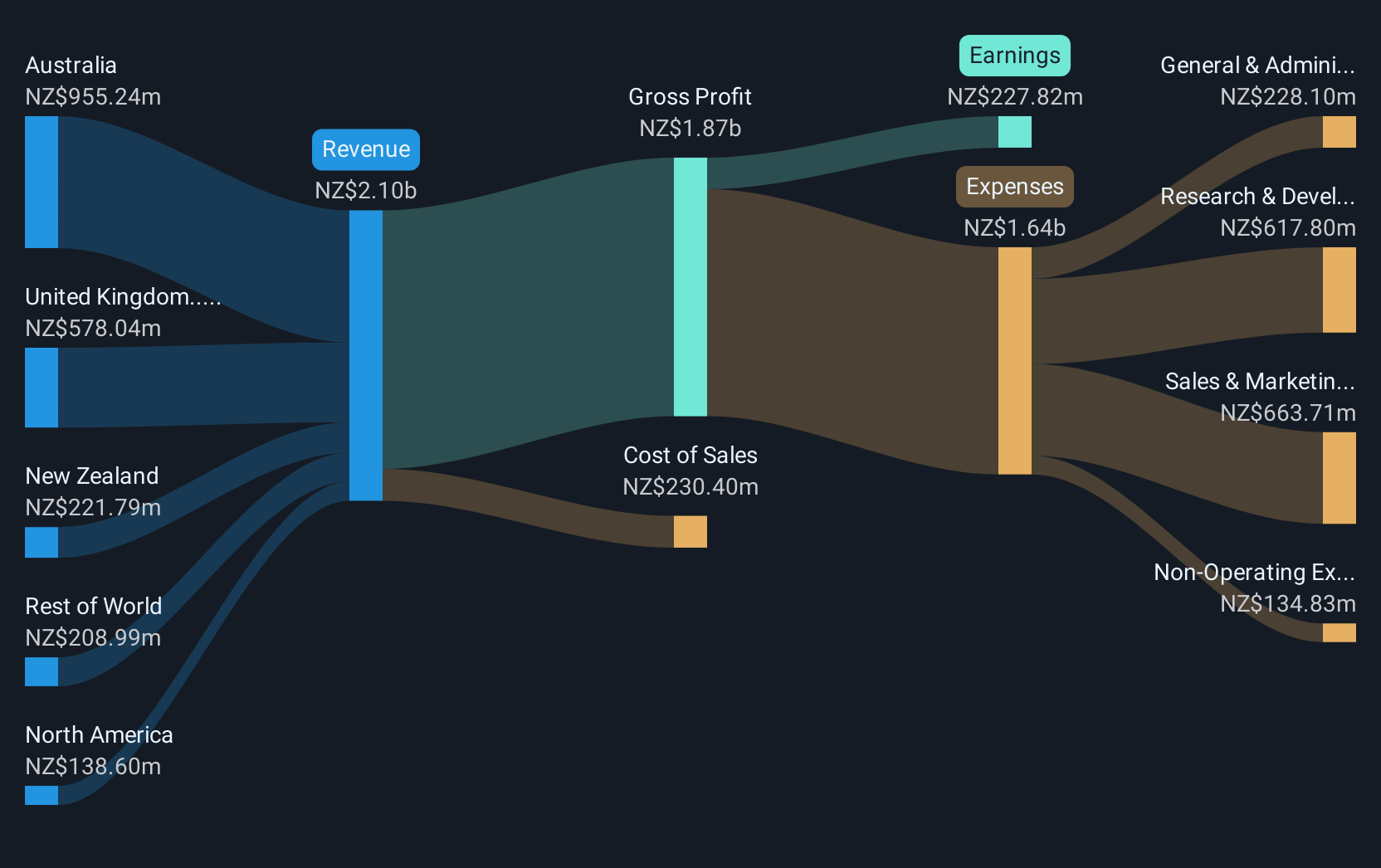

Operations: The company generates revenue of NZ$2.10 billion by providing online solutions tailored for small businesses and their advisors globally.

Xero, an innovator in cloud-based accounting software, has demonstrated robust growth with a 30.4% increase in earnings over the past year, outstripping the software industry's average of 5.6%. This performance is buoyed by a strategic focus on R&D, which not only enhances its product offerings but also aligns with evolving market demands for integrated financial solutions. Recent developments include the launch of new bill payment capabilities in partnership with BILL, streamlining operations for U.S. small businesses and reinforcing Xero's commitment to improving client cash flow management—a critical component as evidenced by their latest revenue surge to NZD 2.1 billion. These initiatives underscore Xero’s potential to maintain its trajectory amidst competitive pressures and shifting technological landscapes.

- Navigate through the intricacies of Xero with our comprehensive health report here.

Understand Xero's track record by examining our Past report.

Next Steps

- Discover the full array of 47 ASX High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:XRO

Xero

Engages in the provision of online business solutions for small businesses and their advisors in Australia, New Zealand, the United Kingdom, North America, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives