WiseTech Global (ASX:WTC) Is Down 14.4% After Regulatory Probe Into Executive Share Trading - What's Changed

Reviewed by Sasha Jovanovic

- Earlier this week, WiseTech Global’s Sydney office was searched by Australia’s securities regulator and federal police as part of an investigation into alleged share trading by founder and chairman Richard White and three employees covering late 2024 to early 2025.

- This development comes amid ongoing questions about corporate governance and has brought significant attention to the company, even though WiseTech has stated that no formal charges have been made and neither the company nor its operations are under direct accusation.

- We’ll assess how the regulatory probe into executive share trading could affect WiseTech’s previously discussed investment thesis and growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

WiseTech Global Investment Narrative Recap

For shareholders, WiseTech Global hinges on two key beliefs: continued leadership in cloud-based logistics software and the ability to expand recurring revenues via its transaction-based CargoWise model alongside successful integration of major acquisitions like E2open. The recent regulatory probe into executive share trading, while a short-term distraction, does not appear to affect the company’s immediate commercial rollouts or the integration pace of E2open, the main catalyst and risk for near-term results.

Among recent company announcements, WiseTech’s ongoing M&A activity, highlighted by the headline acquisition of E2open, is especially relevant to the current situation. As the business focuses on integrating E2open and pursuing further deals, operational execution will be closely watched for signs of distraction or risk migration, although no changes have been signaled in forward guidance or strategic targets.

Yet amid strong long-term growth drivers, investors should weigh the risk that...

Read the full narrative on WiseTech Global (it's free!)

WiseTech Global's narrative projects $2.0 billion in revenue and $486.9 million in earnings by 2028. This requires 35.8% yearly revenue growth and a $286.2 million earnings increase from $200.7 million currently.

Uncover how WiseTech Global's forecasts yield a A$119.68 fair value, a 66% upside to its current price.

Exploring Other Perspectives

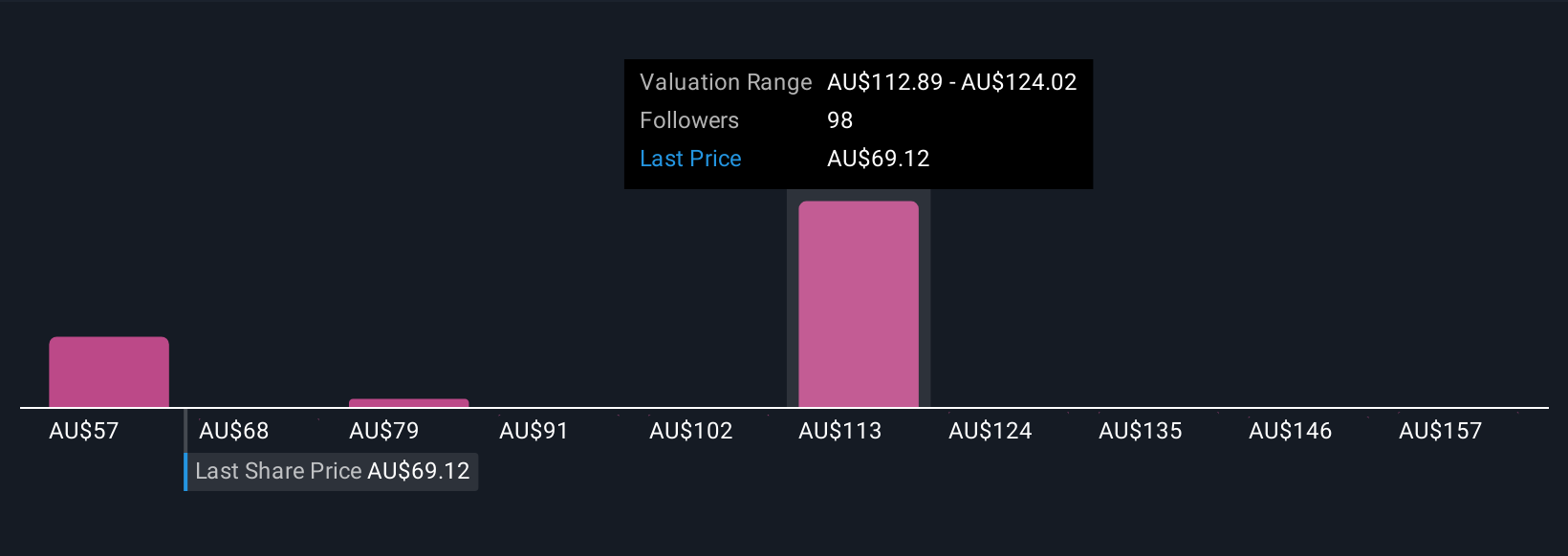

Nineteen Simply Wall St Community members place WiseTech’s fair value between A$56.97 and A$150.14 per share. Against this range, recent scrutiny around executive conduct raises questions for many about the consistency of corporate governance and its influence on future performance.

Explore 19 other fair value estimates on WiseTech Global - why the stock might be worth over 2x more than the current price!

Build Your Own WiseTech Global Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WiseTech Global research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free WiseTech Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WiseTech Global's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WiseTech Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WTC

WiseTech Global

Engages in the development and provision of software solutions to the logistics execution industry in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives