Insider Trading Probe Could Be a Game Changer for WiseTech Global (ASX:WTC)

Reviewed by Sasha Jovanovic

- In the past month, WiseTech Global experienced heightened attention after regulatory investigations were launched into alleged insider trading involving its staff, with the event raising questions about the company's governance practices.

- This regulatory focus is notable given WiseTech Global's central role in the ASX 200 technology sector and its ongoing drive for global leadership in logistics software innovation.

- We'll examine how the regulatory scrutiny around insider trading allegations may impact WiseTech Global's investment story and future outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

WiseTech Global Investment Narrative Recap

Belief in WiseTech Global revolves around its capacity to lead logistics software innovation by expanding its platform across the global supply chain, driven by recurring SaaS revenue, M&A execution, and operational leverage. While recent regulatory investigations into alleged insider trading have sparked a sharp sell-off and raised questions around governance, the most important short-term catalyst, the integration and revenue uplift from E2open, remains largely dependent on operational performance. The biggest current risk is that distractions or instability from governance concerns could impact integration progress, putting financial discipline and growth targets at risk.

The appointment of Ms. Sandra Hook and Mr. Rob Castaneda as new Independent Non-Executive Directors in June 2025 stands out as especially timely, bringing added governance and technology experience to the board. This move addresses broader investor concerns by potentially strengthening WiseTech’s board oversight and risk management, key factors as the company manages its largest-ever acquisition and heightened regulatory scrutiny.

However, investors should be aware that despite robust product momentum, heightened board turnover could introduce…

Read the full narrative on WiseTech Global (it's free!)

WiseTech Global's narrative projects $2.0 billion revenue and $486.9 million earnings by 2028. This requires 35.8% yearly revenue growth and a $286.2 million earnings increase from $200.7 million currently.

Uncover how WiseTech Global's forecasts yield a A$119.12 fair value, a 84% upside to its current price.

Exploring Other Perspectives

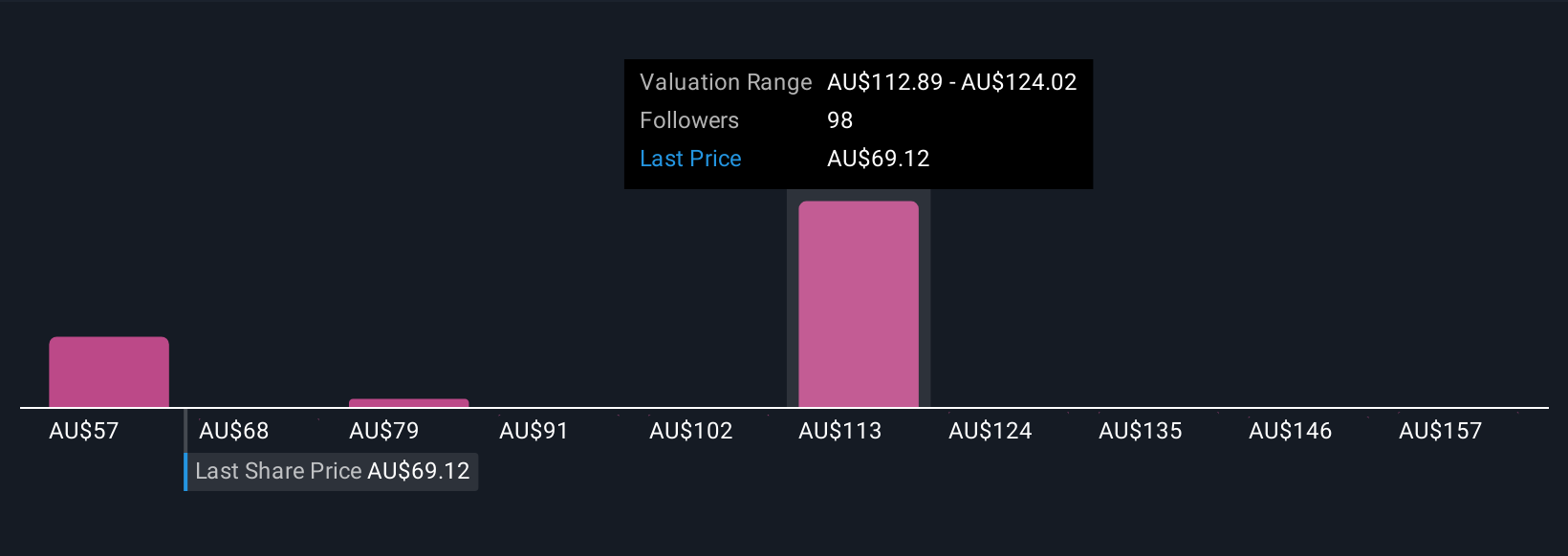

Twenty private investors in the Simply Wall St Community estimated WiseTech Global's fair value anywhere between A$59.50 and A$168.58 per share. With board renewal and governance now firmly under the spotlight, some may see opportunity while others focus on the potential impact of ongoing regulatory scrutiny.

Explore 20 other fair value estimates on WiseTech Global - why the stock might be worth over 2x more than the current price!

Build Your Own WiseTech Global Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WiseTech Global research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free WiseTech Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WiseTech Global's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WiseTech Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WTC

WiseTech Global

Engages in the development and provision of software solutions to the logistics execution industry in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives