- Australia

- /

- Specialty Stores

- /

- ASX:TPW

ASX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The ASX200 is set to gain more than half a percent, following US markets up as the S&P 500 and Nasdaq both extended their winning streak. Investors are optimistic, with all sectors closing in the green and attention turning to potential rate cuts from the Federal Reserve. In this buoyant market environment, growth companies with high insider ownership can be particularly attractive. These stocks often benefit from strong alignment between management and shareholders, which can drive long-term value creation.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 102.6% |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Acrux (ASX:ACR) | 14.6% | 115.6% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.8% |

| Liontown Resources (ASX:LTR) | 16.4% | 69.7% |

| Catalyst Metals (ASX:CYL) | 17.5% | 75.7% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 49.4% |

| Adveritas (ASX:AV1) | 21.1% | 103.9% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Change Financial (ASX:CCA) | 26.6% | 77.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

PWR Holdings (ASX:PWH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PWR Holdings Limited designs, prototypes, produces, tests, validates, and sells cooling products and solutions internationally with a market cap of A$941.54 million.

Operations: The company's revenue segments include PWR C&R generating A$41.98 million and PWR Performance Products contributing A$111.26 million.

Insider Ownership: 13.4%

PWR Holdings reported strong earnings for the year ending June 30, 2024, with sales of A$97.53 million and net income of A$20.99 million, reflecting solid growth from the previous year. The company's earnings per share increased to A$0.2469. Forecasts indicate revenue and earnings growth above market averages at 13.2% and 15.6% per year respectively, while trading at a significant discount to its estimated fair value enhances its appeal as a growth company with high insider ownership in Australia.

- Unlock comprehensive insights into our analysis of PWR Holdings stock in this growth report.

- Our expertly prepared valuation report PWR Holdings implies its share price may be too high.

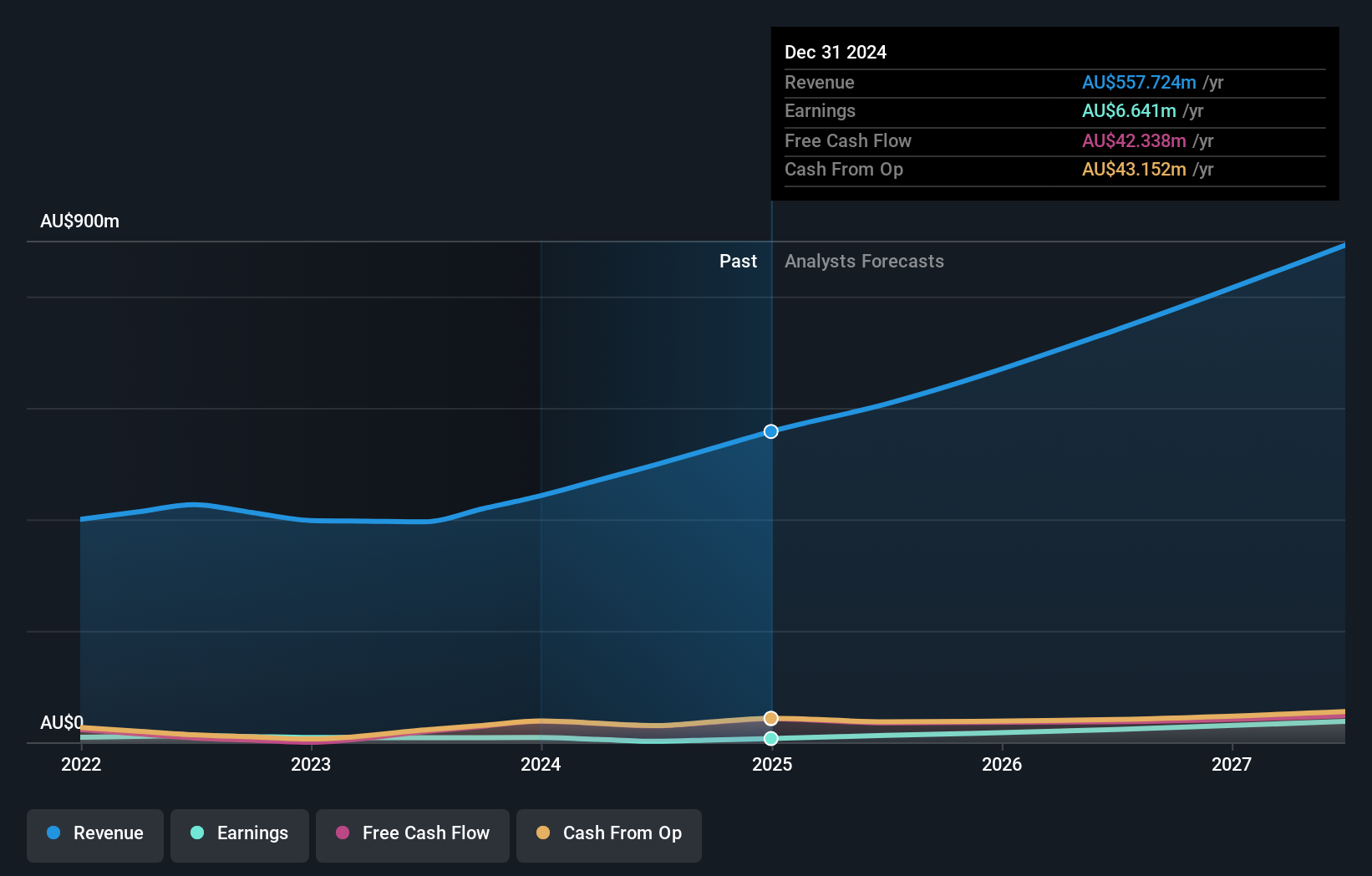

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally with a market cap of A$7.37 billion.

Operations: The company's revenue segments are comprised of Software (A$317.24 million), Corporate (A$83.83 million), and Consulting (A$68.13 million).

Insider Ownership: 12.3%

Technology One has demonstrated consistent growth, with revenue rising to A$240.83 million for H1 2024 from A$201.01 million a year prior and net income increasing to A$48 million. Forecasts suggest revenue growth of 11.5% annually, outpacing the Australian market average of 5.3%. The appointment of Paul Robson as Non-Executive Director highlights the company’s commitment to strategic transformation and operational efficiency, essential for sustaining its global SaaS platform expansion.

- Dive into the specifics of Technology One here with our thorough growth forecast report.

- The analysis detailed in our Technology One valuation report hints at an inflated share price compared to its estimated value.

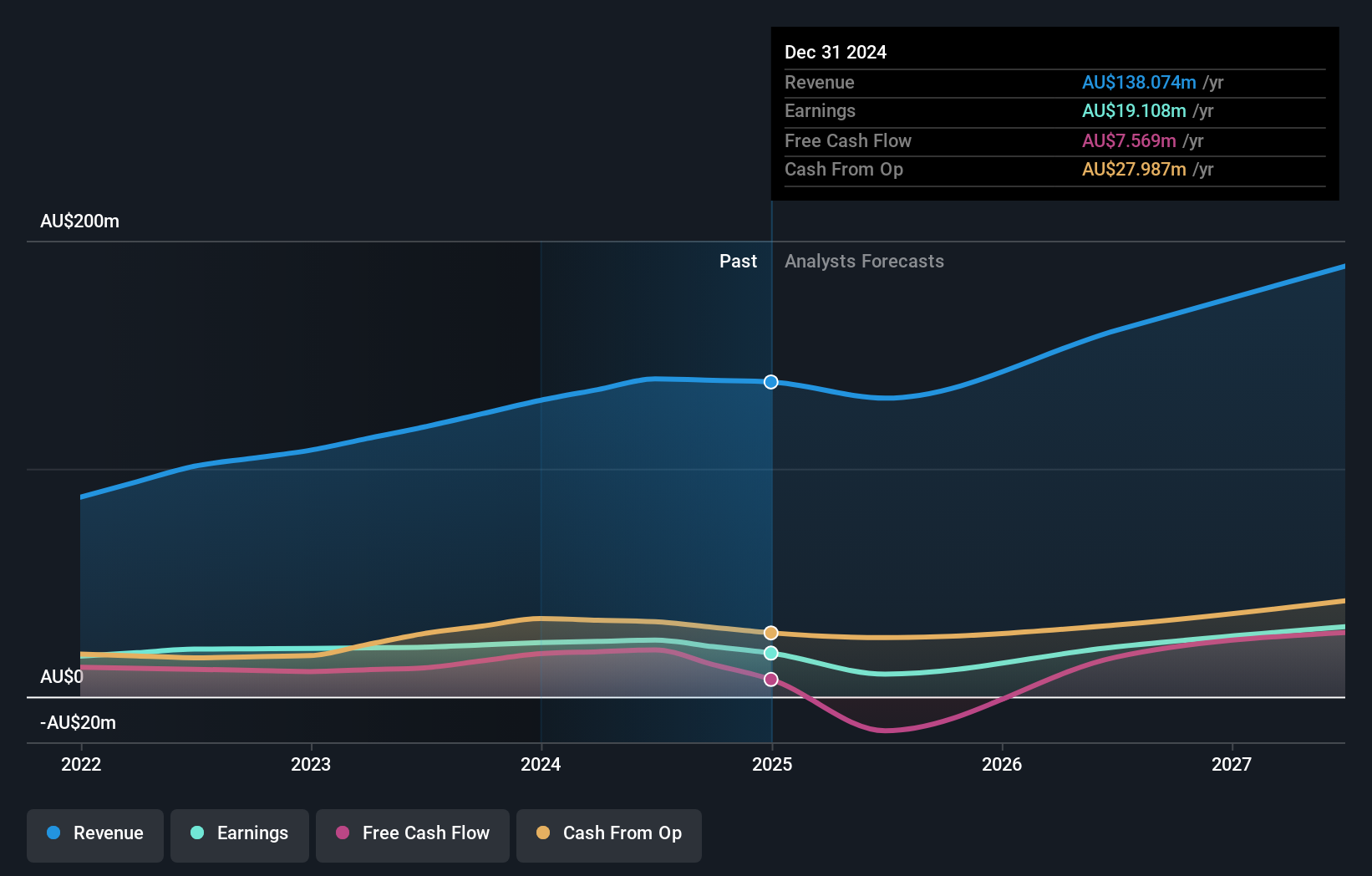

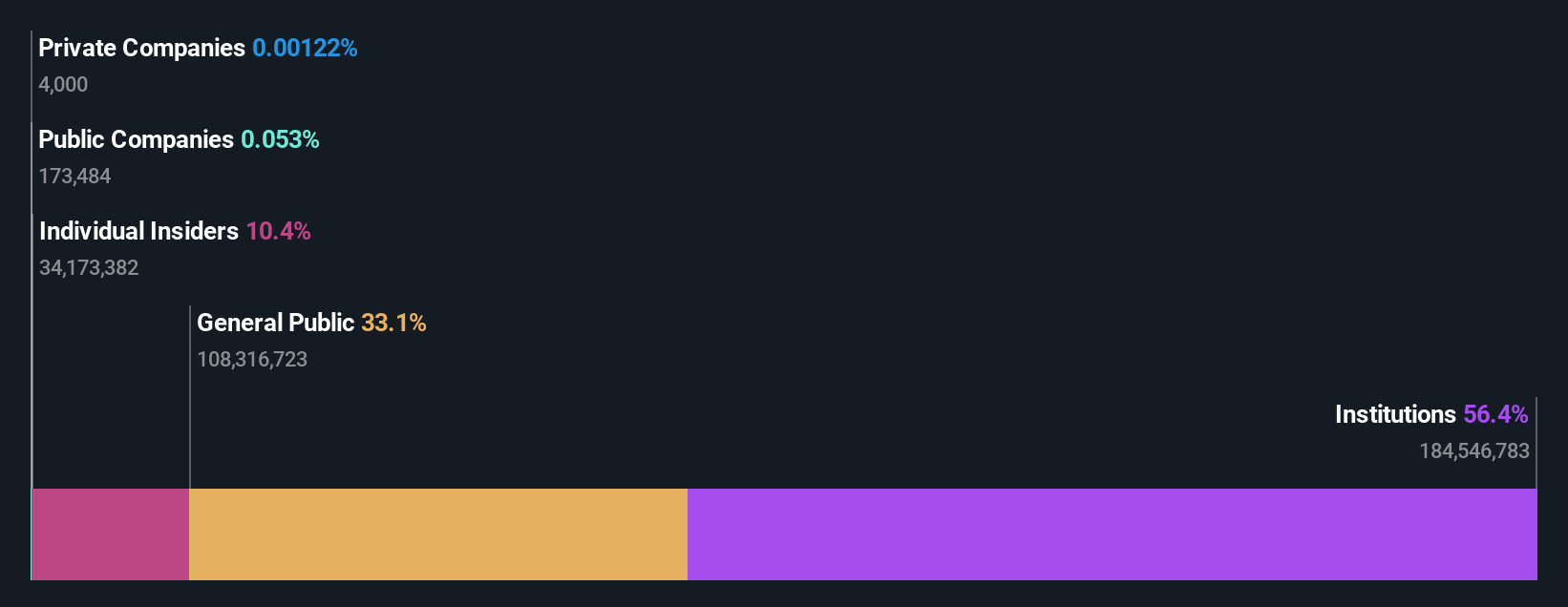

Temple & Webster Group (ASX:TPW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Temple & Webster Group Ltd (ASX:TPW) operates as an online retailer of furniture, homewares, and home improvement products in Australia with a market cap of A$1.40 billion.

Operations: The company generates A$497.84 million from the sale of furniture, homewares, and home improvement products in Australia.

Insider Ownership: 13.7%

Temple & Webster Group is poised for significant growth, with revenue expected to increase by 17.8% annually and earnings projected to grow by 46.8% per year, outpacing the broader Australian market. Recent executive changes include the appointment of Cameron Barnsley as CFO, bringing extensive financial services experience. The company has initiated a share buyback program worth A$30 million to manage capital effectively while retaining flexibility for future growth opportunities.

- Navigate through the intricacies of Temple & Webster Group with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Temple & Webster Group's share price might be on the expensive side.

Make It Happen

- Discover the full array of 91 Fast Growing ASX Companies With High Insider Ownership right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Temple & Webster Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TPW

Temple & Webster Group

Engages in the online retail of furniture, homewares, and home improvement products in Australia.

Flawless balance sheet with high growth potential.