Here's Why Symbio Holdings (ASX:SYM) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Symbio Holdings (ASX:SYM). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Symbio Holdings with the means to add long-term value to shareholders.

Check out our latest analysis for Symbio Holdings

Symbio Holdings' Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Symbio Holdings managed to grow EPS by 4.8% per year, over three years. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

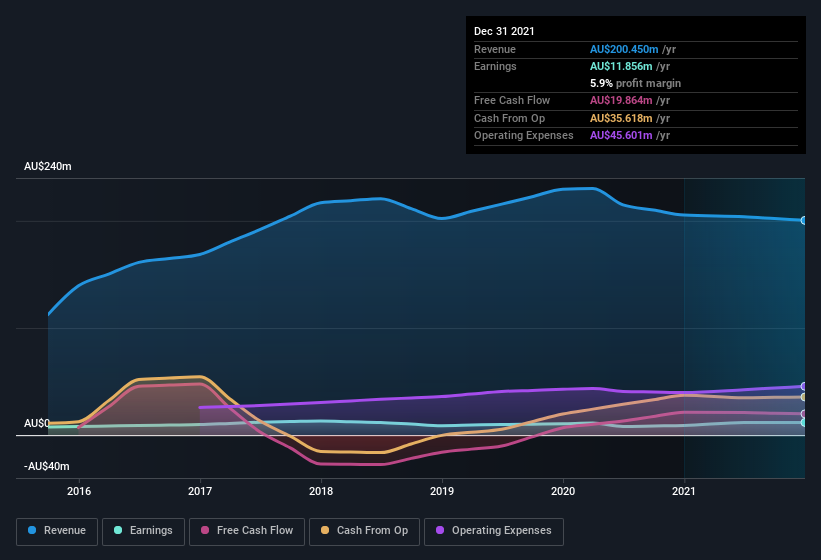

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Unfortunately, Symbio Holdings' revenue dropped 2.4% last year, but the silver lining is that EBIT margins improved from 6.7% to 8.7%. That's not a good look.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Symbio Holdings' forecast profits?

Are Symbio Holdings Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own Symbio Holdings shares worth a considerable sum. With a whopping AU$107m worth of shares as a group, insiders have plenty riding on the company's success. Amounting to 29% of the outstanding shares, indicating that insiders are also significantly impacted by the decisions they make on the behalf of the business.

Does Symbio Holdings Deserve A Spot On Your Watchlist?

As previously touched on, Symbio Holdings is a growing business, which is encouraging. If that's not enough on its own, there is also the rather notable levels of insider ownership. The combination definitely favoured by investors so consider keeping the company on a watchlist. Now, you could try to make up your mind on Symbio Holdings by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SYM

Symbio Holdings

Symbio Holdings Limited provides communication services to software companies, telecom providers, and enterprise customers in Australia, New Zealand, and Internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026