SiteMinder Limited (ASX:SDR) Just Released Its Yearly Results And Analysts Are Updating Their Estimates

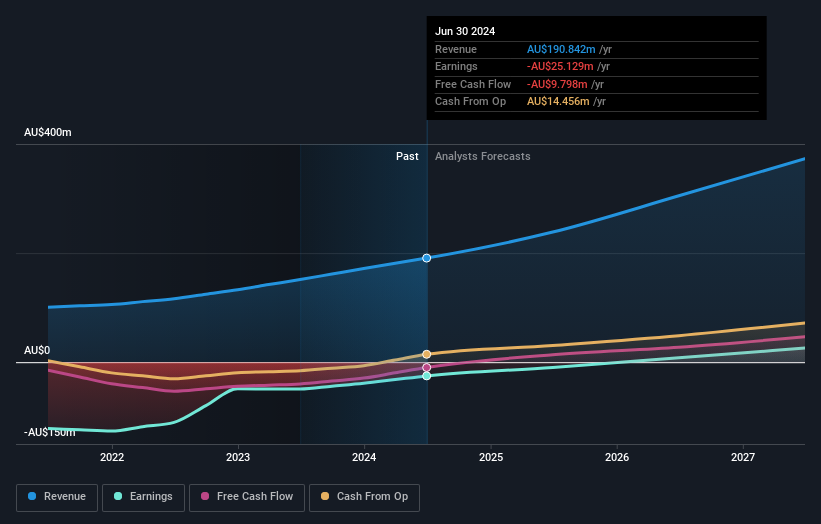

SiteMinder Limited (ASX:SDR) shareholders are probably feeling a little disappointed, since its shares fell 5.7% to AU$4.92 in the week after its latest yearly results. It was a pretty bad result overall; while revenues were in line with expectations at AU$191m, statutory losses exploded to AU$0.10 per share. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

View our latest analysis for SiteMinder

Taking into account the latest results, the current consensus from SiteMinder's 16 analysts is for revenues of AU$238.5m in 2025. This would reflect a major 25% increase on its revenue over the past 12 months. The loss per share is expected to greatly reduce in the near future, narrowing 60% to AU$0.036. Before this earnings announcement, the analysts had been modelling revenues of AU$239.2m and losses of AU$0.027 per share in 2025. While this year's revenue estimates held steady, there was also a very substantial increase in loss per share expectations, suggesting the consensus has a bit of a mixed view on the stock.

The consensus price target held steady at AU$6.51, seemingly implying that the higher forecast losses are not expected to have a long term impact on the company's valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic SiteMinder analyst has a price target of AU$10.00 per share, while the most pessimistic values it at AU$3.20. We would probably assign less value to the analyst forecasts in this situation, because such a wide range of estimates could imply that the future of this business is difficult to value accurately. With this in mind, we wouldn't rely too heavily the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. The period to the end of 2025 brings more of the same, according to the analysts, with revenue forecast to display 25% growth on an annualised basis. That is in line with its 23% annual growth over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 15% per year. So it's pretty clear that SiteMinder is forecast to grow substantially faster than its industry.

The Bottom Line

The most important thing to take away is that the analysts increased their loss per share estimates for next year. Fortunately, they also reconfirmed their revenue numbers, suggesting that it's tracking in line with expectations. Additionally, our data suggests that revenue is expected to grow faster than the wider industry. The consensus price target held steady at AU$6.51, with the latest estimates not enough to have an impact on their price targets.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have forecasts for SiteMinder going out to 2027, and you can see them free on our platform here.

We also provide an overview of the SiteMinder Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SDR

SiteMinder

Provides software and online licensing solutions in the Asia Pacific, Europe, the Middle East, Africa, and the Americas.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion