Here's What Analysts Are Forecasting For SiteMinder Limited (ASX:SDR) After Its Annual Results

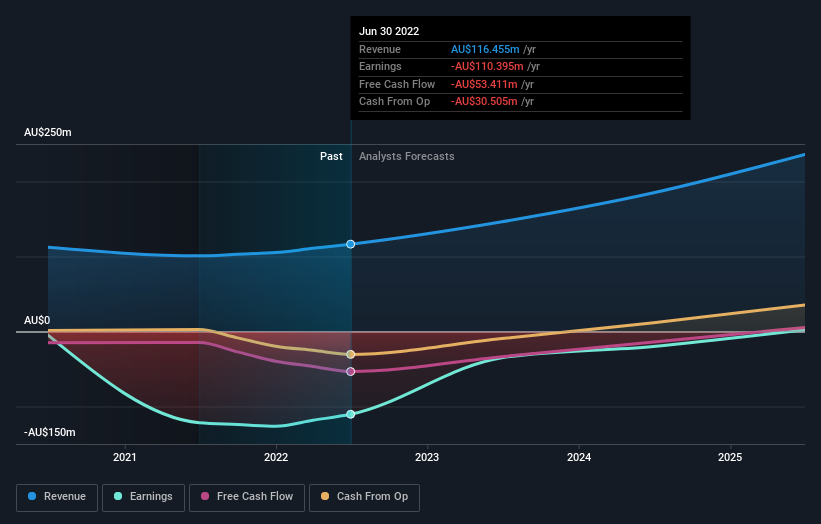

Shareholders might have noticed that SiteMinder Limited (ASX:SDR) filed its full-year result this time last week. The early response was not positive, with shares down 9.7% to AU$3.64 in the past week. It was a pretty bad result overall; while revenues were in line with expectations at AU$116m, statutory losses exploded to AU$0.55 per share. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

Check out our latest analysis for SiteMinder

Following the latest results, SiteMinder's seven analysts are now forecasting revenues of AU$146.4m in 2023. This would be a sizeable 26% improvement in sales compared to the last 12 months. Losses are predicted to fall substantially, shrinking 70% to AU$0.13. Yet prior to the latest earnings, the analysts had been forecasting revenues of AU$143.0m and losses of AU$0.10 per share in 2023. So it's pretty clear the analysts have mixed opinions on SiteMinder even after this update; although they upped their revenue numbers, it came at the cost of a massive increase in per-share losses.

There was no major change to the consensus price target of AU$5.49, with growing revenues seemingly enough to offset the concern of growing losses. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic SiteMinder analyst has a price target of AU$6.80 per share, while the most pessimistic values it at AU$4.20. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's clear from the latest estimates that SiteMinder's rate of growth is expected to accelerate meaningfully, with the forecast 26% annualised revenue growth to the end of 2023 noticeably faster than its historical growth of 15% over the past year. Compare this with other companies in the same industry, which are forecast to grow their revenue 16% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect SiteMinder to grow faster than the wider industry.

The Bottom Line

The most important thing to note is the forecast of increased losses next year, suggesting all may not be well at SiteMinder. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have estimates - from multiple SiteMinder analysts - going out to 2025, and you can see them free on our platform here.

We also provide an overview of the SiteMinder Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SDR

SiteMinder

Provides software and online licensing solutions in the Asia Pacific, Europe, the Middle East, Africa, and the Americas.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion