Lars Lindstrom is the CEO of ReadCloud Limited (ASX:RCL), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also assess whether ReadCloud pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for ReadCloud

Comparing ReadCloud Limited's CEO Compensation With the industry

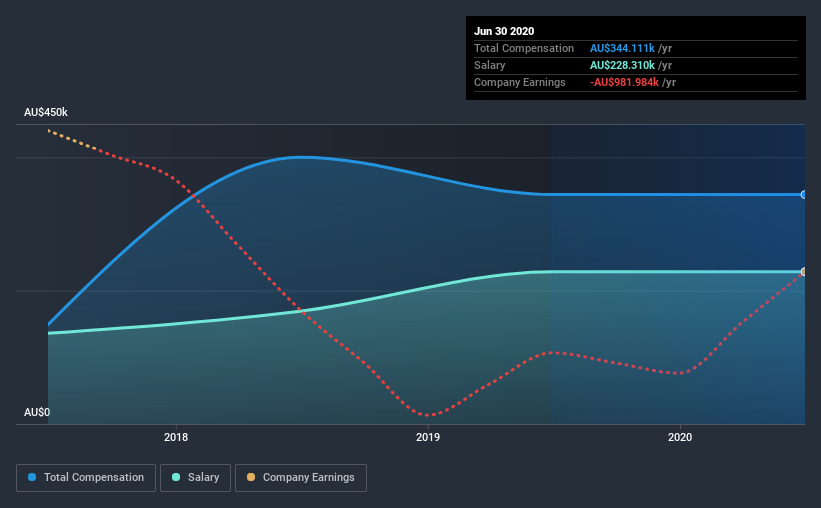

Our data indicates that ReadCloud Limited has a market capitalization of AU$72m, and total annual CEO compensation was reported as AU$344k for the year to June 2020. This means that the compensation hasn't changed much from last year. Notably, the salary which is AU$228.3k, represents most of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below AU$254m, reported a median total CEO compensation of AU$324k. So it looks like ReadCloud compensates Lars Lindstrom in line with the median for the industry. What's more, Lars Lindstrom holds AU$5.2m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$228k | AU$228k | 66% |

| Other | AU$116k | AU$116k | 34% |

| Total Compensation | AU$344k | AU$344k | 100% |

On an industry level, around 60% of total compensation represents salary and 40% is other remuneration. ReadCloud is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

ReadCloud Limited's Growth

Over the last three years, ReadCloud Limited has shrunk its earnings per share by 31% per year. It achieved revenue growth of 62% over the last year.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has ReadCloud Limited Been A Good Investment?

Boasting a total shareholder return of 65% over three years, ReadCloud Limited has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

As we touched on above, ReadCloud Limited is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Shareholder returns for the company have been strong for the last three years. Revenues have also showed some positive momentum, recently. However, on a concerning note, EPS is not growing. Overall, the company's performance hasn't been that disappointing for us to object the CEO compensation.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 3 warning signs for ReadCloud that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade ReadCloud, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:RCL

ReadCloud

Provides eLearning software and industry based training solutions to schools and educational institutions in Australia.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success